In at this time’s put up, we’re going to settle the nice debate as soon as and for all – and that’s the reply to 1 query:

Which is the higher funding – shares vs actual property?

Learn till the tip of this put up for the professionals and cons of each, and our opinion as somebody who has invested and suggested individuals in each asset lessons.

It’s no secret that actual property investing has created 90% of the world’s millionaires.

And proper now, there are over $95 trillion {dollars} invested within the inventory market, which is an entire lot of cash.

Which is Higher- Shares vs. Actual Property Investing?

So which is best between shares vs. actual property investing? We’re going to have a look at a number of areas to find out this reminiscent of:

- Appreciation

- Revenue from Dividends or Money Stream

- Tax Benefits

- Liquidity

- Tangibility

- Ease and Simplicity

- Management

So let’s begin with appreciation.

1. Appreciation

It principally signifies that the asset you put money into will enhance in worth over time.

Each, shares and actual property respect in worth. However yet another than the opposite.

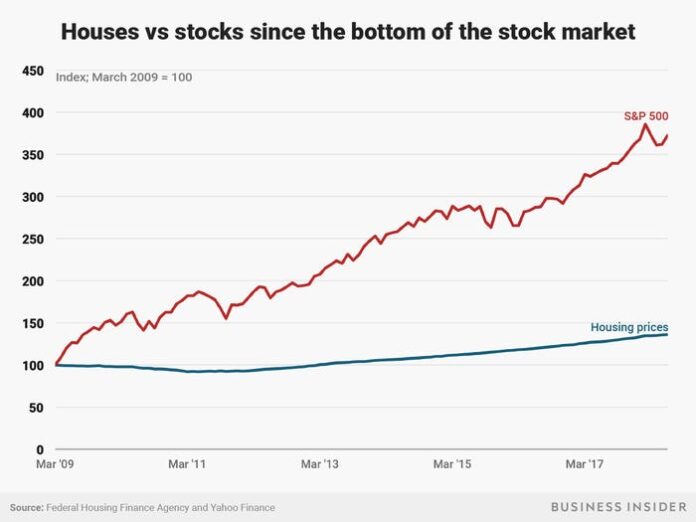

In keeping with Enterprise Insider, the inventory market has appreciated virtually 3x as a lot because the housing market for the reason that 08 recession.

Appreciation is a vital issue whenever you decide what asset you put money into as a result of it means that you can reap the benefits of compound curiosity.

Appreciation is why billionaire buyers like Warren Buffet advocate investing in inventory funds just like the S&P 500 because the single-best inventory funding for most individuals.

For instance, the S&P index fund, which consists of 500 of the biggest corporations in america, had a mean annualized return of 10% since its inception in 1926.

Due to compound curiosity, because of this your cash would double in 7 years at this price.

So in the event you invested $100,000 at this time, you’d have $200,000 in 7 years, and $400,000 in 14 years.

Or let’s say you’re beginning with completely nothing proper now…

…in the event you began investing $1,000 per thirty days with a ten% development price, you’d have over $1.3 million {dollars} in 25 years.

That’s how highly effective compound curiosity and appreciation is. And traditionally talking, the inventory market has appreciated greater than the actual property market.

In order that’s 1 level for the inventory market.

2. earnings

Each, shares vs. actual property investing can present constant earnings to you as an investor.

Within the inventory market, earnings is paid to you within the type of a dividend. There are shares with very excessive dividends, and a few shares that don’t pay dividends in any respect.

In the event you put money into a bunch of shares, just like the S&P 500 for instance, then you definately would obtain a mean of all the dividends paid out from that group.

Traditionally, the S&P 500 has paid a dividend yield of about 1.88% per yr, which is about $1800 on a $100,000 funding.

This isn’t life-changing if we’re being sincere, however to be truthful, you may put money into shares with increased dividends, however these usually respect much less in worth.

Alternatively, whenever you put money into actual property, earnings is paid to you within the type of money circulation from lease.

Sometimes, actual property buyers will make no less than 8-12% in rental earnings on their money funding.

And we’ve even seen returns as excessive as 15-20%.

Now, in fact, there’s the argument that there’s a lot of labor in actual property investing and it definitely will be, but it surely doesn’t must be.

