Utilizing a 401(ok) to start out a enterprise is feasible when you’re on the lookout for financing exterior of a enterprise mortgage. Whereas 401(ok) accounts are primarily used for retirement financial savings, they can be used for enterprise functions within the type of a rollover for enterprise startups (ROBS), a 401(ok) mortgage, or an everyday 401(ok) withdrawal.

Relying in your circumstances, one of the best 401(ok) enterprise financing possibility can fluctuate. Every has nuances that may have an effect on your whole prices, the velocity at which you obtain entry to funds, and your eligibility. The choice you choose might also have tax implications, so you could need to contemplate talking with an accountant to make sure you received’t have an surprising invoice while you file your taxes.

Key Takeaways:

- 401(ok) enterprise financing can enable you entry to funding with minimal to no debt obligations.

- A 401(ok) can present funds for enterprise functions and will be related to quite a lot of prices, laws, and particular qualification standards.

- Utilizing a 401(ok) to purchase a enterprise may help finance an acquisition, or you should utilize it to fund an present enterprise for use for quite a lot of enterprise functions.

Utilizing a Rollover for Enterprise Startups (ROBS)

How a ROBS Works

A ROBS means that you can entry funds out of your retirement accounts with out penalty or tax implications. That mentioned, there are numerous tax guidelines and laws that enterprise homeowners should adhere to.

When utilizing a ROBS, it really works by first transferring the funds in your private retirement account to your organization’s retirement plan. That plan is then designated as an entity that may buy inventory within the enterprise, offering you with entry to the cash. It’s much like a person buying inventory in a publicly owned firm, as that motion is what supplies further funds that the corporate can use.

Because of the complexity of one of these transaction and the implications of improperly conducting a ROBS, it’s extremely really helpful that you simply use an skilled ROBS supplier like Guidant Monetary. It’s an professional in ROBS transactions and supplies one of many business’s greatest audit safety and authorized assist companies within the occasion any subject arises.

Professionals & Cons

Who Ought to Take into account a ROBS

For these contemplating a ROBS, decide whether or not or not you could have the assets to be thought-about eligible. You may also contemplate talking with a ROBS supplier to achieve further perception, as many of those firms supply free consultations. They’ll educate you in regards to the course of and assist you to decide if one of these rollover could be a great match to your circumstances. If you happen to suppose a ROBS would possibly be just right for you, contemplate the next standards.:

- Your corporation is, or can be, structured as a C Company (C-corp): One of many core necessities of a ROBS is that your online business should be a C-corp. That is to permit the corporate to have shareholders and the following buy of inventory that may enable you entry to the funds.

- You’ve got a big retirement account steadiness: With most ROBS suppliers, you’ll want a minimal steadiness of $50,000 to be eligible. That is largely finished to make sure you aren’t charged extreme charges in relation to the quantity being rolled over.

- You don’t need month-to-month mortgage funds: Since a ROBS is just not a mortgage, you received’t need to make month-to-month funds. This may help from a money move perspective and likewise prevent on curiosity prices.

- You might be comfy risking your retirement account steadiness: If your online business fails, you additionally threat dropping the retirement funds used within the rollover.

- You’re unable to qualify for a enterprise mortgage: Most enterprise loans have necessities for issues like credit score rating, time in enterprise, and income. A ROBS has no such standards, which is why we additionally recognized it as one of many greatest methods to fund a startup.

Abstract of Typical Charges, Phrases & {Qualifications}

Learn how to Get a ROBS

As a ROBS could be a complicated transaction to maneuver, we extremely suggest working with an skilled ROBS supplier. Along with Guidant Monetary, you can too contemplate our different suggestions for the greatest ROBS firms.

Usually, a ROBS transaction will be simplified into the next six steps.

- Step 1: Set up a C-corp.

- Step 2: Create a retirement plan inside the C-corp.

- Step 3: Select a custodian for the retirement plan (take a look at our picks for the greatest 401(ok) firms).

- Step 4: Rollover funds from private retirement accounts to the C-corps retirement plan.

- Step 5: Have the C-corp’s retirement plan buy inventory within the firm.

- Step 6: Make the most of accessible funds for enterprise functions.

If you happen to’re on the lookout for further particulars for every stage, you possibly can reference our ROBS information.

Utilizing a 401(ok) Mortgage

How a 401(ok) Mortgage Works

A 401(ok) mortgage means that you can borrow in opposition to the steadiness in your 401(ok) retirement account. IRS guidelines usually restrict the quantity you possibly can borrow to both 50% of your vested steadiness or $50,000, whichever is much less.

Repayments are usually made quarterly and are anticipated to be paid in full inside 5 years from mortgage origination. Though 401(ok) loans carry an rate of interest, that curiosity is repaid to your retirement account.

Moreover, since 401(ok) loans are usually tied to an employer, you’ll be required to repay the mortgage on an accelerated timeline when you separate from the corporate. If that occurs, you’ll have till the due date of your subsequent federal tax return to repay the mortgage.

