For almost eight many years, the U.S. innovation ecosystem has been underpinned by a intentionally decentralized mannequin of federal analysis help. Rooted within the imaginative and prescient laid out by Vannevar Bush in Science, The Limitless Frontier, the mannequin rests on a easy however profound premise: sustained public funding in primary analysis fuels personal sector dynamism and long-term nationwide competitiveness. Bush, writing within the aftermath of World Conflict II, noticed that wartime collaboration between academia and business had borne fast technological fruit — and correctly foresaw that the nation would profit from facilitating scientific inquiry not simply throughout wartime, but in addition on an ongoing foundation.

Key establishments together with the Nationwide Science Basis, Nationwide Institutes of Well being, and a large community of analysis (R1) universities have operationalized this imaginative and prescient. Fairly than making top-down strategic bets, the U.S. innovation ecosystem spreads comparatively modest sums throughout a big selection of scientific inquiry, trusting that some portion will yield breakthrough insights. These public investments will not be about speedy returns; they’re about creating a reservoir of data and functionality from which the personal sector can draw and infrequently revenue.

The Trump administration, in a matter of months, has minimize analysis funds, lowered the overhead charge relevant to federally funded analysis, and tried to claw again analysis grants already accepted. Narrowing this analysis portfolio within the identify of effectivity will harm the enterprise economic system, and in the end, American competitiveness.

Analysis and Growth {Dollars} as Enterprise Portfolio

American public analysis funding capabilities as an preliminary enterprise portfolio, upstream from the extra lauded enterprise capital ecosystem. The federal government locations an enormous variety of small bets throughout disciplines, producing a pipeline of discovery that, over time, feeds downstream commercialization.