Particularly not at this time.

Lately, you may simply passively put money into actual property by means of platforms like Fundrise…

…or CrowdStreet and let another person do all the give you the results you want.

Or you should buy properties and rent a very good property administration firm to handle your property for you.

So in the end, in terms of passive earnings, actual property investing wins by far.

So let’s give actual property 1 level on our scoreboard right here.

Now we’re tied up.

3. Tax Benefits

So let’s check out the tax facet of issues – our favourite a part of the equation by far.

While you put money into shares, you solely pay taxes whenever you promote your shares, not when it will increase in worth.

While you promote your shares, you’d pay both short-term or long-term capital positive aspects. And that is handled very otherwise for tax functions.

Brief-term capital positive aspects are taxed similar to your unusual earnings, which is the best sort of earnings tax that exists. Unusual earnings tax brackets can vary from 0-40%.

Whereas alternatively, long-term capital positive aspects are taxed at a a lot decrease price, which may vary from 0-20%.

So how do you pay long-term capital positive aspects tax in your shares?

It’s easy – all you must do is maintain your shares for greater than 1 yr and you may reap the benefits of the decrease tax price.

This implies in the event you’re day-trading and shopping for and promoting shares day-after-day, you’re going to pay short-term capital positive aspects taxes, which is far increased than long-term capital positive aspects.

So there are some tax benefits of investing in shares, so long as you maintain your shares for an extended time frame.

Now, let’s check out the tax benefits of actual property.

The tax benefits related to actual property alone could single-handedly make actual property the very best funding of all time.

You’ll be able to actually earn cash tax-free, and even keep away from taxes legally.

You’ll be able to reap the benefits of the depreciation, which works like magic, as a result of it means that you can declare an expense for one thing that doesn’t value you any cash.

It’s the one tax deduction that may decrease your earnings with out truly costing you a greenback.

So hypothetically, you may earn rental earnings from actual property and report a loss to the IRS after claiming depreciation.

And this isn’t a tax loophole, it’s actually part of the tax legislation.

The federal government needs to offer reasonably priced housing and needs to encourage individuals to put money into actual property.

They even permit you to speed up the speed of depreciation expense you’re taking in your actual property investments.

Try this put up subsequent to study extra about actual property depreciation.

However what occurs whenever you promote the property?

Technically, you’d pay capital positive aspects tax in your property whenever you promote it, similar to a inventory.

However happily, there’s this tax code referred to as the 1031 change.

The 1031 change means that you can promote one property with out paying capital positive aspects taxes, so long as you purchase the same property.

It’s sort of such as you’re “swapping” one funding for an additional. However the magnificence is in the truth that you may preserve “swapping” into higher-value properties.

For instance, let’s say you purchased a $100,000 dwelling. And 5 years later, the house is price $150,000, so that you resolve to promote it.

Nicely now, whenever you promote it, you will have $50,000 greater than what you paid for it. Now you should buy a $150,000 property and never pay any taxes on that achieve.

You’re successfully rising your wealth, however you aren’t paying any taxes to develop your wealth.

For this reason we love actual property investing. Right here’s our put up on 1031 change defined that you could learn after.

In the event you promote a inventory within the inventory market, you’re going to be taxed on it even in the event you purchase one other inventory.

The tax code extremely favors actual property investing, and a whole lot of millionaires use it to pay little to no taxes in any respect.

And by the best way, taxes are the only best expense that most individuals pays over the course of their lifetime.

So by mitigating this, you may develop your wealth exponentially.

Let’s go forward and provides actual property some extent right here.

Now for this inventory vs. actual property investing debate, let’s deliver all the pieces collectively right here and handle among the elephants within the room.

Generally, actual property has a better return than shares when you think about all issues – tax financial savings, money circulation, and appreciation.

For this reason 90% of millionaires put money into actual property.

Nevertheless, there are some non-financial explanation why individuals resolve to not put money into actual property or shares which are price mentioning as nicely right here.

So let’s handle it.

4. Liquidity

Actual property is an illiquid asset. When you put money into actual property, you can not get your cash out of it simply.

So in the event you put money into actual property, the one money you may depend on is the money circulation coming in from rental earnings.

