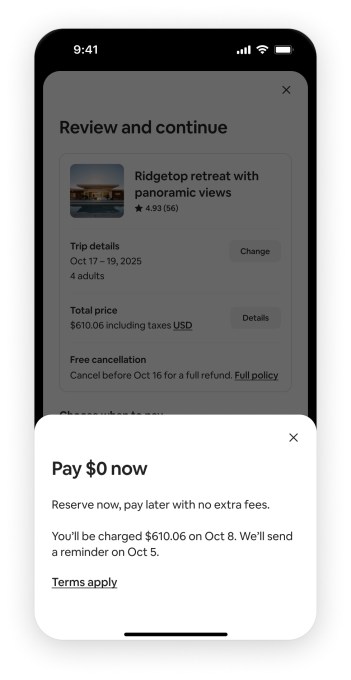

Airbnb stated on Tuesday that it’s launching its “Reserve Now, Pay Later” characteristic — which lets customers safe bookings with out quick cost — globally. This enables customers to cancel their bookings if there’s a change of plans with out dropping cash upfront.

The corporate launched the characteristic within the U.S. final yr for home journey. Airbnb stated that properties with a “versatile” or “average” cancellation coverage are eligible for the upfront reservation. With this feature, customers get charged nearer to their check-in date reasonably than on the time of reserving. The characteristic mirrors “purchase now, pay later” cost plans which have turn into common in e-commerce, making costly journey extra accessible by spreading out prices. The corporate famous that for the reason that launch, the characteristic noticed 70% adoption for eligible bookings.

Throughout its earnings requires This autumn 2025, Airbnb stated that the characteristic helped develop nights booked within the quarter.

“Reserve Now, Pay Later noticed important adoption amongst eligible visitors in This autumn. It’s additionally led to longer reserving lead occasions and a mixture shift in direction of bigger whole houses, particularly these with 4 or extra bedrooms, contributing to the rise in common day by day price,” Ellie Mertz, CFO of Airbnb, stated through the name.

Mertz famous that Airbnb’s total cancellation price jumped from 16% to 17% for the quarter, and it was greater amongst prospects who use the upfront reserving product. Nevertheless, she stated that this was “not vastly materials relative to the broader cancellations on the platform.”

Final yr, the corporate surveyed U.S. vacationers together with Focaldata, a London-based market analysis and polling firm. Of these surveyed, 60% of members stated {that a} versatile cost choice is vital whereas reserving a vacation, and 55% stated that may use a versatile cost choice.

The corporate has been experimenting with pay-later merchandise for years now. Again in 2018, Airbnb launched a product that allowed customers to guide a property by paying 20% or 50% of the full costs. upfront, with the remainder due later. In 2023, the corporate partnered with fintech agency Klarna to let customers pay for his or her stays in 4 installments over six weeks.

Techcrunch occasion

Boston, MA

|

June 23, 2026