The fintech trade has revolutionized the best way we handle cash, make investments, and conduct monetary transactions. With the rise of digital banking, cellular wallets, and funding platforms, fintech apps have turn into an integral a part of our day by day lives. By 2027, the worldwide digital funds market is predicted to succeed in $12.55 trillion, pushed by the rising adoption of cellular wallets and contactless cost options.

Nonetheless, constructing a user-friendly fintech app is not any small feat. It requires a deep understanding of consumer wants, strong know-how, and a seamless consumer expertise (UX).

On this weblog, we’ll discover the most important challenges in constructing user-friendly fintech apps and supply actionable options to beat them. Whether or not you’re a fintech app growth firm or a enterprise trying to rent fintech app growth providers, this information will assist you to navigate the complexities of making a profitable fintech utility.

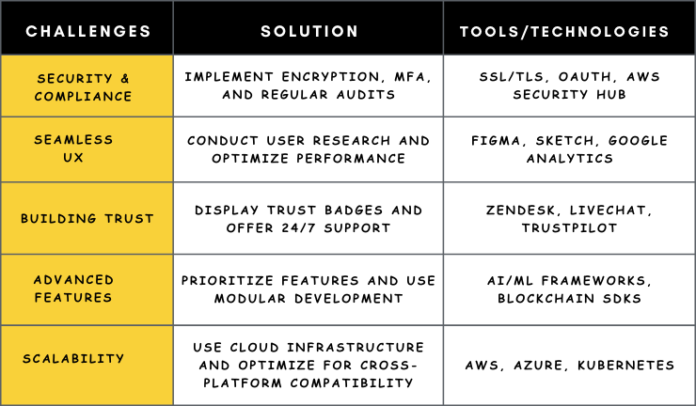

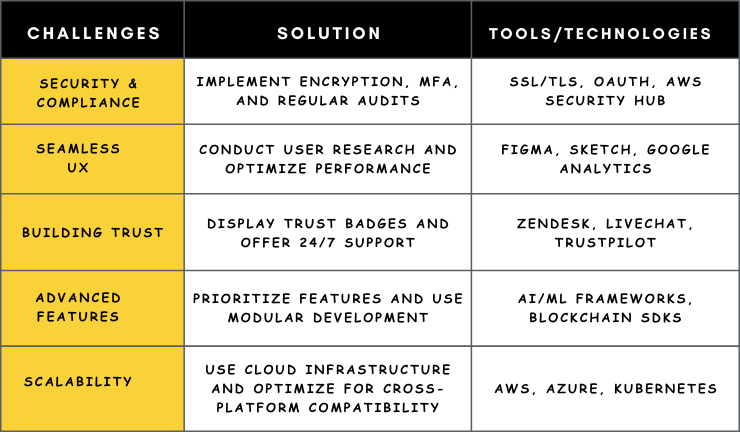

Key Challenges in Fintech App Improvement

The fintech trade is booming, with improvements like cellular banking, digital wallets, and blockchain reshaping the monetary panorama. Nonetheless, constructing a fintech app that’s each practical and user-friendly is not any simple job. Builders and companies face a myriad of challenges, from making certain strong safety and regulatory compliance to delivering a seamless consumer expertise and integrating superior options. These hurdles could make or break the success of a fintech app in an more and more aggressive market. On this part, we’ll discover the important thing challenges in fintech app growth and supply actionable methods to beat them, making certain your app not solely meets consumer expectations but additionally stands out as a trusted and revolutionary resolution.

1. Guaranteeing Safety and Compliance

Fintech purposes deal with extremely delicate monetary info, which makes safety an absolute necessity. Customers count on their private and monetary info to be protected against breaches, fraud, and cyberattacks. Moreover, fintech apps should adjust to strict rules like GDPR, PCI-DSS, and PSD2.

Challenges:

- Balancing safety with consumer comfort.

- Maintaining with evolving regulatory necessities.

- Stopping knowledge breaches and fraud.

Options:

- Implement end-to-end encryption and multi-factor authentication (MFA).

- Recurrently replace the app to adjust to the newest rules.

- Conduct penetration testing and safety audits to determine vulnerabilities.

2. Delivering a Seamless Person Expertise (UX)

A poorly designed or unintuitive interface can shortly frustrate customers and result in app abandonment. Fintech apps have to be intuitive, quick, and straightforward to navigate, even for non-tech-savvy customers.

Challenges:

- Designing a easy but feature-rich interface.

- Guaranteeing fast loading speeds and seamless efficiency.

- Catering to various consumer demographics.

Options:

- Carry out consumer analysis to determine and deal with key ache factors and preferences.

- Use a minimalist design with clear calls-to-action (CTAs).

- Optimize the app for efficiency by lowering load instances and enhancing responsiveness.

3. Constructing Belief with Customers

Belief is crucial in fintech. Customers must really feel assured that their cash and knowledge are secure. Constructing belief requires transparency, reliability, and glorious buyer help.

Challenges:

- Overcoming skepticism about digital monetary providers.

- Offering clear charge buildings and phrases.

- Providing dependable buyer help.

Options:

- Show safety certifications and belief badges prominently.

- Present clear and concise details about charges and insurance policies.

- Supply 24/7 buyer help by way of a number of channels (chat, e-mail, cellphone).

Able to Construct your Subsequent Fintech App?

Contact us right now and take step one towards making a game-changing monetary resolution.

4. Integrating Superior Options

Fashionable fintech apps want to supply superior options like AI-driven insights, biometric authentication, and blockchain integration. Nonetheless, integrating these options with out compromising usability is a problem.

Challenges:

- Guaranteeing compatibility with current techniques.

- Avoiding characteristic overload that confuses customers.

- Sustaining app efficiency with superior functionalities.

Options:

- Give attention to creating options that align with each consumer calls for and tech firms targets.

- Use modular growth to combine options seamlessly.

- Take a look at the app rigorously to make sure efficiency isn’t compromised.

The AI in fintech market is projected to develop at a CAGR of 19.7% from 2024 to 2030, highlighting the rising significance of AI-driven options like chatbots and fraud detection techniques.

5. Guaranteeing Scalability

Fintech apps should deal with rising consumer bases and rising transaction volumes with out crashing or slowing down. Scalability is crucial for long-term success.

Challenges:

- Managing excessive transaction volumes throughout peak instances.

- Scaling infrastructure with out downtime.

- Supporting a number of gadgets and platforms.

Options:

- Use cloud-based infrastructure for flexibility and scalability.

- Implement load balancing and auto-scaling mechanisms.

- Optimize the app for cross-platform compatibility.

By 2030, international fintech investments are anticipated to exceed $1.5 trillion, with a big deal with scalable options that may deal with rising consumer calls for.

Why Accomplice with a Fintech App Improvement Firm?

Constructing a user-friendly fintech app requires experience in design, product growth, safety, and compliance. Partnering with a good fintech app growth firm can assist you:

- Leverage trade greatest practices.

- Save time and sources.

- Guarantee your app meets regulatory requirements.

- Ship a seamless consumer expertise.

When selecting fintech app growth providers, search for a supplier with a confirmed monitor report, experience in fintech, and a deal with user-centric design.

Ultimate Ideas

The fintech trade is booming, however competitors is fierce. To face out, your app have to be safe, user-friendly, and have wealthy. By addressing the challenges outlined above and partnering with the correct fintech app growth firm, you possibly can create an app that not solely meets consumer expectations but additionally drives enterprise progress.

The submit Greatest Challenges in Growing Fintech Apps & The way to Overcome Them appeared first on ISHIR | Software program Improvement India.