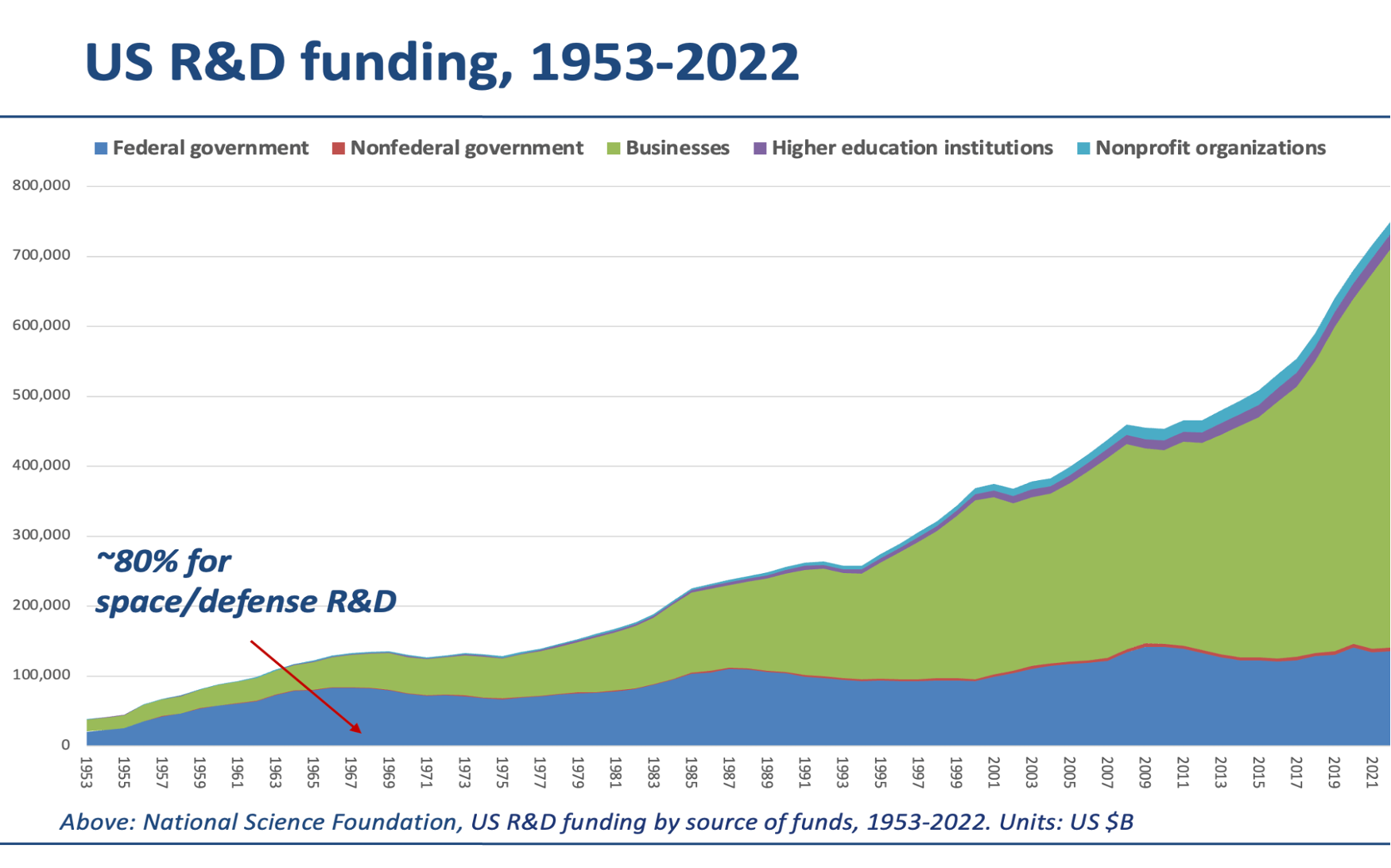

As of 2022, the US spent an estimated $885.6 billion on analysis and growth, of which $159.8 billion was funded by the federal authorities. U.S. gross home product that yr was $26 trillion; whole federal outlays had been $6.3 trillion. Thus, about 2.5 p.c of federal outlays went to analysis. The chart under (drawn from Nationwide Science Basis information), exhibits spending on analysis and growth in the US from 1953 to 2022.

Think about the case of the Superior Analysis Tasks Company Community of the late Sixties. This community begat the Web, which then wanted a browser. Federally funded analysis carried out on the College of Illinois yielded Mosaic, which later grew to become Netscape, the primary main Web browser. Or take the early work on lipid nanoparticles, funded by the Nationwide Institutes of Well being and different companies for many years. That analysis grew to become important to the deployment of the primary mRNA COVID-19 vaccines in 2020. By way of affect, NASA estimates that each greenback spent on analysis and growth has a 7X multiplier impact because it travels by way of the economic system.

This analysis innovation ecosystem is a necessary enabler of the downstream enterprise capital ecosystem that has reworked the U.S. economic system. Just like the enterprise economic system, the analysis innovation ecosystem is characterised by an influence legislation distribution of returns. Some analysis strands yield at present’s mRNA or CRISPR. Others by no means traverse the valley of loss of life — the stage the place business curiosity is just too unsure and technical danger too excessive to draw personal funding. . The very heterogeneity of the portfolio is the purpose. The successes within the brief tail emerge due to the breadth of exploration that has characterised the U.S. innovation ecosystem for 80 years.

There are two valleys of loss of life: one technological and one business. The analysis ecosystem addresses the previous; the enterprise capital ecosystem focuses on the latter. The analysis ecosystem de-risks technological seeds; in the meantime, enterprise capitalists spend money on groups, applied sciences, and markets. And enterprise capital itself thrives on an influence legislation: just a few large fund-returning winners make up for an extended tail of middling or failed investments. The genius of the U.S. innovation ecosystem is that it tolerates this uncertainty, understanding that uneven returns are a characteristic, not a bug.

From Discovery to Deployment: A Division of Innovation Labor

To totally recognize the energy of the U.S. innovation ecosystem, it helps to know how concepts transfer from the laboratory to {the marketplace}. One extensively used framework for tracing this course of is the Expertise Readiness Degree (TRL) scale, a nine-point system initially developed by NASA.

On the earliest phases (TRLs 1–3), analysis is usually theoretical or experimental. Universities and analysis institutes, supported by companies together with the Nationwide Science Basis, Nationwide Institute of Well being, and Division of Vitality Workplace of Science, play a lead function right here. These establishments generate foundational data without having to foretell sensible software. For instance, the discoveries behind at present’s therapeutics and gene enhancing emerged from curiosity-driven work lengthy earlier than their relevance to international public well being or biotechnology grew to become clear.

As applied sciences advance to TRLs 4–6, the problem turns into one among validation and integration — shifting from the lab bench to practical prototypes. That is the area of nationwide laboratories, College Affiliated Analysis Facilities, and Federally Funded Analysis and Growth Facilities just like the RAND Company. These establishments conduct utilized analysis and system integration, serving to promising applied sciences navigate the valley of loss of life. It was on this center stage that Lawrence Berkeley and Oak Ridge Nationwide Laboratories helped transition early battery chemistries into viable storage applied sciences, and the place MIT Lincoln Laboratory refined radar and sensor programs that grew to become important to missile protection. In the present day, improvements in nuclear fusion are following the identical trajectory.

Lastly, TRLs 7–9 mark the transition to commercialization. That is the place applied sciences are demonstrated in real-world settings, manufactured at scale, and dropped at market. On this last stage, the personal sector takes the lead. Consider SpaceX, which scaled up reusable rocket know-how after foundational propulsion work carried out at NASA, or Moderna, which commercialized mRNA platforms first explored by way of Nationwide Institutes of Well being-funded analysis.

