Look, taxes are the only best expense that most individuals can pay over the course of their lives.

Not your dream home, not your dream automotive, or another tangible factor you’ll be able to put your palms on. It’s taxes.

Consider it or not, taxes are evading virtually each single a part of your life. You pay taxes in your earnings, in your purchases, the property you personal, and a lot extra.

However what in case you might write off virtually something that you just bought?

What if we informed you that taxpayers are leaving thousands and thousands of {dollars} on the desk by not taking full benefit of the tax code?

Look, there are over 80,000 pages within the tax code, and on a type of pages, it means that you can deduct virtually something.

Simply have a look for your self.

Part 162 of the inner income code says that you may “deduct all odd and essential bills paid or incurred in the course of the taxable 12 months to hold on any commerce or enterprise”.

So prepare as a result of, in right this moment’s submit, we’re going to clarify how one can write off virtually something.

At present, we’re going to show you methods to write off something – effectively, virtually.

What we’re about to inform you isn’t a “tax loophole” that may get you in hassle. The truth is, it’s fairly the alternative.

Tax write-offs and deductions can be found for everybody.

It’s, fairly actually, written as a part of the tax code to incentivize folks to take motion to develop the economic system.

The issue is that most individuals are intimidated by tax deductions and write-offs a lot, in order that they don’t take them in any respect and wind up paying far more in taxes than they need to.

The truth is, some specialists say that the typical particular person will spend 25 to 35 p.c of their complete life working to pay taxes.

Simply take into consideration that, 25 to 35 p.c of your life. Not being spent to repay your hire or your mortgage. To not put money into inventory markets, actual property, or what you are promoting.

However no, actually, simply to pay taxes to the federal government.

By the way in which, talking of inventory and actual property, now we have one other submit that discusses which is the higher funding – shares vs actual property investing. You’ll want to learn that subsequent.

The Tax Code is Not Your Enemy

What’s even crazier is that lots of people assume that the tax code is their enemy.

However the tax code is just not your enemy. It was not written to simply take your cash.

It was written to develop the economic system, enhance jobs, present inexpensive housing, and promote many initiatives that the federal government depends on to offer for its residents.

Subsequently, if you may make the tax code your pal, then it is possible for you to to profit from the way it was written.

Simply give it some thought.

If there have been no companies, there can be no jobs. That will be a catastrophe, proper?

So the federal government permits enterprise house owners to take write-offs that aren’t out there to staff.

Or how about actual property? If there isn’t a housing, folks wouldn’t have wherever to stay. That will be chaotic, proper?

So the federal government encourages actual property traders to put money into actual property…

…by permitting them to put in writing off issues like depreciation and so many extra issues that aren’t out there to common taxpayers.

So what’s our level right here?

Our level is that you may decrease your tax invoice, not by dishonest the system, however by as an alternative aligning your self with the incentives that lie inside it.

In the event you stick round till the tip of this submit, then you’ll know extra about how taxes work and how one can make the most of tax write-offs to decrease your earnings.

With that mentioned, let’s break this all the way in which down.

What are Tax Write Offs and Tax Deductions?

To start with, tax write-offs and tax deductions discuss with the very same factor.

So anytime you hear somebody say tax write-off, simply know that they’re referring to tax deductions.

In the end, tax deductions are eligible bills that you may deduct out of your taxable earnings.

Now, there are two various kinds of taxpayers – common taxpayers, which might be wage earners.

After which there are tremendous taxpayers, who’re primarily enterprise house owners and traders.

You’ll see that the tremendous taxpayers reap probably the most tax advantages, as a result of they align themselves extra intently with the pursuits of the federal government.

The “Common” Taxpayer Write Offs

The typical taxpayer is somebody who has a job, household, and mortgage or hire.

The tax code was written to offer for the typical taxpayer, somewhat than to incentivize them.

The federal government needs to be sure that this particular person has entry to jobs, inexpensive housing, healthcare, and so forth.

Subsequently, the tax code doesn’t incentivize the typical taxpayer as a lot. Common taxpayers, like wage-earners, are very restricted in what they’ll deduct from their taxes.

