A enterprise credit score report is a snapshot of an organization’s monetary well being. It reveals particulars in regards to the firm’s debt and the way it dealt with debt funds up to now. It’s damaged into varied sections, every exhibiting totally different info for firm liens, excellent loans, derogatory fee info, and up to date credit score purposes.

Lenders and traders usually use the data in a report to find out whether or not to challenge funding to a enterprise — and, in that case, what charges and phrases to supply. A report may also be utilized by potential enterprise companions making an attempt to judge the corporate’s monetary well being. For these causes, it’s necessary to know what info goes into your corporation credit score report and how you can learn it.

Enterprise credit score reviews could be obtained from totally different credit score bureaus, though Dun & Bradstreet (D&B) is mostly utilized by lenders. D&B additionally gives different services that permit enterprise homeowners to watch their enterprise credit score profile.

How you can learn a enterprise credit score report

Though the precise format and particulars of a enterprise credit score report could fluctuate barely relying on the corporate issuing the report, there are various sections you’ll generally see. These are summarized under utilizing a pattern report from Experian, a supplier that may give you entry to your report and credit score rating.

- Enterprise profile is a normal overview of your organization, equivalent to its contact info, years in enterprise, and enterprise kind.

- Enterprise credit score rating and danger ranking is a numerical rating reflecting a selected kind of danger related to an organization.

- Credit score abstract is a high-level overview of an organization’s credit score accounts, equivalent to whole balances, fee quantities, liens, delinquent accounts, and extra.

- Account fee historical past usually gives particulars of every particular person account, together with creditor names, balances, fee phrases, account sorts, and fee historical past.

- Credit score inquiries include particulars of latest purposes for credit score, such because the creditor title and the date they pulled a enterprise credit score report.

- Vital derogatory info particulars late funds, judgments, tax liens, bankruptcies, and foreclosures.

- UCC filings could include particulars on if the enterprise has pledged any objects as collateral.

Enterprise profile

One of many first sections you’ll probably see on your corporation credit score report is a normal profile of your organization.

