Amazon can transfer your stock at will, and this might dramatically affect the states the place you’ve gotten a gross sales tax nexus and owe cash.

How To Decide If You Owe Gross sales Tax In A Particular State

Usually, you owe gross sales tax the states the place you’ve gotten a bodily presence, obtain advantages, or conduct enterprise in. This would come with your property state, in addition to states the place you:

- An workplace or workplace

- Have workers or contractors working

- Attend commerce reveals or have affiliate entrepreneurs in

- Have drop-shippers storing/delivery stock out of in your behalf

- Have stock, warehouse, or different bodily items

If your enterprise engages in any of the above, you must greater than doubtless apply for a gross sales tax allow in that state. A information for every state is offered by TaxJar right here.

How Amazon FBA Stock Creates A Gross sales Tax Nexus

As an Amazon FBA Vendor, you’re making a bodily presence — or nexus — in a state everytime you ship a listing cargo to an out-of-state Amazon FBA warehouse. Because you now have a nexus on this state, you’ll have to file for a gross sales tax allow and begin gathering gross sales in that state based mostly upon their rules.

When Did Amazon Create Your Gross sales Tax Nexus?

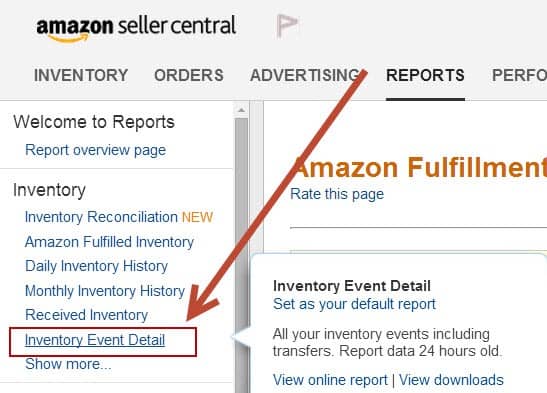

The very first thing you’ll want to do is to find out when Amazon established a nexus in a selected state. Inside your Amazon Vendor Central account, yow will discover out the place your stock is saved by accessing your Stock Occasion Element Report by going to:

- Vendor Central

- Studies

- Success

- Stock Occasion Element

Nonetheless, these stories could be cumbersome and really obscure. You’ll be introduced with an inventory of Success Facilities the place your stock has been saved and this may be huge!

The most suitable choice could be to make use of a service like WhereStock to find out the place and when your stock was first stocked in every state. For less than $29, WhereStock will ship your FBA Inventory Areas report back to your electronic mail inside one enterprise day.

You’ll now have the ability to decide the states the place your stock was retailer and the primary inventory date. This would be the first date the place you’re stock could have given you a nexus on this state.

Is Your Product Taxable or Tax Exempt?

Not ever product is taxed the identical approach in each state. It’s vital to go over the gross sales tax tips in every state that you’ve got a nexus in to find out whether or not or not your product is even taxable in that state.

When you’ve got questions on whether or not or not your product is taxable, you must examine with every state’s taxing authority.

Registering For Gross sales Tax Permits

Earlier than gathering gross sales tax in a state, you’ll want to apply for and obtain a gross sales tax allow. Most states can help you apply on your gross sales tax allow on-line and the knowledge required for every state is pretty customary:

- Firm Info

- Enterprise and mailing tackle

- Social Safety (SSN) or Employment Identification (EIN) quantity

- Contact info of signers/house owners

- North American Trade Classification Code (NAICS)

- Date of nexus triggering enterprise exercise

- Date your enterprise first had gross sales of any type

- Gross sales forecasts to find out how regularly you’ll have to file gross sales tax returns

It’ll often take one to 10 enterprise days to get a response for on-line functions and two to eight weeks for paper functions.

Should you’d reasonably not do that course of by yourself, we advise outsourcing the registration course of to an organization like Gross sales Tax System that solely focuses on the gross sales tax registration course of. For $95 per state, they’ll tackle your complete registration course of.

Additionally they present you the choice of getting all your gross sales tax correspondence mailed to them, the place they’ll type by means of the paperwork and maintain you knowledgeable of any pressing points.

Accumulating Tax On Your Amazon Orders

When you’re registered to gather gross sales tax, you’ll have to make it possible for your gathering gross sales tax on all your related Amazon orders by means of their gross sales tax assortment platform:

- Login to Vendor Central

- Setting -> Tax Settings

- Click on “View/Edit your Tax Assortment and Transport & Dealing with and Giftwrap Tax Obligation Settings”

From right here, you’ll have the ability to add product tax codes to make sure that you’re apply the best tax on every of your gadgets.

You’ll have to enter your state gross sales tax registration quantity earlier than Amazon will permits you to enter your gross sales tax assortment info. That is to make it possible for sellers don’t illegally gather gross sales tax from prospects and maintain the cash for themselves.

Submitting Gross sales Tax Returns

For many sellers, manually gathering your gross sales knowledge for every state will seem to be a cumbersome activity even earlier than submitting the precise return. For that reason, we advise utilizing a service like TaxJar to file your e-commerce gross sales tax returns.

They’ll mixture the gross sales knowledge from all your e-commerce platforms (Amazon, Shopify, and so on) right into a single report, which they’ll then use to file your state return for as little as $17 monthly.

What If You Haven’t Been Paying Tax

Should you’ve had stock in a Success by Amazon warehouse in a state for months (or years!) and also you’ve not collected gross sales tax throughout this era then you can owe a big sum of money. You’ll be able to both:

- Ignore Tax Legal responsibility — It is perhaps tempting to disregard a state’s gross sales tax legal responsibility completely, particularly in the event you solely owe a number of {dollars}. Nonetheless, this isn’t advisable since you’ll accrue curiosity and penalties on this legal responsibility over time in the event you’re audited and caught.

- Voluntarily Disclose Tax Legal responsibility — Should you voluntarily disclose your tax legal responsibility, you may have the ability to keep away from most, if not all, of the curiosity and penalties in your late fee.

Should you’re questioning about the place you’re most certainly to be audited, Taxify put collectively an inventory based mostly upon an inside pole of their purchasers, which is under:

Want Further Help?

Lanyap Monetary is a tech-based accounting and monetary providers agency that makes a speciality of streamlining their purchasers’ monetary operations by means of FinTech software program and cloud-based functions.