With the assistance of Entriwise and our information beneath, you’ll have the option combine your gross sales information in Quickbooks precisely and effectively.

One of many first belongings you study in accounting is that that you must reconcile your checking and bank card accounts to make sure that the transactions that make up your monetary statements are correct and up-to-date. This course of concerned matching the transactions in your checking or bank card assertion with the transactions inside your chart of accounts inside Quickbooks (or equal accounting software program).

Sadly, in terms of reconciling your gross sales information from Amazon, it isn’t as easy. That is largely attributable to Amazon’s reserved balances, in addition to how — and when — your income flows into your checking account.

You may need $50k in gross sales in a single month and solely present $30k in deposits from Amazon in your checking account. If this case sounds acquainted, it’s as a result of Amazon has a reserved balances the place they maintain a share of your income to guard them in opposition to any potential returns or refunds. Additionally they don’t have a conventional financial institution assertion, which makes reconciling your data moderately tough.

Fortunate for you, we’re going to point out you precisely easy methods to import your Amazon gross sales information immediately into Quickbooks utilizing Entriwise, and easy methods to reconcile this information to substantiate it’s accuracy.

Why We Use Entriwise

Entriwise integrates your gross sales information into Quickbooks. With Entriwise, you’ll have the ability to simply categorize your gross sales information into income (gross sales value), refunds, charges (Amazon promoting charges), and reimbursements.

The prices related to promoting on Amazon shouldn’t be one thing to take flippantly. For instance, you may promote an merchandise on Amazon for $40.00 however solely obtain $25.00 in spite of everything of Amazon’s charges. If so for you, then it is very important perceive the COGS (Value of Items Bought) related to promoting on Amazon by breaking down the $25.00 deposit within the instance above as follows:

- Income: $40.00

- Value of Items Bought (Amazon Charges): $15.00

- Gross Revenue: $25.00

By breakdown your gross sales transaction on this method, you’re higher perceive the price related to promoting this merchandise on Amazon vs one other gross sales channel.

With Entriwise, you’ll have the ability to breakdown everybody of your transactions on this method with none of the guide work.

Now, we’ll clarify easy methods to correctly set all the pieces up!

Creating An Amazon Financial institution Account Inside Your Quickbooks’ Chart of Account

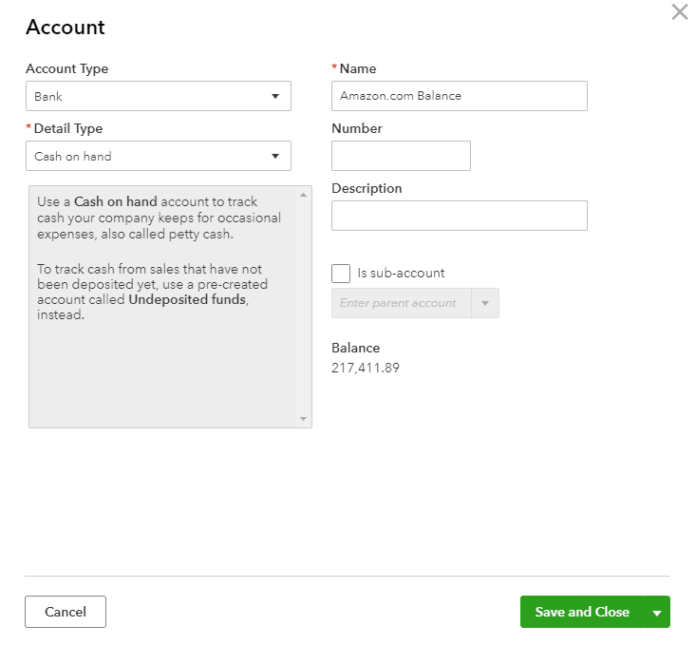

To be able to correctly import your entire gross sales information into Quickbooks, you’ll first must create a checking account referred to as ‘Amazon.com Stability’ — or another comparable title. Entriwise will import your Amazon gross sales information immediately into this account.

Perceive Your Amazon Vendor Central Assertion View Report

This would be the report that we are going to use to reconcile your Amazon orders & charges as soon as they’re imported into your Amazon.com Stability account inside Quickbooks.

You’ll be able to entry this report inside your Amazon Vendor Central account by going to Reviews > Funds > Assertion View. Be aware the next:

- We’re reconciling “Normal Orders” on this instance.

- Assertion Interval: August twenty third, 2018 to September sixth, 2018.

- Interval Ending Date: September sixth, 2018 would be the interval ending date to your reconciliation inside Quickbooks.

- Closing Stability: $217,411.89 is the closing stability that must be entered into your reconciliation with Quickbooks.

- Switch Quantity: That is the quantity that’s truly being transferred from Amazon (additionally your Amazon.com Stability Account) into your checking account throughout this era. Please pay attention to the switch date.

- Unavailable Stability Quantity: This quantity Amazon holds for any chargeback points. For those who discover, unavailable stability ($84,569.60) is the distinction between the closing stability ($217,411.89) and the switch quantity ($132,842.29). In case you have no Unavailable Stability, Amazon will cost the refunds on the bank card you may have on file.

Now that we perceive the Assertion View Report. We are able to go over the Entriwise in some extra element.

How To Set up Your Gross sales Information Inside Entriwise

Entriwise is a program that’s solely dedicate to reconciling and integrating your Amazon Sellers Central information into Quickbooks. This system aggregates your order data and separates it into the next classes: orders (income), refunds, charges, and reimbursements.

Product & Service Mapping

In the course of the setup course of chances are you’ll select between automated or guide dealing with of all forms of Amazon FBA and vendor fulfilled transactions: orders, refunds, vendor charges; FBA inbound, outbound, disposal charges; reimbursements, changes, and so forth.

For those who select automated dealing with, then Entriwise will sync your gross sales information with their default chart of account alternative for every sort of transaction.

For those who select guide dealing with, then you’ll be able to then you’ll be able to change the mapping sort as you please (ie, they may map an merchandise to a expense account and you may want the merchandise mapped to a COGS account).

Under is an instance of how the mapping display appears to be like inside Entriwise:

This mapping is then translated into your Quickbooks’ chart of account as follows:

Importing Gross sales Information into Quickbooks

After getting synced Entriwise along with your Quickbooks file, you’ll be able to import your gross sales information. To do that, go to the Amazon Statements part of Entriwise, select the ‘Settlement Interval’ that you just want to import, and click on Import. At this level, Entriwise will confirm the Product & Service Mapping along with your Chart of Accounts. As soon as the mapping is confirmed as correct, the info will begin to import. This may need a number of hours relying on the quantity of transactions.

When the import is accomplished you‘ll see a report just like the one above.

If there aren’t any discrepancy, then that signifies that your gross sales information has been imported into Quickbooks and that the info is able to be reconciled.

Reconciling Your Gross sales Information Inside Quickbooks

To be able to reconcile your gross sales information inside Quickbooks, you’ll must enter the Ending Stability and Ending Date for the assertion interval that was simply imported.

If the import was carried out accurately, then your reconciliation must be as choosing all the open transactions, and it is best to see “$0.00” because the distinction remaining.

If there’s a distinction remaining it’s normally as a result of switch quantity from the prior assertion interval and this may should be entered manually.

In Closing

It’s our hope that the knowledge above has demystified the method of built-in and reconciling your Amazon gross sales information inside Quickbooks. In case you have any questions, be happy to succeed in out, and we’d be comfortable to help!

Lanyap Monetary is a tech-based accounting and monetary providers agency that focuses on streamlining their shoppers’ monetary operations via FinTech software program and cloud-based purposes.