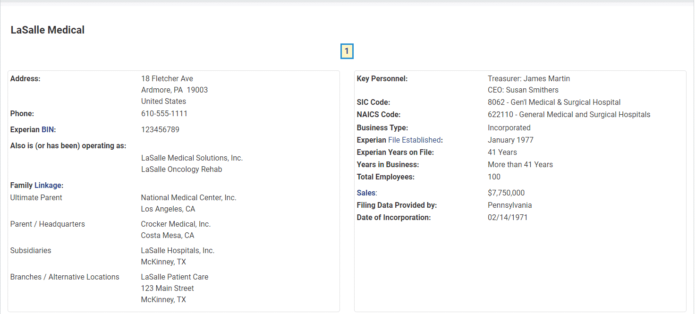

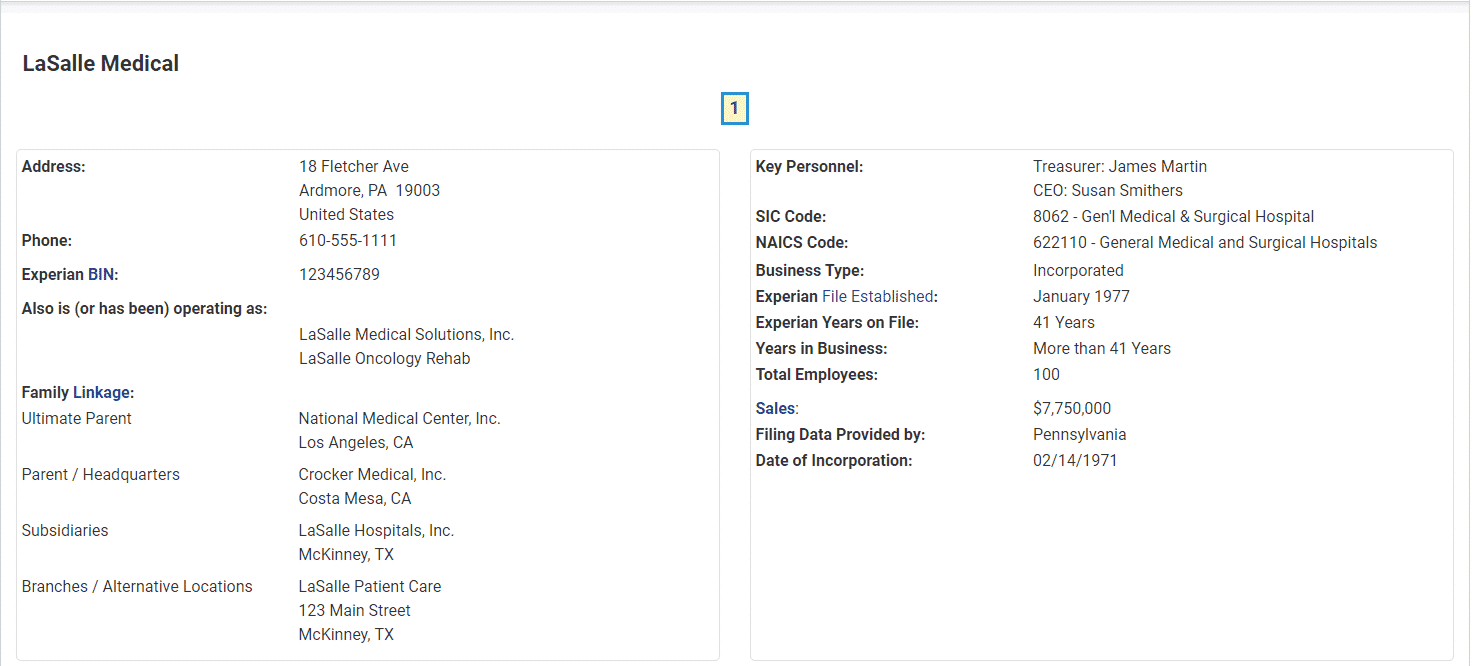

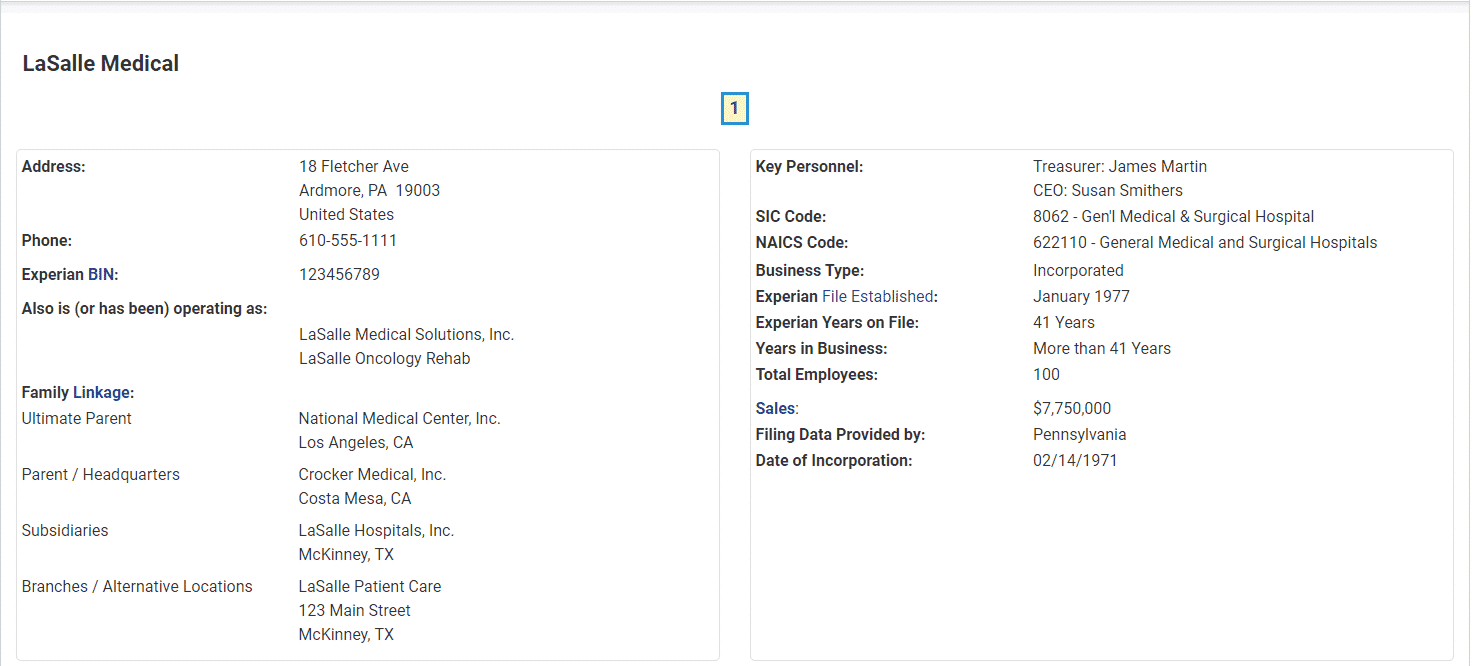

A enterprise profile part taken from a pattern credit score report by Experian for a fictitious enterprise. (Supply: Experian)

This part accommodates details about your corporation, equivalent to your organization’s title, deal with, and different contact info. Whereas many of the objects are self-explanatory, this part may include much less generally used terminology which will embody the next:

- BIN (Enterprise Identification Quantity) is a singular quantity that the credit score bureau makes use of to establish your organization. It operates equally to an Employer Identification Quantity (EIN) or Social Safety Quantity (SSN).

- SIC (Normal Industrial Classification) Code corresponds to a US authorities system for figuring out the trade through which your corporation operates. You’ll be able to go to the US SEC’s SIC Code Checklist to find the SIC code on your trade.

- NAICS (North American Business Classification System) Code is used to categorise which trade your organization operates in. Though much like SIC codes, NAICS codes can present a better degree of element. You’ll be able to go to the NAICS’s code by trade web page to search out your code.