This division of labor throughout the innovation lifecycle is a quiet however highly effective engine. Universities generate risk. Labs cut back danger. Markets ship scale. Every performs a definite function, and every is determined by the well being of the others. Strategic efforts to bypass or consolidate this construction — to shortcut curiosity in favor of focused returns — danger breaking the suggestions loops which have made the U.S. innovation mannequin so resilient and productive.

The Double Energy Regulation

We describe this phenomenon as an underappreciated “double energy legislation” of American innovation. First, federal analysis funding, distributed extensively and with out inflexible priorities, produces breakthrough scientific data with extremely unequal payoffs. Second, this data is captured by a downstream enterprise capital system that additionally operates on an influence legislation distribution of returns.

Whereas the facility legislation nature of enterprise capital is well-documented (and even gives the title of a e book that Jon makes use of at school: The Energy Regulation: Enterprise Capital and the Making of the New Future), the truth that a double energy legislation is at work is much less understood. Simply as failure is rewarded within the enterprise economic system if it results in classes that de-risk the entrepreneur’s subsequent enterprise, so too should the breadth of inquiry within the analysis ecosystem be understood as important. It’s a characteristic, not a bug.

Collectively, this “double energy legislation” creates an innovation engine that has made the US a world chief throughout a number of sectors, not only one. The outcomes are lumpy, nonlinear, and troublesome to plan — however they’re unequalled of their total yield. It’s the type of industrial coverage that different international locations cite with admiration as an unmitigated American coverage success.

The Perils of Conflating Breadth of Analysis with Inserting Strategic Bets

The present administration, nonetheless, has sought to disrupt this mannequin. Now we have seen this film in deliberate economies earlier than and it has not gone effectively. Along with making a disincentive to pursue federally funded analysis, this additionally runs opposite to energy legislation logic.

It’s the prerogative of administrations to position bets. The Apollo program and Operation Warp Velocity are each examples of the facility of focused federal help. The moonshots themselves ship fruit, and so, too, do their by-products. However such bets needs to be positioned individually from the broad analysis portfolio described above. Additional, applications like DARPA’s profit from program managers having the autonomy to dive deeply into fixing one specific technological drawback, and discover the proper reply, not a most well-liked reply.

By emphasizing “strategic sectors,” governments would possibly leverage industrial coverage based mostly on short-term, non-scientific judgment about which applied sciences deserved help. Fairly than betting on science, we start betting on bureaucratic foresight.

This shift additionally undermines a primary understanding that has lengthy ruled American innovation. Universities and researchers have accepted uncertainty and competitors (to not point out decrease pay) as a result of the system has been clear and open to heterogeneity of analysis inquiry. Consequently, startups, traders, and society at giant have benefited from a gradual stream of publicly funded science. Additional, since Bayh-Dole, universities and entrepreneurs have benefited from with the ability to take part within the commercialization of analysis initially funded by the federal authorities.

Strategic bets, mixed with culling of the analysis portfolio, danger concentrating assets, narrowing participation, and in the end bringing a completely pointless finish to this 80-year run of success.

Transferring Ahead

The innovation ecosystem that underpins U.S. nationwide safety is the product of many years of belief, funding, and experimentation. Preserving it requires resisting the temptation of management — recognizing that scientific discovery can’t be pressured into strategic lanes with out degrading its potential.

To compete with geopolitical challengers like China, the US ought to double down on the very mannequin that constructed its technological and human capital benefit: decentralized funding, open inquiry, and public-private complementarity.

Defunding the analysis innovation ecosystem within the identify of effectivity is penny-wise and pound-foolish. Additional, it’ll shrink the pool of know-how obtainable to be dropped at market by the downstream enterprise economic system. Would enterprise capitalists transfer upstream, to fill in gaps within the analysis funding ecosystem? Unlikely — they’ve very totally different incentives, pushed by the necessity to ship constant returns to restricted companions. They don’t seem to be within the enterprise of funding analysis.

Any administration would do effectively to recollect this. America’s edge doesn’t lie in predicting the longer term. It lies in getting ready for it by supporting the unpredictable and attracting the brightest on this planet to work on inventing the longer term.

Jon Metzler is a seamless lecturer on the Haas Faculty of Enterprise on the College of California, Berkeley, the place he teaches on technique for the networked economic system, and innovation and entrepreneurship. Jon is a college mentor at Berkeley SkyDeck, the accelerator for Berkeley-affiliated startups. He’s additionally a college fellow and a member of the school advisory board on the Berkeley Danger and Safety Lab.

Andrew W. Reddie is an affiliate analysis professor on the College of California, Berkeley’s Goldman Faculty of Public Coverage, the place he teaches on the intersection of know-how and worldwide safety and is the founding father of the Berkeley Danger and Safety Lab.

Picture: NASA’s Scientific Visualization Studio by way of Wikimedia Commons