Key Messages

- The SBA 504 Mortgage Program facilitates long-term, fixed-rate financing for ground-up development, minor/main renovations, tenant enhancements, or buying industrial/industrial property. This program sometimes requires solely 10 % down, with 40 % funded by an interim lender and 50 % by a traditional lender, offering an economical possibility for increasing companies.

- Approval and funding timelines are influenced by the scope of the work concerned and acquiring thorough documentation. It’s important to companion with the lender offering the development/enchancment mortgage to assessment web site plans, contractor bids, and scopes of labor proper from the start to reduce the necessity for rework on the finish of the mission.

- Intently monitoring development attracts and alter orders or working with a 3rd celebration fund management firm are essential for safeguarding interim lenders. They assist make sure that accomplished enhancements are verified, lien waivers are tracked, and prices align with the authorised finances.

- By partnering early with CDC Small Enterprise Finance, lenders can higher handle dangers, anticipate the wants of debtors, and preserve enchancment tasks on schedule from the choice of bids, by modifications within the prices of the mission and timelines to make sure a well timed 504 Debenture takeout throughout the Interim Lenders maturity of their mortgage.

Many debtors seeking to buy older or unfinished buildings typically require inside renovations earlier than they will begin operations. These renovations are sometimes known as tenant enhancements. SBA 504 financing can help with these upgrades, however solely when they’re made by the borrower within the industrial property they may personal and occupy.. Since these industrial actual property tasks contain permits, phased development, and a number of draw requests, lenders normally search clear steering from the outset.

CDC Small Enterprise Finance, a part of the Momentus Capital branded household of organizations, collaborates with lenders and the small enterprise borrower to confirm mission eligibility, assess timelines, and handle the required documentation all through the mission to make sure a clean and well timed funding..

From the time the lender is structuring the mortgage, finalizing contractor bids and throughout closing, early coordination with CDC Small Enterprise Finance helps industrial actual property debtors perceive what qualifies for eligible SBA financing. Moreover, it gives lenders with a clearer view of mission timelines, occupancy necessities, and facilitates a clean transition from interim financing to the SBA 504 takeout.

With this stable basis and early partnership, CDC Small Enterprise Finance can determine and assist forestall delays when the scope of the advance modifications throughout development. This enables lenders to help their debtors in making a smoother course of and navigating their development with larger confidence.

Understanding How SBA 504 Tenant Enhancements Work

Understanding how SBA 504 tenant enhancements work is essential for debtors and contractors. The time period tenant enhancements refers to inside renovations executed throughout the area that the borrower will occupy within the bought property. It’s necessary to notice that enhancements for third-party tenants don’t qualify.

As Vice President of 504 Mortgage Processing and Closing, I at all times advise that for the reason that borrower should occupy 100% of the improved area, it’s very important to determine early on which elements of a constructing are eligible for 504 financing.

Eligible enhancements can embody HVAC methods, plumbing, electrical upgrades, fireplace and life security enhancements, accessibility modifications, framing, and inside ending work. These enhancements are sometimes vital in older buildings or industrial actual property properties which have had completely different makes use of previously. Moreover, inside enhancements can signify a good portion of the whole mission value, making early evaluation important.

What can you utilize a SBA 504 Tenant Enchancment Mortgage on?

| Eligible Work | Ineligible Work |

|---|---|

| Borrower-Occupied Inside Work Framing, drywall, ceilings, flooring, inside doorways, paint, or insulation |

Enhancements Inside Non-borrower Tenant Suites Beauty upgrades for rental tenants or enhancements benefiting one other enterprise |

| Mechanical & Utility Upgrades HVAC set up or alternative, electrical rewiring, or plumbing upgrades |

Third-Get together Methods Specialty methods for a separate tenant or tools serving a tenant’s unique use |

| Life-Security & Code Compliance Fireplace sprinklers, alarms, ADA upgrades, seismic upgrades, or accessibility work |

Non-Operational Enhancements * Décor, shows, free furnishings, advertising and marketing installations or signage not required by code |

| Everlasting Fixtures Constructed-in counters, millwork, fastened casework |

Movable Furnishings * Tables, chairs, décor, detachable shelving |

| Building Attracts (Verified) Progress-based disbursements, site-verified completion, or unconditional lien waivers |

Unverified Attracts Work submitted with lacking documentation or prices that don’t match the authorised scope |

*Non-operational Enhancements and Movable Furnishings will not be lined until allotted as a Furnishings, Fixtures, and Gear value within the authentic mortgage construction. If a borrower provides them to the scope of labor after mortgage approval, the objects would must be reviewed for eligibility and corrections made to the SBA Phrases and Circumstances. Thus inflicting a possible delay within the funding of the debenture.