Enterprise credit score rating & danger ranking

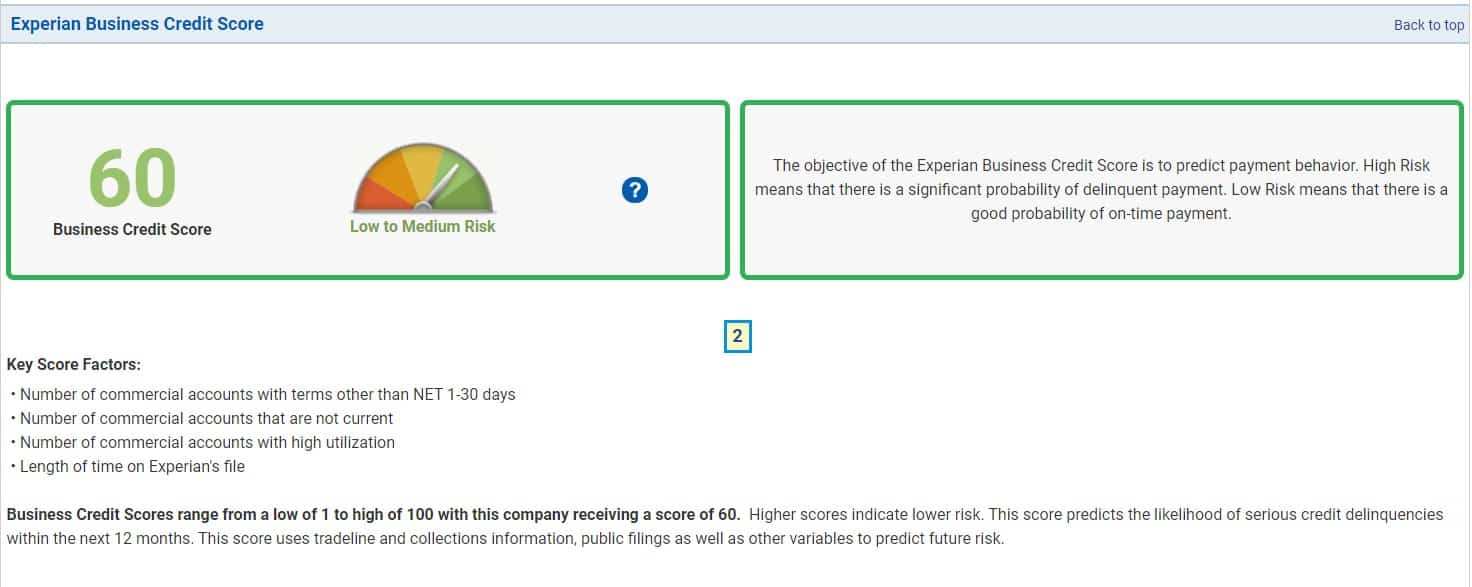

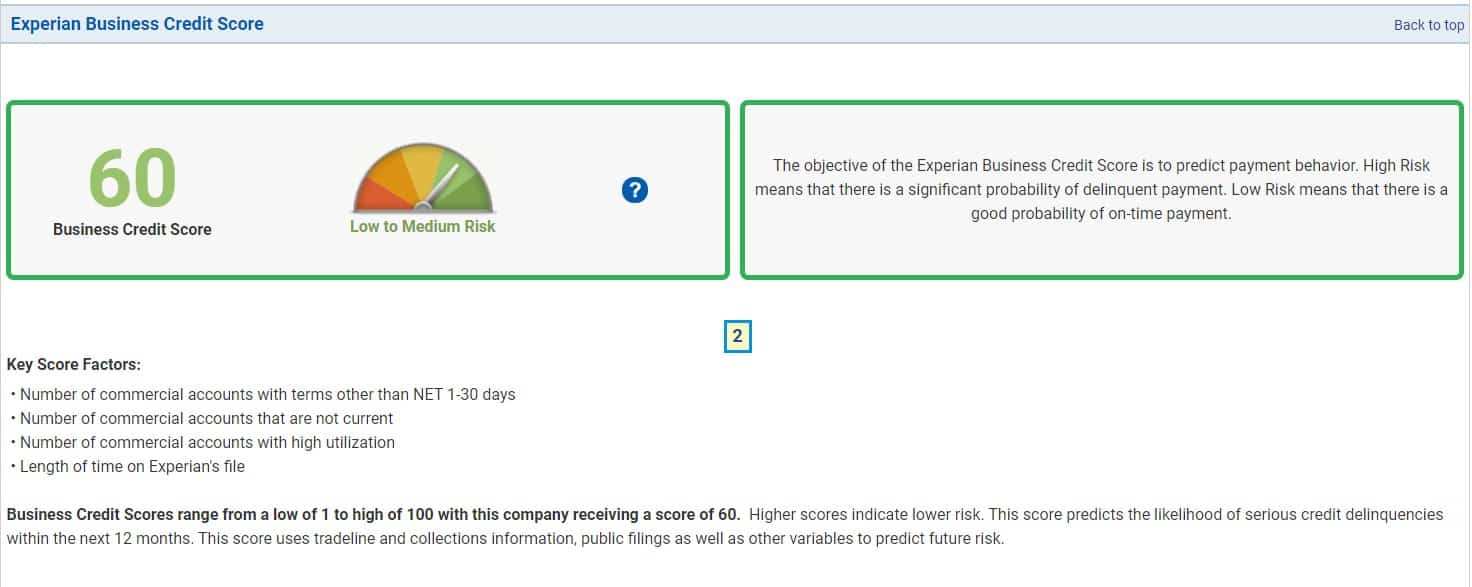

Relying on the place you get your corporation credit score report, you may additionally get a credit score rating. The picture under is one instance of a rating you would possibly get for those who obtained a credit score report by Experian.

An instance of how Experian would possibly show credit score scores on its credit score reviews. (Supply: Experian)

Credit score scores are designed for instance your total danger degree, and several types of scores measure varied danger components. For