Whether or not you’re simply now beginning your individual firm otherwise you’ve been within the weeds for some time, it’s necessary to know what enterprise construction is one of the best match for you. There are a number of choices with completely different execs and cons. Proceed studying or skip to the infographic to be taught extra concerning the varied frameworks. Should you want speedy help then contact these llc formation companies.

Proprietorships and Partnerships

A sole proprietorship is a typical enterprise construction. It’s taxed like a person since it’s owned by one particular person, and it’s straightforward to create and regulate. Nonetheless, a proprietor has limitless private legal responsibility, that means they’re chargeable for every thing. It may also be tough to acquire long-term capital. Moreover, it’s difficult to switch possession from a sole proprietor. Which means it’s very probably the enterprise will die with the proprietor.

Common partnerships are similar to proprietorships. The principle distinction is that they’re owned by two or extra companions as an alternative of a sole proprietor. They’re nonetheless easy to create and have the tax good thing about being taxed as a person. Common companions keep management of the corporate. The cons are the identical as these of the proprietorship: limitless legal responsibility, tough to acquire capital, and illiquid (or tough to switch possession).

A restricted partnership, LP, is a particular type of partnership. The companions have restricted legal responsibility, however no management over the agency’s operations. This sort of enterprise is widespread for dangerous industries, corresponding to oil drilling, mining, and actual property.

Companies

A C-corporation usually known as only a company, is definitely seen as an individual. They’re chartered by the state and are, consider it or not, residents of the state the place they shaped. Legally talking, an individual is somebody who can sue and be sued, pay taxes individually, and contribute limitless sums of cash to a political marketing campaign. An organization additionally has all of those traits, technically making it an individual. The professionals of a c-corp embrace limitless life, transferral of possession (by inventory), restricted legal responsibility, and ease in producing massive quantities of capital.

Like LPs and partnerships, an S-corporation is a particular type of company. It’s basically a loophole for small enterprise companies. They keep away from paying the double taxes that companies expertise by passing their earnings by their homeowners for taxation. Nonetheless, there can solely be 100 stockholders or much less who’re US residents or resident aliens.

A restricted legal responsibility firm, or LLC, is one other newer particular company. Like S-corps, earnings is handed to homeowners for tax functions. Their homeowners can embrace international entities and shareholders reasonably than solely American citizenry. The important thing level, nevertheless, is that they’ve restricted legal responsibility.

Extra On LLCs

It’s foreseeable that restricted legal responsibility corporations will take the place of S-corporations and partnerships. This sort of enterprise construction is enticing as a result of it comprises a mixture of advantages. These benefits embrace:

- Decreased legal responsibility

- Decreased complexity

- Move-through taxation

- Officiality

- Extra homeowners

As with most issues, there are some downsides related to LLCs. Some disadvantages embrace tough fairness compensation, investor oversight, and the necessity for a brand new worker identification quantity (EIN) and respective financial institution accounts. A neater solution to management your employees compensations is to contemplate implementing this return to work program.

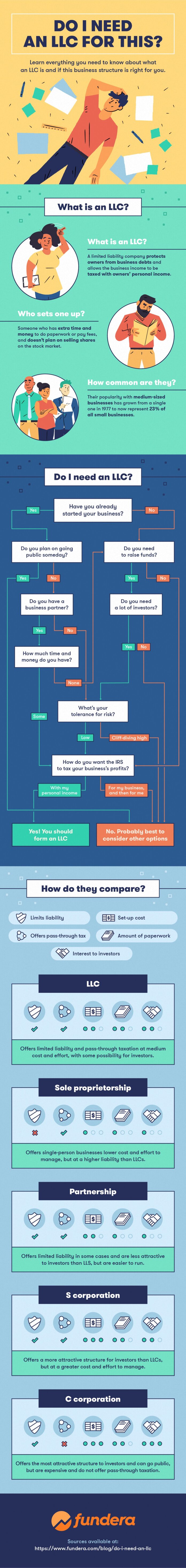

Most startups and small companies can reap the advantages by registering as a restricted legal responsibility firm. Should you suppose the LLC enterprise construction could also be best for you and what you are promoting, be taught extra within the infographic beneath offered by Fundera. The visible additionally features a flowchart that may show you how to resolve whether or not you must type an LLC or think about different choices.

Authored by:

Meredith is Editor-in-Chief at Fundera. Specializing in monetary recommendation for small enterprise homeowners, Meredith is a present and previous contributor to Yahoo!, Amex OPEN Discussion board, Fox Enterprise, SCORE, AllBusiness and extra.

Meredith is Editor-in-Chief at Fundera. Specializing in monetary recommendation for small enterprise homeowners, Meredith is a present and previous contributor to Yahoo!, Amex OPEN Discussion board, Fox Enterprise, SCORE, AllBusiness and extra.