Some tasks begin as easy tenant enhancements, however the scope can change as soon as bids are available in or partitions come down. When that occurs, the contractor points a change order, which is a proper replace to the scope and value. The interim lender and CDC Small Enterprise Finance will then conduct a re-review utilizing the up to date plans, a revised mission value breakdown (together with sources and makes use of), and all the required permits, invoices, and lien waivers. This ensures that the work remains to be eligible and throughout the construction offered on the time of SBA approval. If the modifications are substantial (e.g., they have an effect on eligibility, occupancy, or the authorised finances), underwriting might have to get entangled, and a proper mortgage modification will must be issued earlier than the subsequent draw request is authorised.

Work That Could Be Eligible, However Requires Further Evaluation

| Doubtlessly Eligible Work | Why It Takes Longer / What’s Wanted |

|---|---|

| Shell Enhancements Supporting Borrower House Roof restore, exterior structural work, or façade updates tied to borrower use |

Wants up to date plans/web site particulars and value allocation so the work is clearly tied to the borrower-occupied portion and isn’t an unique profit to leased-out suites. |

| Specialised Operational Construct-Outs Meals-prep, lab, medical plumbing, or manufacturing or light-industrial areas |

Requires an in depth scope, permits, and documentation exhibiting the enhancements are everlasting and straight assist the borrower’s operations. |

| Delicate Prices Architectural and engineering charges, permits, inspections, or affordable contingencies |

Could require extra documentation or revisions so prices are affordable, permitted, and absolutely supported by invoices and lien waivers. |

| Change Orders Affecting Eligibility Modifications shifting work into ineligible areas, proprietor occupancy or the authorised finances |

Usually triggers a assessment from underwriting (and typically a mortgage modification) if there is a rise or important lower to the mission. Evaluation with the Interim Lender of the proposed change order, revised scope/bids, and an up to date mission value breakdown earlier than extra attracts are authorised. |

Understanding the Significance of Occupancy Necessities

SBA 504 occupancy guidelines play a vital position in tenant enchancment tasks. To qualify for an SBA 504 mortgage, debtors have to occupy a minimum of 51 % of an present constructing or 60 % of latest development. These occupancy ranges dictate which enhancements could be financed.

Through the assessment course of, the funds can solely be used for the borrower’s portion of the constructing. They will enhance the general shell, however debtors can’t enhance the area they’re leasing out to different non-affiliated companies. Since occupancy impacts eligibility, it’s important for industrial actual property lenders to confirm web site plans, proposed scopes, and contractor bids in the course of the preliminary software part.

Moreover, modifications to mission scopes can affect eligibility. Vital alterations could make it “nearly like a model new mortgage.” Due to this fact, early collaboration amongst lenders, CDC Small Enterprise Finance, the contractor, and the borrower is important to keep away from delays. This proactive method additionally minimizes rework attributable to change orders that would have an effect on occupancy or the general finances.

Guarantee Your Borrower’s Tenant Enchancment Venture Meets SBA 504 Necessities

Seek the advice of with our SBA 504 consultants to assist your borrower keep on schedule with their enhancements.

How Building Attracts & Fund Management Assist Lenders

Many tenant enchancment tasks require funds to be launched in phases. These are known as development attracts or draw requests. CDC Small Enterprise Finance works with the interim lender all through the development/enchancment course of , and displays the mission’s progress to make sure well timed funding/take out of the Interim Lender Mortgage. This method safeguards the lender’s pursuits and helps make sure the interim mortgage is paid off as anticipated, and inside their Interim Mortgage maturity.

Each SBA 504 mortgage requires non permanent funding supplied by the interim lender earlier than the 504 debenture is funded. This interim financing covers the time between real-estate/land closing and mission completion. Lenders stay on this interim place till all development and enhancements are accomplished, mortgage funds are absolutely disbursed, correct documentation is obtained, and the SBA debenture has been funded.

