The monetary companies trade is within the midst of an exhilarating transformation, and Synthetic Intelligence (AI) is the spark igniting all of it! Image this: in 2025, AI adoption in monetary companies skyrocketed by over 30%, with the market poised to hit a staggering USD 41.16 billion by 2030.

From crafting personalised banking experiences to outsmarting fraudsters in real-time, AI is rewriting the foundations of FinTech. However with nice energy comes nice duty, moral challenges like knowledge privateness, algorithmic bias, and accountability are demanding consideration.

Let’s dive into how synthetic intelligence in FinTech is shaking issues up and the moral tightrope firms should stroll.

What Does AI Imply to Fintech?

Think about a financial institution that is aware of you want your bestie, nailing your monetary wants with spot-on precision! That’s AI in FinTech, mixing machine studying, pure language processing, and knowledge analytics to make monetary companies smarter, sooner, and oh-so-personal. It’s not nearly automating boring duties, it’s about supercharging selections with insights from huge knowledge swimming pools. Whether or not it’s a chatbot fixing your midnight banking woes, a robo-advisor constructing your dream portfolio, or fraud detection techniques catching crooks in milliseconds, AI is the spine of a slicker, customer-first monetary world.

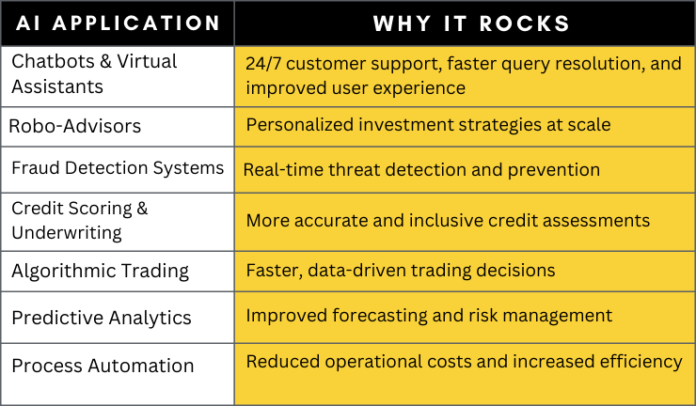

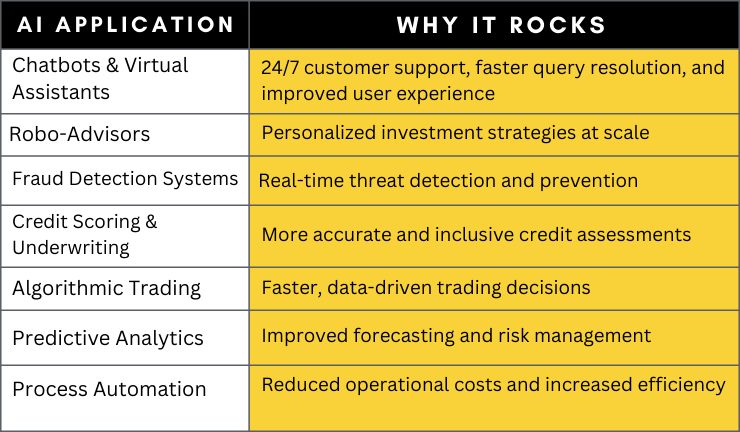

Right here’s a fast peek at AI’s starring roles in FinTech:

The Transformative Function of AI in FinTech

Your Financial institution, Your Manner: AI makes banking really feel prefer it was designed only for you. Chatbots and apps analyze your habits and preferences to serve up tailor-made recommendation and real-time assist. The outcome? Happier clients who stick round.

Choices at Warp Velocity: Overlook sluggish, error-prone human evaluation. AI crunches mountains of information to approve loans, assess dangers, or execute trades sooner than you possibly can say “revenue.” It’s constant, fast, and game-changing.

Fraud? Not on AI’s Watch: AI is sort of a digital Sherlock Holmes, recognizing suspicious transactions in real-time and shutting down fraud earlier than it hurts. This builds belief and retains your cash safe.

Lean and Imply Operations: By automating repetitive duties like doc processing or buyer onboarding, AI streamlines workflows and slashes prices, letting firms give attention to the large stuff.

Compliance Made Simple: AI retains up with ever-changing rules, flagging points and making certain every part’s above board, with out the headache of handbook checks.

Threat-Savvy Smarts: AI’s superior modeling predicts dangers with uncanny accuracy, serving to firms make higher calls on loans, investments, and extra.

Innovation on Steroids: FinTechs can roll out new options shortly, staying forward of traits and buyer wants with scalable AI instruments and cloud-based platforms.

