The SBA not too long ago launched a direct PPP mortgage forgiveness portal in an effort to streamline the mortgage forgiveness course of.

That is actually excellent news, in our opinion, particularly in case you utilized for the primary or second attracts of the Paycheck Safety Program.

We all know lots of you’ve got had points making use of for PPP mortgage forgiveness by way of your taking part lender or financial institution.

And people points vary from them not accepting forgiveness purposes or simply not offering readability on the kinds required for forgiveness.

It’s actually simply been a trouble for lots of enterprise homeowners to efficiently get their PPP mortgage forgiven.

So in case you had been 1 of the tens of millions of small enterprise homeowners who obtained the Paycheck Safety Program mortgage or PPP mortgage, this replace is particularly for you.

PPP Overview

For those who recall, the Paycheck Safety Program was launched to assist small enterprise homeowners retain their staff and stay in enterprise.

Now it was set as much as be a “forgivable” mortgage.

This implies as soon as the funds had been obtained, you may apply for forgiveness and never need to pay any of the mortgage again, if the funds had been used for payroll and different qualifying enterprise bills.

The Drawback with Making use of for Forgiveness from Banks

Previous to this replace, forgiveness may solely be utilized by way of your lender or financial institution.

And this has offered big administrative issues.

Many enterprise homeowners have been unable to use for forgiveness by way of the financial institution as a result of:

- banks have been closing their forgiveness purposes,

- delaying the mortgage forgiveness course of, or

- even partially forgiving loans with out rationalization.

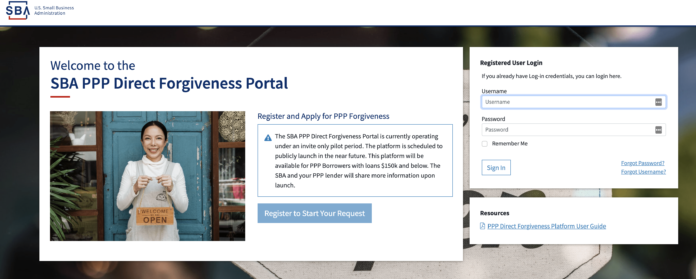

The New SBA PPP Direct Forgiveness Portal

Now, attributable to this SBA replace, forgiveness is immediately out there by way of the SBA’s new PPP mortgage forgiveness portal, in case your PPP mortgage was underneath $150,000.

The purpose of the SBA’s portal is to ease the burden on banks by permitting small companies to immediately apply for forgiveness from the SBA.

Who Can Use the PPP Mortgage Forgiveness Portal?

Particularly, the portal will simplify forgiveness for smaller companies, together with sole proprietors.

The overwhelming majority of companies who utilized for the PPP mortgage obtained loans underneath $150,000.

In reality, the common mortgage measurement was $42,000. So for many of you, making use of immediately by way of the SBA is a viable choice.

And contemplating the forgiveness course of is already troublesome as it’s…

…having this portal choice is superior information and can assist tens of millions of companies to get again to what they do greatest and that’s operating their companies.

The brand new PPP mortgage forgiveness portal will start accepting purposes from PPP debtors on August 4th of 2021. Merely go to the SBA web site to use.

Along with this new platform, the SBA is establishing a customer support workforce to reply questions and immediately help debtors with their purposes.

Once more, that’s extra excellent news, contemplating banks have been a bit of unaware of what the SBA has been asking for by way of forgiveness purposes.

Now you can bypass the center man or ‘the financial institution’ and converse on to the SBA relating to your PPP questions.

And that is the quantity and occasions you may contact them along with your questions.

![]()

The SBA additionally launched a person information for the portal. And it’s designed to stroll you thru step-by-step easy methods to register on the brand new platform and apply for forgiveness.

Lenders Requirement

One other element to contemplate is that lenders are required to decide into this program by way of the SBA.

Lenders even have a separate portal they need to register by way of with a view to opt-in.

What this implies is that, as a borrower, you’ve got 2 choices to use for forgiveness.

- One is thru the brand new SBA PPP mortgage forgiveness portal web site.

- And the second is thru the lender you utilized from.

Both choice works completely effective. Some debtors haven’t had any points with their financial institution and would favor to use by way of that route.

For a lot of others, this isn’t the case, and making use of by way of the SBA’s portal can be higher.

However in case you do wish to apply for forgiveness immediately from the SBA, your financial institution or lender has to opt-in.

Solely debtors with taking part lenders within the SBA’s portal can use the portal to use for forgiveness.

In response to the SBA’s most up-to-date press launch, at the moment, 600 banks have opted during which would enable over 2 million debtors to use by way of the portal.

That is roughly 30% of loans underneath $150,000 that haven’t utilized for forgiveness.

Nevertheless, in case you navigate to this hyperlink and obtain their listing of taking part lenders, you will note that there are nearly 900 lenders listed.

So there’s a good probability that your lender is taking part within the SBA’s direct mortgage forgiveness program.

For those who don’t see your lender listed, we’d suggest calling them and asking in the event that they plan on opting in and after they anticipate to take action.

Get Able to Apply

For those who do plan on making use of for forgiveness and are patiently ready for the SBA’s portal to develop into out there…

…there are some things you are able to do to arrange and submit your utility as quickly because it turns into out there.

For debtors with loans underneath $150,000, you may fill out Type 3508-S and this represents the short-form model of the mortgage utility.

Some paperwork you would want to incorporate in your forgiveness utility are:

- Financial institution statements or third-party payroll service supplier studies

- Payroll tax filings

- State quarterly enterprise and particular person worker wage reporting

- Enterprise hire funds

- Enterprise utility funds

- Lined working bills

- Lined provider prices

The particular paperwork which might be required will rely on the data supplied in your authentic PPP mortgage utility and the way you used the funds.

However you can begin gathering this data now so as soon as the portal opens, you may submit your utility instantly.

That’s all we’ve for this put up. We hope you discovered it useful.

However when you have any questions or when you have had points getting your PPP mortgage forgiven, then work with our tax consultants as we speak.

Our knowledgeable workforce can undoubtedly enable you to along with your issues about taxes and extra. Contact us now!