instance, some credit score rating fashions measure the chance of defaulting within the subsequent 12 months, whereas others could assess the prospect of your corporation going bankrupt.

Credit score abstract

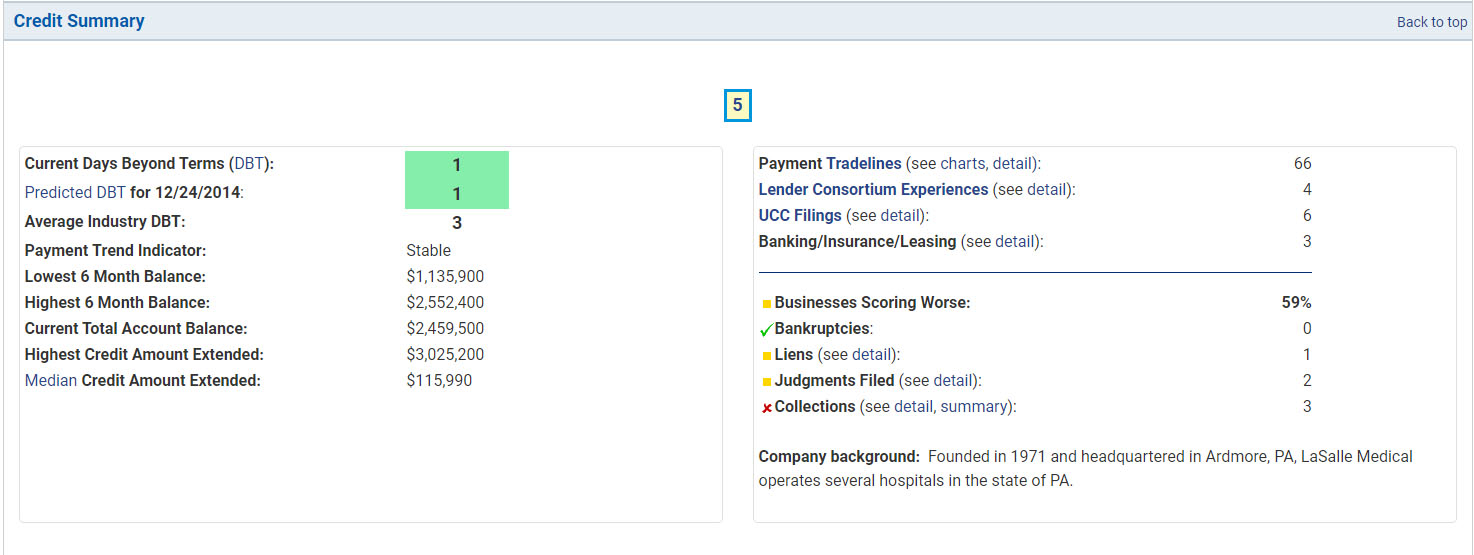

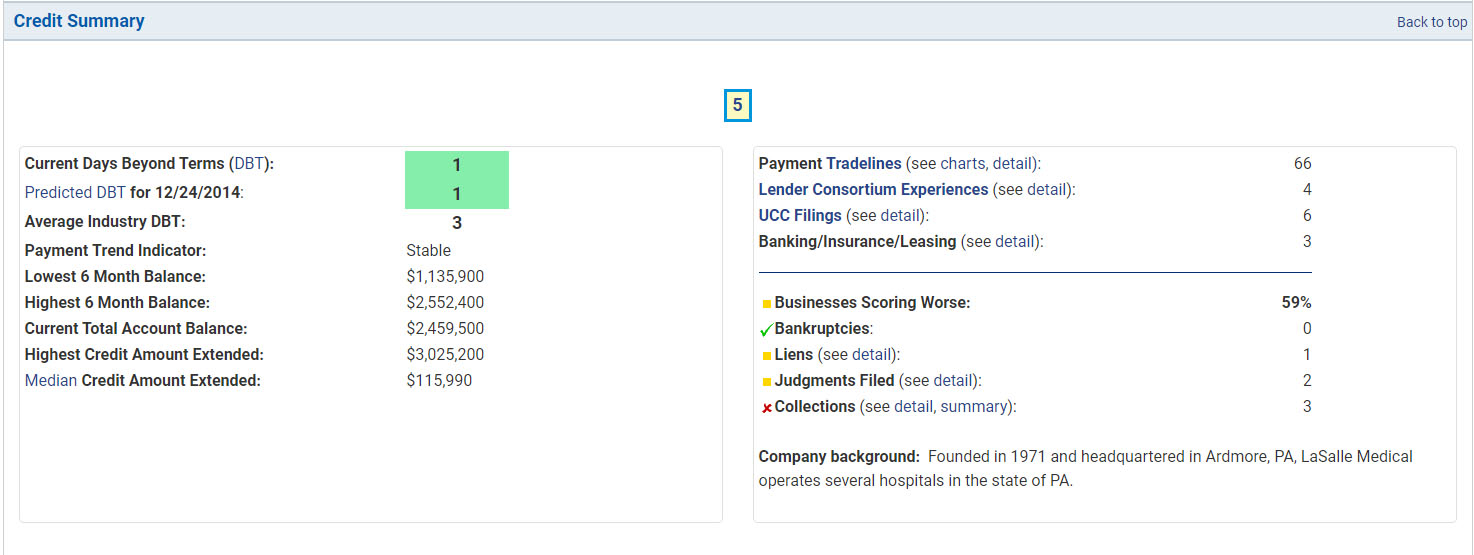

This part of your corporation credit score report is a fast overview of assorted elements of your credit score. It would present a abstract of your mortgage fee historical past and replicate the way you make the most of your credit score accounts. It would usually additionally embody info on UCC liens for any property pledged as collateral.

