Japanese traders have been promoting Eurozone authorities debt on the quickest tempo in additional than a decade, with analysts warning that the transfer by one of many bloc’s cornerstone bondholders might result in sharp market sell-offs.

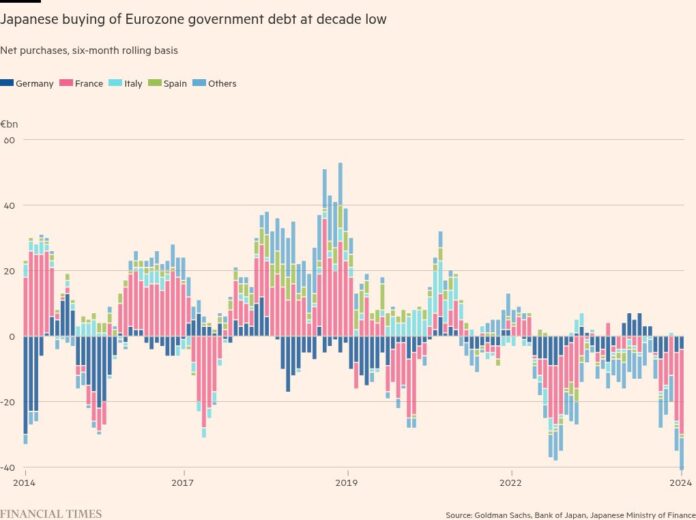

Web gross sales by Japanese traders rose to €41bn within the six months to November — the newest figures to be launched — in keeping with information from Japan’s ministry of finance and the Financial institution of Japan, compiled by Goldman Sachs.

The prospect of upper bond yields at dwelling and political upheaval in Europe — together with the collapse of the ruling coalition in Germany resulting in elections subsequent month, and turmoil in France which has been working below an emergency finances legislation — have accelerated the gross sales, analysts say. French bonds have been probably the most offered throughout the interval at €26bn.

The gross sales add additional strain to indebted European governments already going through a bounce in borrowing prices, and spotlight how rising Japanese rates of interest after years in detrimental territory are reshaping monetary markets all over the world.

Japanese traders returning house is a “recreation changer for Japan and world markets,” stated Alain Bokobza, head of worldwide asset allocation at Société Générale.

Though Japanese traders have been web sellers of Eurozone bonds for a lot of the previous few years, the tempo has picked up in latest months.

Japanese funding flows have been “a secure supply of [European] authorities bond demand for a very long time,” stated Tomasz Wieladek, an economist at asset supervisor T Rowe Value. However markets are actually “coming into an period of bond vigilance” the place “speedy and violent sell-offs” might occur extra usually.

Gareth Hill, a bond fund supervisor at Royal London Asset Administration, stated the state of affairs had “lengthy been a priority for holders of European authorities bonds, given the traditionally excessive holdings [among] Japanese traders” and will put strain in the marketplace.

As well as, hovering prices of hedging in opposition to swings within the worth of the yen have made abroad debt more and more unappealing. Regardless of coming down from a 2022 peak, when hedging prices are accounted for, the 10-year Italian authorities bond yield for Japanese traders is simply over 1 per cent, which is roughly the identical because the Japanese 10-year yield, in keeping with Noriatsu Tanji, chief bond strategist of Mizuho Securities in Tokyo. He pointed to regional banks in Japan as being among the many foremost sellers of European debt.

“Japanese traders have to be asking themselves fairly exhausting to what extent they need to be holding overseas bonds,” stated Andres Sanchez Balcazar, head of worldwide bonds at Pictet, Europe’s largest asset supervisor.

Norinchukin — certainly one of Japan’s largest institutional traders — final yr stated it deliberate to dump greater than ¥10tn of overseas bonds this monetary yr. In November, it recorded a lack of round $3bn within the second quarter after realising losses on its giant holdings of overseas authorities bonds.

The pullback by Japanese traders is placing upward strain on bond yields which have already moved greater for the reason that European Central Financial institution began to cut back its stability sheet after an unlimited emergency bond-buying programme throughout the coronavirus pandemic, stated analysts.

France — which has certainly one of Europe’s deepest bond markets and has traditionally been a favorite amongst Japanese traders because of the extra yield it presents over benchmark German debt — has seen giant Japanese outflows in latest months.

Between June and November, as a political disaster deepened that resulted within the fall of Michel Barnier’s authorities, Japanese funds’ whole outflows reached €26bn, in contrast with gross sales of simply €4bn in the identical interval the earlier yr.

“There is no such thing as a query that for France the customer base has modified,” stated Seamus Mac Gorain, head of worldwide charges at JPMorgan Asset administration.

Over the previous 20 years, Japanese traders have change into a cornerstone investor in a number of bond markets as ultra-low yields at dwelling have made overseas investments extra enticing, together with for large traders comparable to pension funds who want to purchase secure sovereign debt.

Whole holdings of overseas bonds by Japanese institutional traders reached $3 trillion at their peak in late 2020, in keeping with IMF.

Nonetheless, as Japanese traders have began to seek for returns at dwelling, their web shopping for of worldwide debt securities have shrunk to simply $15bn in whole over the previous 5 years — a far cry from the roughly $500bn in such purchases they made within the earlier 5 years, in keeping with calculations by Alex Etra, a macro strategist at Exante.

“Whereas Japanese bonds have been fairly unattractive for home traders prior to now, they’re extra enticing now,” stated JPMorgan’s Gorain. “That may be a structural change.”