Moral Issues in AI-Pushed FinTech

AI’s magic comes with a catch, moral dilemmas that might make or break belief. Right here’s what FinTechs have to deal with:

Knowledge Privateness: AI thrives on knowledge, however mishandling it might spell catastrophe. Sturdy cybersecurity and clear knowledge insurance policies are non-negotiable to maintain person information protected.

Bias in Algorithms: If AI’s skilled on flawed knowledge, it could churn out unfair selections, like denying loans to sure teams. Numerous datasets and common audits are key to retaining issues truthful.

Transparency: No one likes a black field. Prospects and regulators have to know the way AI makes selections, particularly for issues like mortgage approvals or fraud flags.

Accountability: When AI messes up, who’s guilty? Clear guidelines are wanted to pin down duty and maintain issues moral.

Job Impacts: Automation’s nice, however it might sideline conventional roles. FinTechs should assist employees by way of reskilling or new alternatives.

Knowledge Ethics: Past safety, firms should use knowledge responsibly, avoiding shady practices and giving customers management over their information.

Market Manipulation: AI in buying and selling may very well be misused to recreation the system. Sturdy oversight is essential to maintain markets truthful.

Eco-Aware AI: AI’s vitality calls for can hurt the planet. FinTechs ought to lean into inexperienced tech to chop their carbon footprint.

Belief and Consent: Need loyal clients? Be upfront about how AI works and get their buy-in earlier than utilizing their knowledge.

Greatest Practices for Moral AI Use in FinTech

AI’s reshaping FinTech, however it wants guardrails to remain truthful and fabulous. Right here’s your playbook for moral AI that wows:

Be Clear: Ditch the black-box vibes! Use explainable AI fashions so clients and regulators perceive selections like mortgage denials. Instruments like SHAP make advanced outputs clear, boosting belief.

Numerous Knowledge, Zero Bias: AI’s solely as truthful as its knowledge. Supply various datasets to keep away from skewed outcomes, like unfair credit score rejections. Common equity checks maintain biases at bay.

Lock Down Knowledge: Deal with person information like gold. Encrypt knowledge, observe GDPR, and use anonymization to thwart hackers. Sturdy cybersecurity builds unshakable belief.

Audit Like a Professional: AI can drift, so audit fashions quarterly for bias or errors. Instruments like Fairlearn guarantee equity, retaining your AI sharp and moral.

Keep Regulatory-Savvy: Rules evolve quick. Construct AI that auto-flags compliance points and adapts to new guidelines, dodging fines and proving you’re legit.

Empower Prospects: Let customers management their knowledge with simple opt-outs and clear consent. Consumer-friendly privateness dashboards present you respect their rights.

Innovate Responsibly: Stability flashy options with impression checks. Contain ethicists to make sure AI promotes inclusion with out hurt.

Preserve People within the Loop: Excessive-stakes calls want human oversight. Escalation paths guarantee equity and accountability.

Moral AI isn’t simply good, it’s the spark that retains synthetic intelligence in FinTech trusted and transformative!

The Way forward for FinTech Is Vivid And Accountable

AI is turbocharging FinTech, delivering unmatched effectivity, personalization, and safety. However to maintain the momentum going, firms should deal with moral challenges head-on, making certain equity, transparency, and belief. At ISHIR, we’re all about constructing AI-powered FinTech options that innovate responsibly.

FAQs: Understanding the Affect of AI in FinTech

Q1. What are the dangers of utilizing AI in monetary companies?

Ans: The principle dangers embody algorithmic bias, lack of transparency in decision-making (black-box fashions), knowledge safety vulnerabilities, and over-reliance on automation. With out correct governance, these dangers can result in monetary exclusion, compliance points, and reputational harm.

How is AI remodeling the FinTech trade?

Ans: AI is revolutionizing FinTech by automating advanced monetary processes, enhancing fraud detection, personalizing buyer experiences, and enabling real-time decision-making. From algorithmic buying and selling to credit score scoring, AI brings velocity, accuracy, and scalability, reshaping how monetary companies function and compete.

Why is ethics necessary in AI-driven FinTech?

Ans: Ethics is essential as a result of AI techniques can unintentionally perpetuate biases, compromise knowledge privateness, and make opaque selections that impression actual monetary lives. Accountable AI ensures equity, transparency, and accountability—particularly essential in finance, the place belief is every part.

Able to Remodel Your FinTech Technique with AI, Responsibly?

Accomplice with ISHIR to construct moral, clever AI options that ship actual outcomes, with out the hype.

The publish The Function of AI in FinTech: Innovation, Transformation, and the Ethics You Can’t Ignore appeared first on ISHIR | Software program Improvement India.