Credit score reviews usually embody a abstract of your credit score historical past, equivalent to this one on a pattern Experian credit score report.

(Supply: Experian)

Widespread objects lined on this part embody:

- Days Past Phrases (DBT): This means what number of days previous the due date your agency pays. Your DBT determine could also be mirrored as your present, common, or historic worst.

- Account Balances: How a lot credit score you’re utilizing will probably be summarized right here, together with the stability of your accounts and the quantity of accessible credit score you need to use. This part may embody information in your highest balances in a given interval.

- Variety of Tradelines: The whole variety of credit score accounts will probably be displayed right here. Accounts can embody bank cards, loans, strains of credit score, and leases.

- UCC Filings: If collateral has been pledged in alternate for financing, it could seem on this part.

- Derogatory Info: Unfavorable fee historical past will probably be displayed right here and might embody late funds, collections, and bankruptcies.

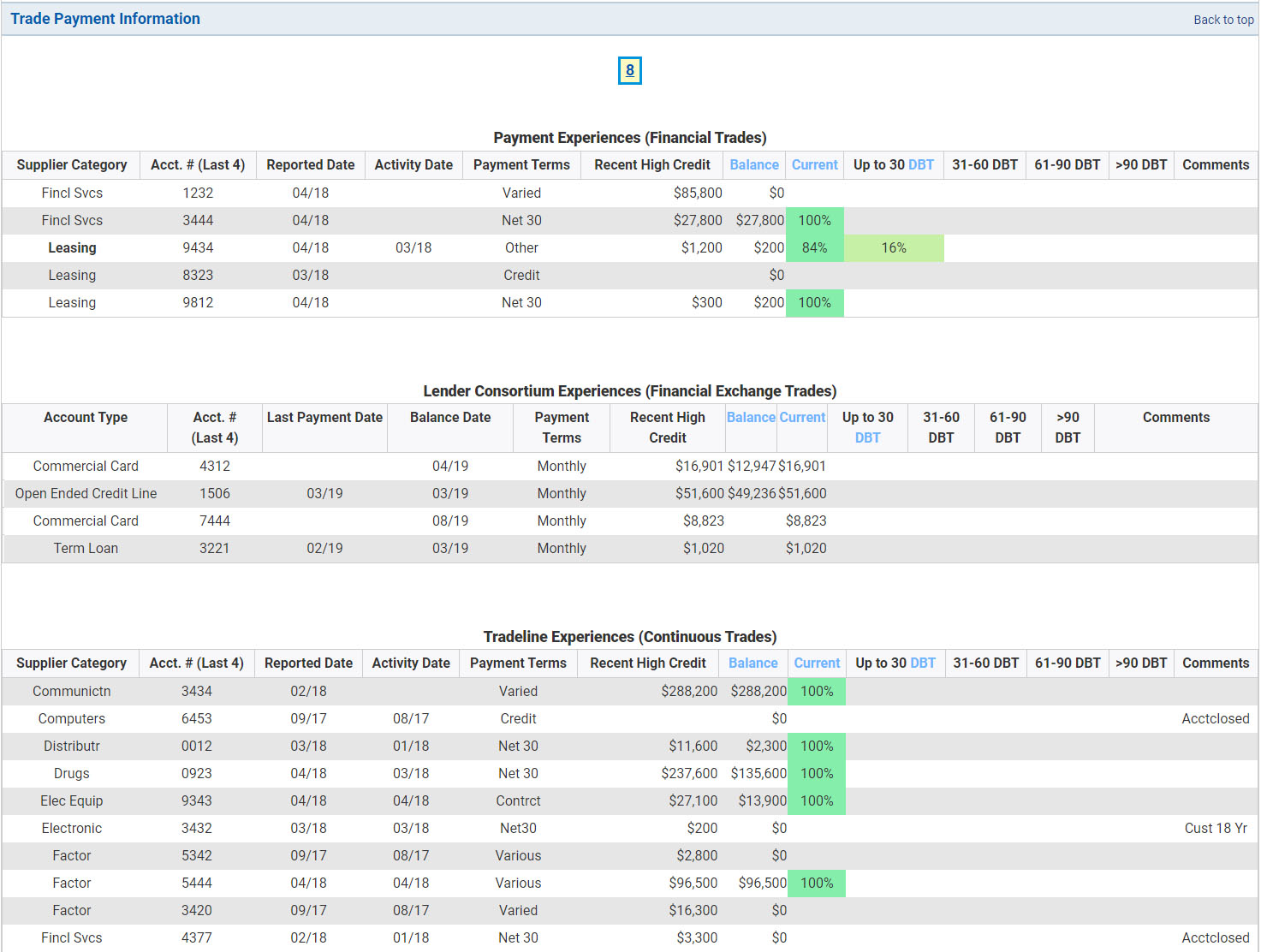

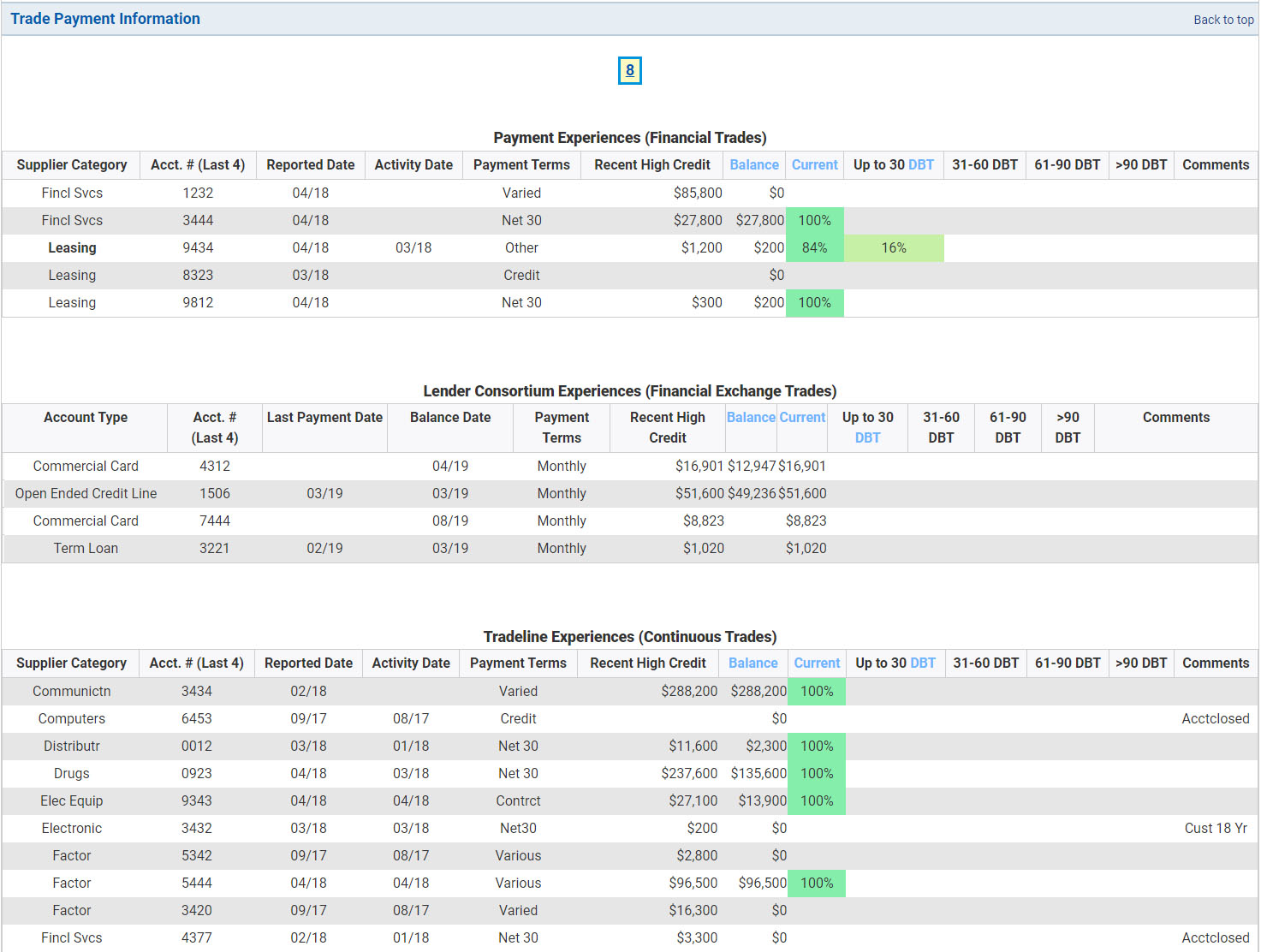

Account fee historical past

The fee historical past of your credit score report will include particulars about every of your particular person accounts

Accounts can embody bank cards, strains of credit score, different loans, and funds to distributors.

as reported by your collectors. It would embody detailed details about your fee historical past, account balances, fee phrases, and fee quantities. The extra accounts that present you pay on a well timed foundation, the simpler it will likely be to construct enterprise credit score.

Your small business credit score report will even present particulars of particular person tradelines. (Supply: Experian)