And if that’s not sufficient, then you definately may end up in a really uncomfortable state of affairs.

Shares, alternatively, are very liquid. In the event you want your cash now, you will get it instantly.

That is very helpful within the case of an emergency otherwise you discover out that it is advisable to make a giant buy.

So let’s give shares some extent for liquidity.

Now, we also needs to point out that liquidity generally is a double-edged sword.

You typically don’t need to interrupt the compounding nature of your investments.

Or make emotional selections that trigger you to panic promote or panic purchase one thing.

Everytime you make investments, it needs to be for the long-term.

Each, shares vs. actual property investing, function in markets and these markets go up and down over time.

And also you don’t need to end up promoting belongings in a downturn.

So no matter what you put money into, we’d counsel ensuring a small % of your portfolio is liquid in money or one other asset that you could depend on when wanted.

5. Tangibility

Shares are intangible belongings.

You’ll be able to’t contact or really feel it. Its worth is pushed up when individuals purchase the inventory and it may possibly crash down if everybody sells the inventory.

It is a main danger of investing in shares.

If the businesses you put money into fail, then you possibly can lose your entire cash with nothing to point out for it.

Now, in fact, you may mitigate this danger by investing in a diversified portfolio that features a whole lot of high quality corporations.

Nevertheless, the actual fact of the matter is that it’s nonetheless an intangible asset and your entire market can crash & go away you with nothing left to point out to your funding.

Whereas with actual property, alternatively, you’re investing in an actual, tangible asset.

Even when your rental enterprise fails, you continue to have a tangible asset that’s going to be price one thing on the finish of the day.

With that mentioned, let’s give actual property some extent.

6. Ease and Simplicity

Actual property investing will be overwhelming, particularly in the event you’re going at it alone.

You need to save up money for a down fee, take out debt to purchase the house, and deal with the house, which may require a whole lot of work.

Now, you may simplify this by passively investing in REITS or personal fairness.

Nevertheless, you continue to want to grasp the nuances and dangers related to these varieties of choices.

Whereas with shares, it’s fairly easy.

You may make a deposit and purchase an excellent index fund immediately. After which your cash is working for you on auto-pilot.

You don’t even have to consider something so long as you assemble your portfolio appropriately.

You’ll be able to even arrange computerized transfers to purchase shares each time you receives a commission from work or your online business.

So let’s give shares some extent for ease of use.

7. Management

With shares, you aren’t in charge of what occurs to your funding.

The inventory market is sort of a curler coaster and you must know experience it.

In the event you put money into particular person shares, the corporate might make one unsuitable choice that leads to an enormous sell-off that crashes your funding.

And even in the event you put money into extremely diversified mutual funds, your entire inventory market might nonetheless crash due to a couple headlines that don’t have anything to do with the companies you’re invested in.

All it takes is just a few downturns so that you can notice how risky the market is.

Like historical past says the inventory market has gone up over time, however does that basically imply that it’s going to go up eternally?

For example, what would occur if everybody simply pulled all of their cash out of the inventory market proper now?

That might be a catastrophe, proper?

It’s the exact opposite with actual property.

When you shut on that property, it’s yours. You are able to do no matter you need with it.

You management the costs you cost, the tenants you settle for, and the methods you deploy to construct wealth.

Actual property is simply extra steady and controllable on the finish of the day.

So let’s give actual property some extent for management.

Shares vs. Actual Property Investing: The Winner

So the ultimate scoreboard right here is 4-3 in favor of actual property.

This implies actual property could be the higher funding automobile in our opinion.

The general returns are undeniably higher when you consider tax financial savings, and we personally like the steadiness of the market compared to the inventory market total.

Diversify your Portfolio

However no matter you put money into, at all times remember that diversification is essential.

You shouldn’t simply diversify throughout totally different sectors within the belongings you purchase, however you also needs to diversify throughout several types of belongings on the market.

We love actual property investing, so our portfolio leans that means.

However we additionally put money into shares, and even throw just a few cash at crypto generally.

Diversification isn’t a nasty technique in terms of investing.

However hopefully, this put up helps you perceive among the professionals and cons between shares vs. actual property investing.

If you’d like extra tricks to decrease your taxes and enhance your wealth, get our wealth administration providers at this time!