As soon as the work is accomplished, our inside development group will work straight with the interim lender and the borrower to substantiate the correct paperwork are so as and meet all native laws and SBA necessities. Moreover, we affirm borrower occupancy previous to the SBA mortgage being finalized.

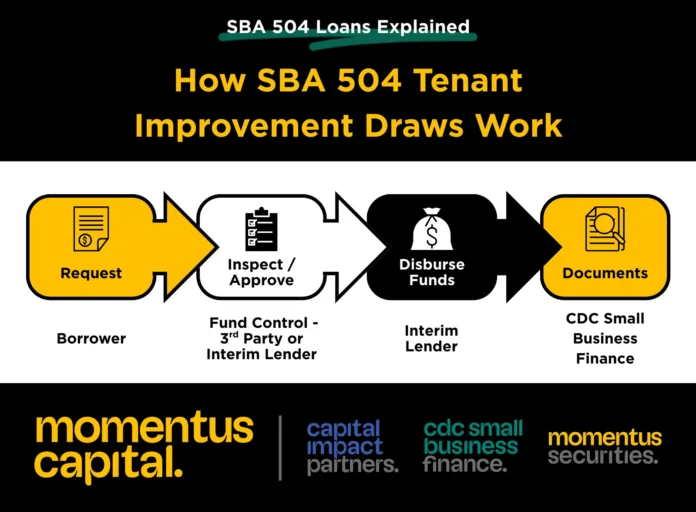

Every draw goes by 4 important steps:

- Request: The borrower or contractor submits invoices, schedules, and assist paperwork on to the Interim Lender (Building Mortgage).

- Examine and Approve: The Interim Lender or third Get together Fund management verifies progress, collects lien waivers, and confirms prices align with the authorised scope.

- Disburse: Interim lender releases funds as work is accomplished and normally holds onto the ultimate retention till a remaining signed-off inspection or Certificates of Occupancy is obtained.

- Documentation: CDC Small Enterprise Finance’s inside development group works with the Lender and Small Enterprise Borrower to confirm all required documentation meets SBA necessities so as to proceed with the funding of the debenture.

Lien waivers play an necessary position when the SBA 504 debenture funds. These are authorized paperwork from a common contractor or vendor confirming they’ve been paid for accomplished work and waive any proper to file a mechanic’s lien.

Whereas a lien can nonetheless be filed in some conditions, most frequently by a subcontractor who has not been paid, CDC Small Enterprise Finance advises that any lien waivers which were filed should be correctly launched to assist guarantee a clear title and funding of the Debenture. Addressing these points early permits the events to resolve disputes in the event that they come up and retains the mission transferring towards remaining funding with out pointless delays.

We require unconditional lien waivers from the final contractor or every vendor if a GC was not used. Since tenant enchancment tasks typically contain a number of subcontractors, correct monitoring prevents surprises at closing. This protects in opposition to future claims and ensures a clear title.

Change orders, formal changes to the development contract that change the scope of the mission, can lengthen timelines or improve prices. If a change impacts eligibility or occupancy, lenders ought to anticipate a revised assessment and extra documentation. Speaking early may also help keep away from delays within the remaining takeout.

CDC Small Enterprise Finance can start the funding course of to repay the Interim mortgage when:

- Documentation of mortgage proceeds have been absolutely disbursed and mission prices allotted.

- The mission is 100% full.

- All documentation has been obtained from the municipalities, together with a remaining, signed-off inspection report (if permits have been required) or a Certificates of Occupancy.

- Unconditional lien waivers are obtained.

Managing Timelines & Interim Financing Publicity

The time it takes to course of industrial actual property tasks can differ primarily based on allowing, inspections, and remaining approvals, which frequently results in prolonged mission schedules. Lenders ought to know that some jurisdictions have extra necessities that may delay issues by weeks, months, and even years.

Market circumstances and value overruns can impression budgets. Whereas a ten % contingency is usually normal, current tasks have sometimes gone past that. In such instances, the borrower should come out of pocket for the fee overruns as SBA solely permits for a ten% contingency to be included within the mission prices. Because of this CDC Small Enterprise Finance works early on and all through the advance/development part to make sure the mission prices stay eligible.