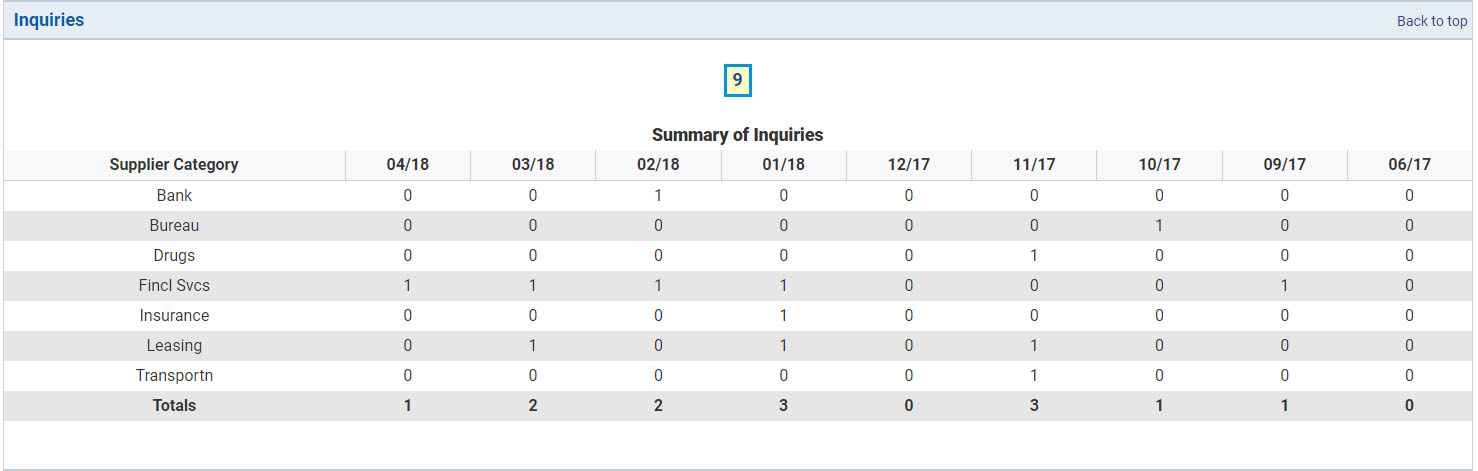

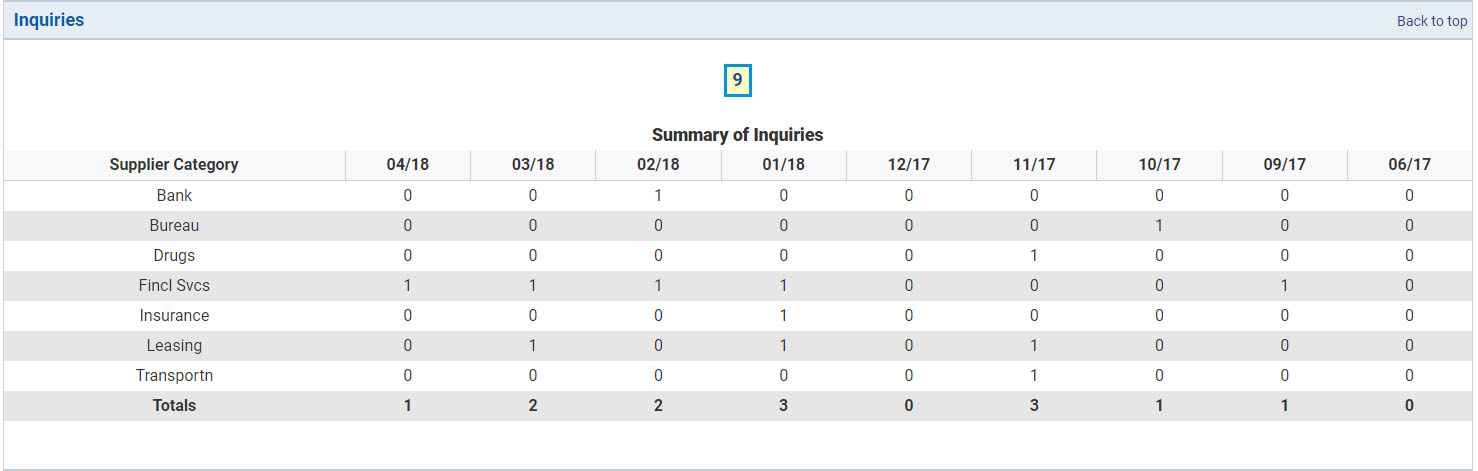

Credit score inquiries

Usually, lenders will verify your corporation credit score report while you apply for financing — and these requests will seem as a credit score inquiry. Experian lists inquiries from the previous 9 months and breaks them down into which varieties of firms have checked your credit score. Relying on the corporate you get your corporation credit score report from, you might be able to see inquiries additional again than 9 months.

Collectors and different firms which have checked your credit score will seem within the credit score inquiries part of your credit score report. (Supply: Experian)

Generally, lenders view companies with numerous inquiries as extra dangerous. It is because it could possibly be an early signal that an organization could also be overextended or determined for credit score. Companies with few credit score inquiries, by comparability, are seen to be decrease danger as they haven’t demonstrated any want for credit score or indicators of potential monetary misery.