However, they’ll take the usual deductions or itemized deductions.

The usual deduction is out there to all taxpayers. As an illustration, in 2021, single taxpayers can deduct $12,500 from their taxable earnings, and married taxpayers can deduct about $25,000.

So for instance, in case you’re married and have $100,000 in earnings, you’ll be able to instantly deduct $25,000 out of your taxable earnings, and solely pay taxes on the remaining $75,000.

Or you’ll be able to itemize your deductions when you’ve got sure bills that exceed the usual deduction.

Itemized deductions assist you to deduct issues like your property mortgage curiosity, property taxes, charitable contributions, and different particular objects.

The thought right here is that in case your itemized deductions exceed your commonplace deduction, it is best to itemize to decrease your tax invoice.

For instance, if you’re single and have $15,000 in itemized deductions, then it is best to itemize since the usual deduction is barely about $12,500.

Aside from taking the usual deduction or itemized deduction, there’s little or no that the typical taxpayer can do to decrease their earnings taxes…

…exterior of contributing to a retirement account to defer taxes till a later date.

Subsequently, in case you’re a median taxpayer who needs to make the most of the tax code to put in writing off virtually something, you need to discover a approach to contribute to the economic system by enterprise or actual property.

You need to turn into an excellent taxpayer.

The “Tremendous” Taxpayer Write Offs

Tremendous taxpayers are enterprise house owners and traders. They can deduct virtually something from their earnings given the appropriate circumstance.

The tax code we confirmed you earlier referred particularly to enterprise house owners.

So long as the expense is a enterprise or funding expense, they’ll deduct it.

And if that enterprise expense offers a private profit, then that could be a plus of being an excellent taxpayer.

So in basic, if the aim of the expense is to provide extra earnings, then it may well possible be deducted.

That’s why tremendous taxpayers can deduct enterprise meals – so long as they’re consuming and discussing enterprise, they’ll deduct that meal from their earnings.

Tremendous taxpayers can do car tax deduction – so long as the car is getting used for enterprise or is getting used to promote that enterprise, they’ll deduct it.

Tremendous taxpayers can deduct a few of their residence mortgage, utilities, and property taxes – so long as they’re utilizing a portion of their residence to conduct enterprise.

As an illustration, a house workplace or a basement that you’re storing stock in or one thing.

Tremendous taxpayers may even deduct their holidays – so long as they do some kind of enterprise throughout that trip interval.

As an illustration, an actual property investor would possibly be capable to deduct a trip in the event that they have been actual property within the space they’re touring to.

As you’ll be able to see, tremendous taxpayers can deduct virtually something – meals, automobiles, housing prices, journey, and extra so long as it’s used to assist them produce extra earnings of their enterprise.

However many tremendous taxpayers are afraid of taking these deductions.

Like, simply final week, a few of our YouTube subscribers requested us:

- Can I write off my service provider bills from Stripe?

- Can I write off the eBay charges I pay once I promote my merchandise?

- Can I write off firm t-shirts that I exploit to promote my enterprise?

That’s all sure, so long as these are respectable enterprise bills, you’ll be able to write it off!

You don’t have to be afraid of tax deductions, it’s actually written within the tax regulation.

The issue with deductions solely arises while you begin claiming private bills as enterprise deductions that don’t have anything to do with what you are promoting.

Like you’ll be able to’t simply purchase a Porsche and write it off from what you are promoting with out it serving some enterprise goal.

If you’re wine and eating purchasers, utilizing it to journey from one enterprise to a different, and even utilizing it to promote what you are promoting, then you definately could possibly deduct the expense out of your earnings.

Enterprise house owners are in a position to write-off virtually something, so long as it meets just a few fundamental necessities.

What are Eligible Bills?