As soon as development is accomplished, remaining occupancy is authorised by the relevant municipality, and all funds are disbursed, lenders ought to anticipate a 60- to 90-day interval for remaining funding after the certificates of occupancy is issued. Sustaining clear communication throughout this part may also help guarantee a smoother transition to the SBA 504 takeout.

Since interim financing stays in place till all work is completed, lenders profit from clear communication and reasonable mission planning. CDC Small Enterprise Finance performs a vital position in setting expectations early, permitting lenders to observe timelines extra successfully.

Why Lenders Work With CDC Small Enterprise Finance

Tenant enchancment and development tasks contain a number of transferring elements. CDC Small Enterprise Finance’s inside assist group is an especially robust and educated again workplace. We’re intimately concerned, continually in communication, and managing expectations. This steering helps lenders keep knowledgeable concerning the timeline of the Debenture funding and what the subsequent steps are to start the funding course of for the borrower. ls.

When lenders companion early within the mortgage course of with CDC Small Enterprise Finance, they will higher anticipate borrower questions, keep away from delays throughout closing, and scale back interim publicity all through the development interval. This steering not solely helps CDC Small Enterprise Finance to remain according to remaining approvals, it permits lenders to know when the interim mortgage is paid off and changed by the everlasting mortgage.

Nonetheless have questions on tenant enchancment eligibility or 504 documentation?

These FAQs cowl the commonest points lenders encounter.

What tenant enhancements/leasehold enhancements are eligible below an SBA 504 mortgage?

Eligible enhancements ought to improve the area occupied by the borrower’s enterprise, together with HVAC, electrical, ADA upgrades, plumbing, flooring, and structural modifications. Enhancements made for third-party tenants don’t qualify.

What’s the distinction between tenant enhancements and leasehold enhancements in response to SBA tips?

Whereas these phrases are sometimes used interchangeably, they really confer with completely different possession eventualities and eligibility standards. Tenant enhancements typically confer with renovations made to a constructing that the borrower owns and occupies, which aligns with the standard construction of an SBA 504 mortgage. Alternatively, leasehold enhancements sometimes confer with upgrades made in an area the borrower is leasing from a landlord.

For SBA 504 functions, financing is tied to the borrower-occupied portion of the property and should straight profit the working enterprise and meet SBA occupancy necessities. Enhancements supposed for third-party tenants or rented suites don’t qualify for 504 financing.

What documentation is required for tenant enhancements in a 504 mission?

So long as licensing, possession, and medical oversight constructions meet SBA expectations, widespread interim lender necessities embody: contractor bids, detailed value breakdowns, flooring plans, permits, proof of borrower funding, invoices, lien waivers, and picture/inspection documentation for every draw.

If no fund management was used, invoices and cancelled checks might be required. On the finish of the day, CDC Small Enterprise Finance wants to indicate that the mortgage from the lender went to proceeds, the entire cash was disbursed, and present the place the cash was disbursed.

How does fund management work for SBA 504 tenant enhancements?

Fund management entails verifying accomplished work, reviewing invoices, monitoring lien waivers, confirming eligible prices, managing draw requests, and making certain that borrower funds are injected earlier than 504 disbursements.

What occupancy necessities have an effect on tenant enchancment eligibility?

In accordance with SBA industrial actual property necessities, debtors should occupy 100% of any area improved with 504 funds and should lease out as much as 49 % of an present constructing and 40 % of latest development. These standards decide tenant enchancment eligibility and shutting necessities.

When ought to lenders have interaction CDC Small Enterprise Finance for tenant enchancment tasks?

CDC Small Enterprise Finance advises involving them when the lender is structuring their mortgage and earlier than remaining approval of contractor bids/invoices to make sure that enhancements are eligible, documentation is correct, and interim-lender publicity is minimized.

Subsequent Steps for Lenders

When a borrower is preparing for a tenant enchancment mission, CDC Small Enterprise Finance can help in confirming eligibility earlier than development or enhancements start. This early assessment helps keep away from widespread delays and permits lenders to supply clear steering.

Have questions on SBA 504 tenant enchancment eligibility? Contact one in all our 504 mortgage officers to assessment your borrower’s mission earlier than bids or work start.