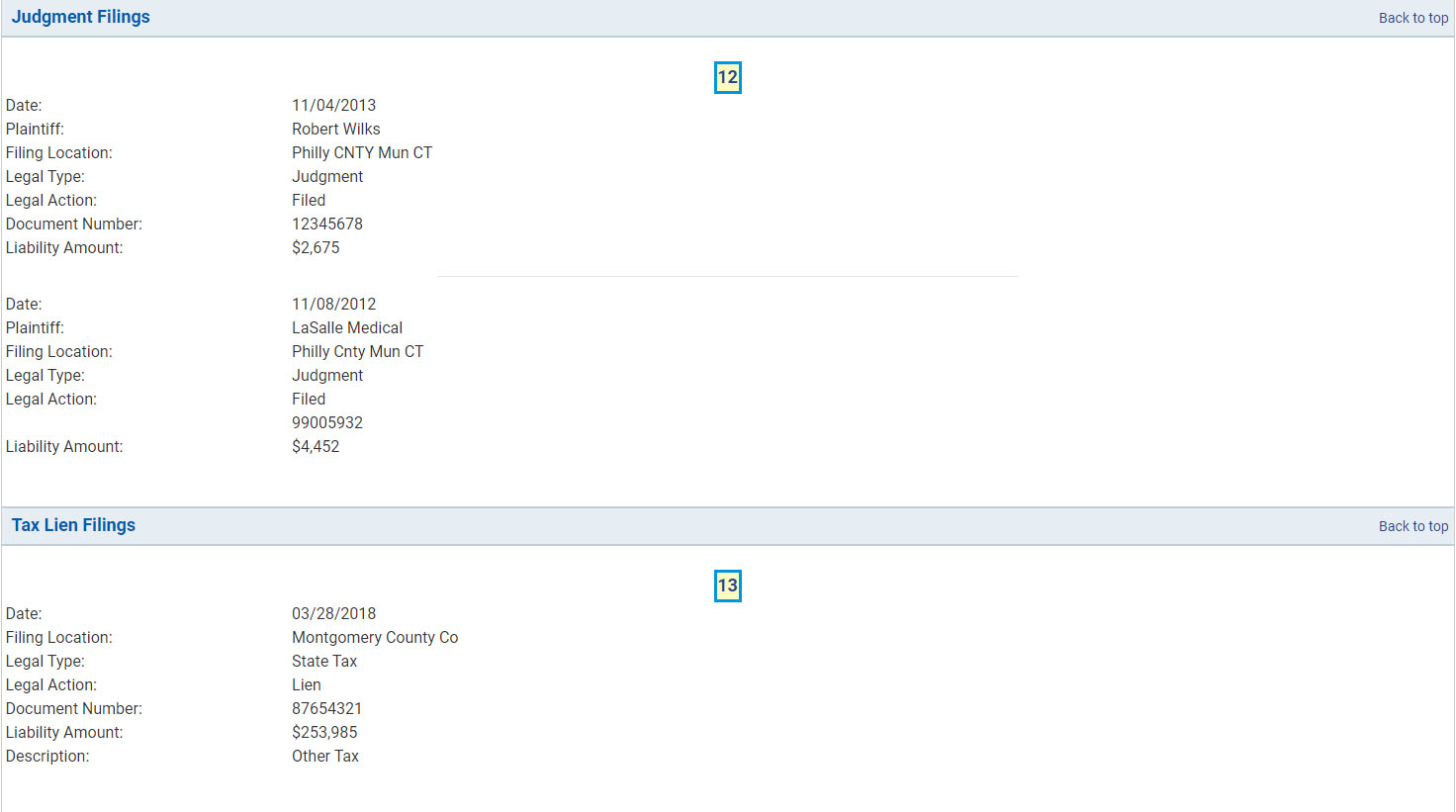

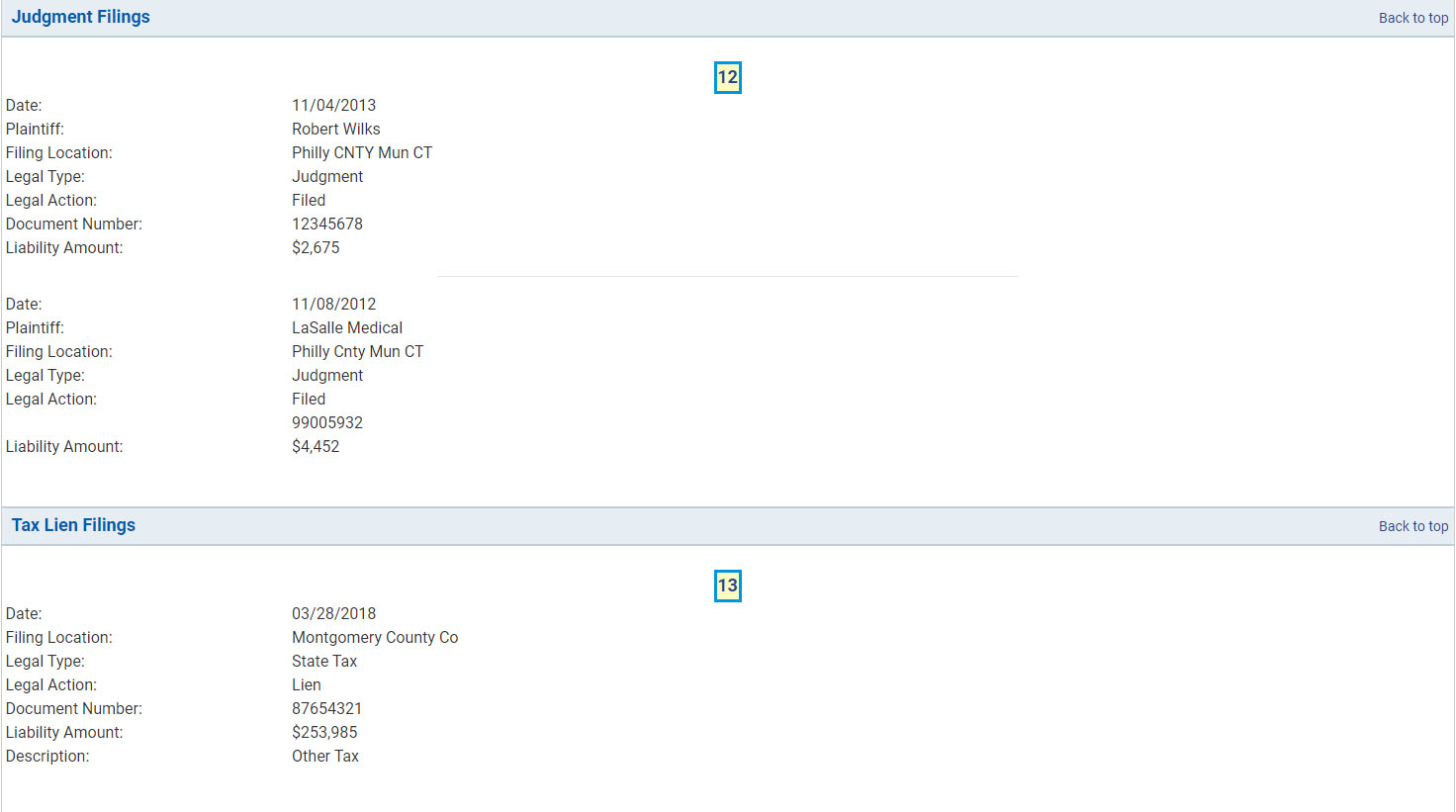

Vital derogatory info

Along with late funds, vital derogatory objects will seem on this part. Whereas some credit score bureaus will separate objects into particular person classes, these things usually embody tax liens, collections, judgments, and chapter filings.

Derogatory info usually has its personal part in your credit score report. (Supply: Experian)