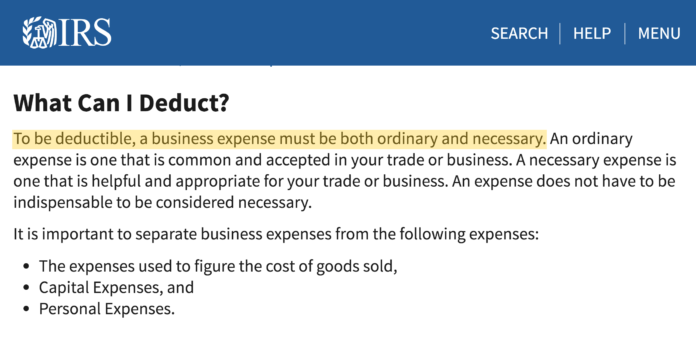

In accordance with the tax code, the expense have to be odd and essential for carrying on the enterprise.

Now, the tax regulation doesn’t particularly outline what odd and essential means.

Subsequently, it’s as much as you to find out what bills qualify as “odd” and “essential” for what you are promoting.

Now, the IRS does try to outline this in a publication.

In accordance with the publication, an odd expense is one that’s frequent and accepted in what you are promoting or commerce.

And a essential expense is one that’s useful or applicable in your commerce or enterprise.

For instance, an odd and essential expense for a automotive dealership may be shopping for automotive elements.

Whereas for our accounting agency, it may be expertise and software program. Certainly, we couldn’t deduct automotive instruments for our accounting enterprise.

Possibly if these automotive instruments have been being utilized to a car that was getting used for enterprise, then certain.

However the thought is that you may’t simply begin shopping for something and writing it off. That’s when you can begin moving into some large hassle with the IRS.

Steps on The right way to Write Off Something (Nearly)

Step 1: Begin a enterprise or turn into an lively investor

Keep in mind, tax deductions profit enterprise house owners and traders probably the most.

Lots of people assume that this implies they need to be rich to make the most of the tax regulation.

You don’t.

These tax deductions can be found for all enterprise house owners and traders, no matter how a lot cash you make.

The truth is, there are particular deductions which might be made for brand spanking new enterprise house owners, just like the startup and group prices deduction that means that you can deduct your startup bills.

And we did a submit on this already, however anybody can begin a enterprise. We did a wholly separate submit on methods to begin a enterprise with out cash.

The truth is, we began our first enterprise with as little as $200.

Step 2: Be certain that your bills have a enterprise goal

If you wish to deduct virtually every little thing, you have to make sure that virtually every little thing you purchase has a enterprise goal.

For this, we wish you to think about the worst-case state of affairs right here. Let’s say the IRS audits you and needs to study extra concerning the deductions you claimed.

In that occasion, you need to have the ability to confidently clarify to the IRS how the bills you claimed as deductions have been used to profit what you are promoting.

So long as that’s in accordance with the tax regulation, then you definately shouldn’t have something to fret about.

Step 3: Be sure to doc every little thing

The third step is to just remember to sustain along with your documentation, like your receipts or invoices.

Once more, within the occasion of an audit, you don’t need to be all over.

If the IRS asks for extra data in your deductions, all you have to do is present proof of the expense and what it was for.

That’s it. But when you don’t sustain with the receipts and invoices, then you might have a tough time proving that the bills have been respectable enterprise deductions.

So make your life straightforward by simply protecting monitor of your receipts for what you are promoting bills

Step 4: Declare the deductions accurately in your tax return

Once you file your taxes, whether or not you’re doing it your self or a tax preparer is doing it for you, be sure to declare your deductions accurately.

Particularly, be sure to are categorizing your bills into the appropriate locations in your tax return.

There are particular classes for every kind of enterprise deduction, so you’ll want to be sure to insert the appropriate quantities in the appropriate classes.

You need to be doing all your bookkeeping all year long, which ought to make it very straightforward to tally up the totals and that to your tax return.

However finally you have to be sure to do that accurately, as a result of any errors might set off an audit.

So there you’ve gotten it, these are the steps on methods to write off something. In the event you assume it can save you extra on taxes however are simply unsure methods to do it, then contact us right this moment!

We’ve a group of CPA tax specialists able to assist in your tax planning, tax preparation, and tax decision.