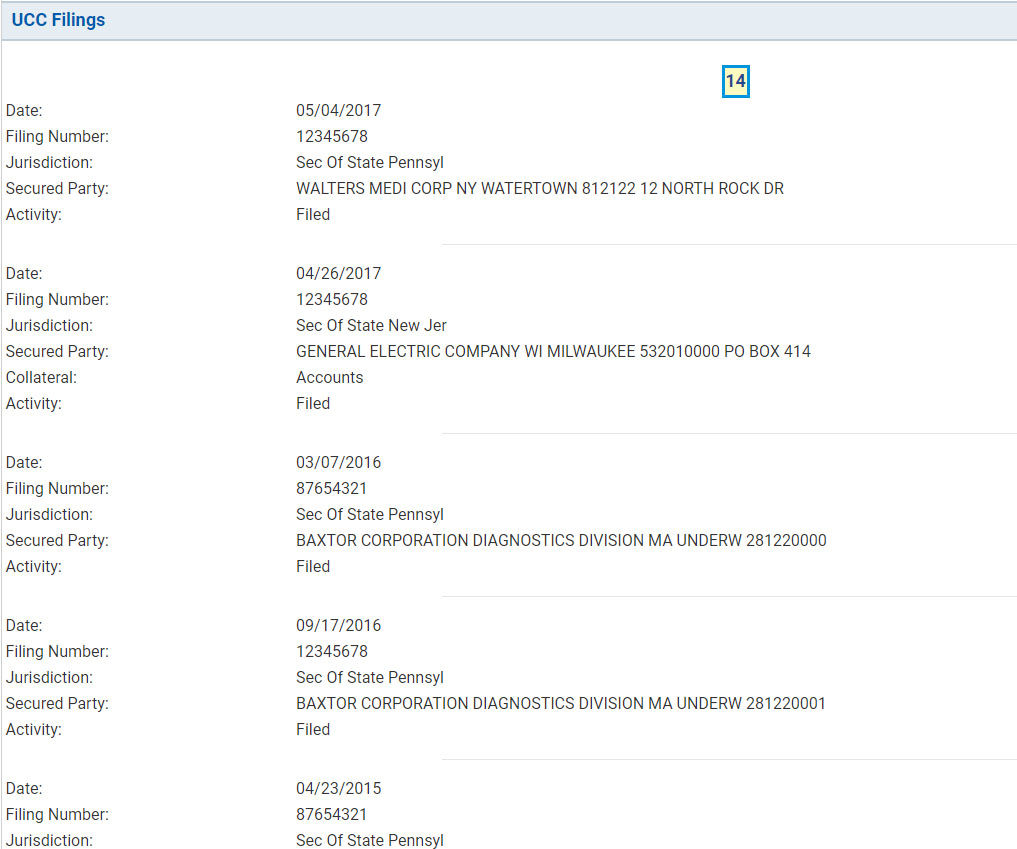

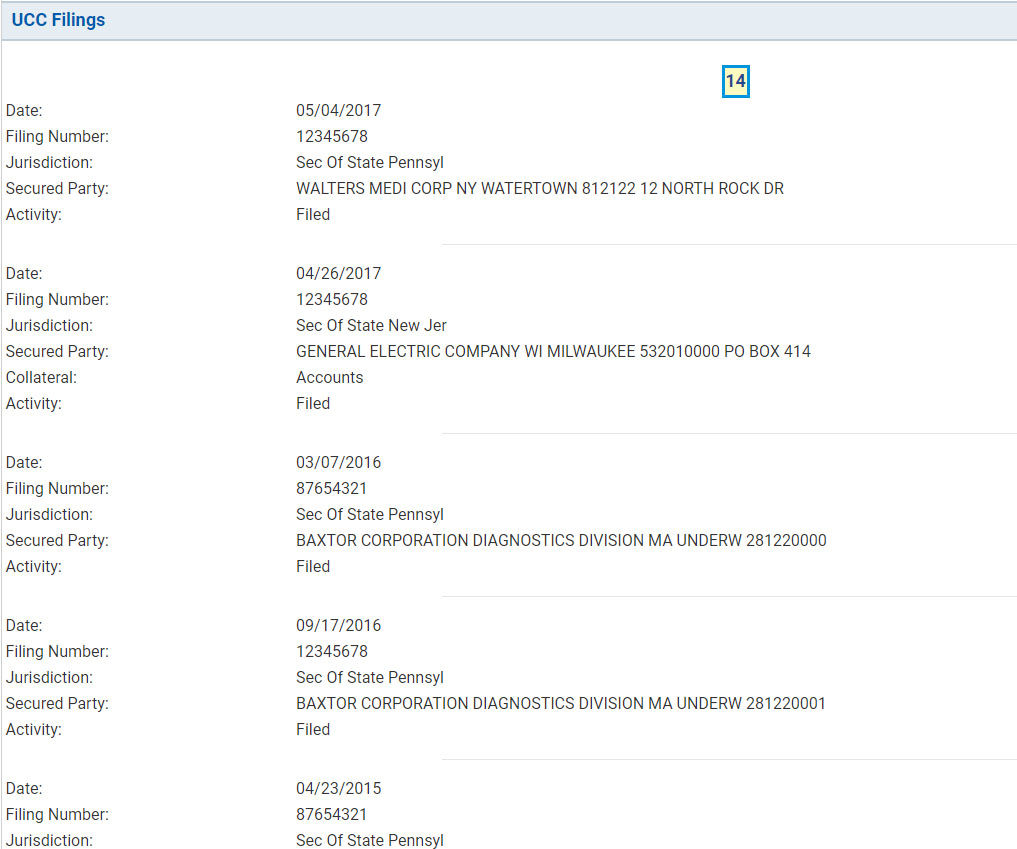

UCC filings

Enterprise property pledged as collateral will usually seem within the UCC filings part of your corporation credit score report. Different lenders accessing this info will be capable of see the date it was filed, the kind of collateral getting used, and the secured celebration.

Any property pledged as collateral could be listed beneath the UCC filings part of your credit score report. (Supply: Experian)

UCC filings are used to decrease the danger of lending cash by claiming a public curiosity within the collateral, permitting the celebration to take authorized possession of it within the occasion of a default. Widespread varieties of collateral that may be pledged embody:

- Accounts receivables

- Contracts

- Enterprise gear

- Stock

- Leases

- Notes receivable

How enterprise credit score reviews are used

Enterprise credit score reviews are primarily used for 3 functions. They’re used to confirm id, consider whether or not your organization will probably be accepted for a mortgage, and decide the charges and phrases you’ll get.

1. Enterprise verification

A enterprise profile is a part of most enterprise credit score reviews. Lenders evaluation this info to see if there are any discrepancies amongst your mortgage software, your supporting paperwork, and the enterprise credit score report. This course of is completed partially to confirm that it’s evaluating the proper firm and that funds are issued to licensed events.

2. Mortgage approval

Enterprise credit score reviews include information about your organization’s funds and reimbursement historical past. These converse to your organization’s capability to tackle extra debt and observe document of creating well timed funds, two essential components lenders take into account when deciding whether or not to challenge extra financing.

3. Charges & phrases

In case you are accepted for financing, the power of your organization’s funds and credit score will usually dictate what charges and phrases you’ll get. Lenders take a look at firms with sturdy funds and credit score as much less more likely to default and can reward them with extra favorable charges and phrases.

The place to get your corporation credit score report & enterprise credit score scores

The next are 4 suppliers that you would be able to go to to get a duplicate of your corporation credit score report. Every has extra services that can assist you monitor your credit score and observe your corporation credit score rating.

Understand that since your credit score report is just a snapshot of information final reported from lenders, the data you see could fluctuate among the many totally different suppliers.

1. Dun & Bradstreet

D&B is among the mostly used credit score bureaus by lenders. It presents several types of enterprise credit score scores and a number of providers to assist firms monitor their credit score. You’ll be able to learn our information on the D&B credit score report to be taught extra.

- PAYDEX® Rating: This rating ranges from 0 to 100 and is decided by an organization’s previous fee efficiency. Larger scores are correlated to firms that pay payments early or on time. Scores of 80 and above are typically thought-about to be low danger.

- Delinquency Predictor Rating (DPS): Measured on a scale from 1 to five, with decrease scores indicating decrease danger, the DPS is supposed to point out the likelihood {that a} enterprise would possibly change into delinquent or go bankrupt.

- Failure Rating: This additionally operates on a scale from 1 to five and is designed to replicate an organization’s chance of submitting chapter or encountering monetary difficulties inside 12 months.

- Most Credit score Suggestion: Because the title suggests, this provides collectors a tenet on how a lot credit score to increase primarily based on an organization’s trade, fee historical past, and different traits.

- D&B Score: That is an total ranking of an organization’s creditworthiness and is decided by info from an organization’s stability sheet and total measurement.

2. Experian

Experian points a rating known as Intelliscore Plus. The newest model of this, known as Intelliscore Plus V3, ranges from 300 to 850, with greater scores being extra favorable. A blended information possibility can be out there for lenders wanting to mix enterprise info with that of particular person homeowners. Some older variations of Intelliscore operated on a scale from 1 to 100, with scores above 75 typically thought-about low danger for lenders.

3. Equifax

Equifax has two important varieties of credit score scores lenders can make the most of.

- Enterprise credit score danger rating: That is the chance of a enterprise being over 90 days late on monetary obligations. The vary is from 101 to 992, with 992 being the least probably.

- Enterprise failure rating: That is the danger {that a} enterprise will go bankrupt within the subsequent 12 months. Scores vary from 1,000 to 1,610, with 1,610 being the least probably.

4. FICO Small Enterprise Scoring Service (SBSS)

FICO SBSS scores are mostly used for Small Enterprise Administration (SBA) loans. Scores vary from 0 to 300, with greater scores representing decrease danger for lenders. For many SBA loans, I like to recommend having an SBSS rating of 155 or greater. You’ll be able to go to Nav to acquire a duplicate of your FICO SBSS credit score rating.

Steadily requested questions (FAQs)

A private credit score report usually solely accommodates info associated to your self as a person, whereas a enterprise credit score report accommodates info on debt and different tradelines which your corporation is accountable for. The kind of report a lender makes use of could rely upon whether or not the corporate’s funds are adequate to qualify alone or if a private assure is required.

I like to recommend checking your corporation credit score report a minimum of as soon as each three to 6 months. You may also take into account enrolling in credit score monitoring providers, a few of that are free and designed to provide you with a warning of any materials adjustments to your credit score profile.

No. The data you see in your credit score reviews can differ if collectors resolve to report information solely to sure credit score bureaus. Moreover, totally different credit score bureaus could sometimes expertise a delay in reporting or receiving information.

Inaccuracies in your corporation credit score report could make it troublesome on your firm to get funding. For instance, the data in your credit score report is used to find out your credit score rating, one among a number of components that may impression your capability to get accepted for a mortgage in addition to the charges and phrases you may get.

Backside line

Lenders use the data in your corporation credit score report to find out whether or not to challenge financing and at what charges and phrases. Understanding how you can learn your credit score report and being conscious of what goes into it may increase your entry to credit score.

Dun & Bradstreet, Equifax, Experian, and Nav are 4 suppliers that may give you entry to your varied reviews and credit score scores. You may also make the most of every firm’s providers to watch adjustments to your corporation credit score reviews.