Professionals & Cons

Who Ought to Take into account a 401(ok) Mortgage

For enterprise homeowners trying to make the most of a 401(ok) mortgage, there are a couple of cases wherein it could be greatest relevant. This will likely embody that:

- You’ve got a sufficiently massive steadiness in your 401(ok): Since 401(ok) loans are restricted to the lesser of fifty% of your vested steadiness or $50,000, you’ll need to make sure that it is going to be sufficient to fulfill your funding wants.

- You don’t anticipate separating out of your employer within the brief time period: Because you’d need to repay the mortgage on an accelerated timeline when you separated out of your employer, we suggest this as an possibility provided that you don’t foresee any short-term modifications in employment.

- You’ve got the power to repay the mortgage shortly if wanted: Because you’d have a shorter interval to repay the mortgage when you separated out of your employer, it’s a good suggestion to additionally produce other means to finish a full payoff simply as a backup plan.

- You don’t qualify for a enterprise mortgage: A 401(ok) mortgage hardly ever has necessities for issues like credit score scores or earnings, which makes it a great possibility to contemplate when you’re unable to get a enterprise mortgage.

Abstract of Typical Charges, Phrases & {Qualifications}

Learn how to Get a 401(ok) Mortgage

Getting a 401(ok) mortgage is often facilitated by your plan’s administrator, so there are nuances in relevant financing steps. Generally, nevertheless, you’ll have to undergo the next:

- Step 1: Contact your plan’s administrator together with your mortgage request.

- Step 2: Overview phrases and full the required paperwork with the main points of your funding request.

- Step 3: Confirm receipt of funds.

- Step 4: Confirm common funds by payroll deductions or different strategies as allowed by your plan administrator.

Utilizing a 401(ok) Withdrawal

How a 401(ok) Withdrawal Works

Through the use of a 401(ok) withdrawal, you possibly can entry the vested portion of your 401(ok) account steadiness. Nonetheless, it’s necessary to take into account that this selection is often related to hefty penalties, charges, and taxes.

401(ok) accounts are designed for retirement, so the IRS assesses an further earnings tax of 10% on withdrawals made previous to the age of 59.5. Because the funds you withdraw might also be taxed as common earnings, your plan administrator may be required to withhold 20% for federal taxes.

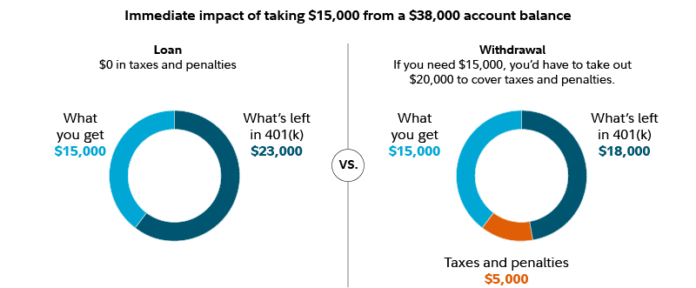

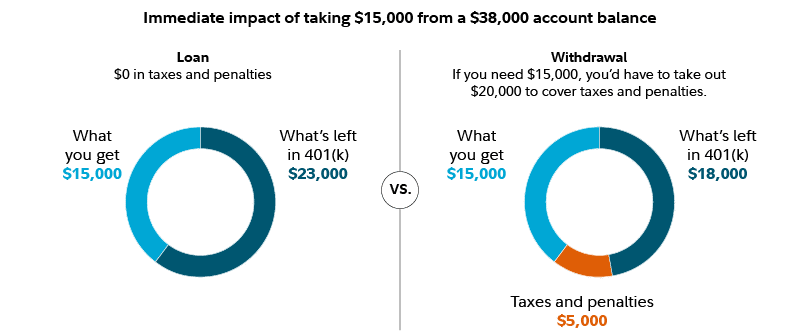

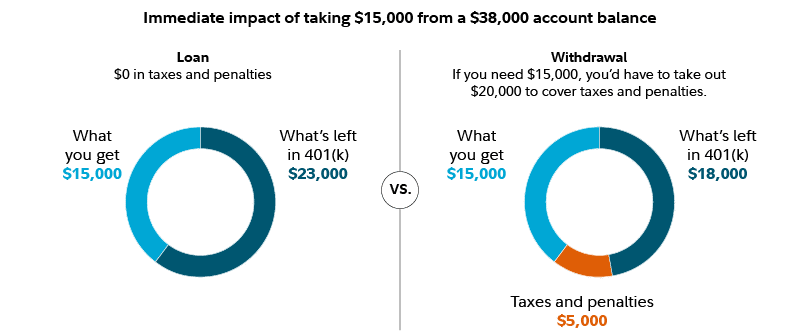

As an example the impression that penalties and taxes may have on a 401(ok) mortgage versus an early withdrawal, Constancy supplies an instance of how a person would want to take out practically $23,000 simply to internet $15,000 in funds. See the graphic beneath.

Instance of Mortgage vs 401(ok) withdrawal by Constancy (Supply: Constancy)

Instance of Mortgage vs 401(ok) withdrawal by Constancy (Supply: Constancy)

Though the exact quantities can fluctuate relying in your distinctive circumstances, the important thing takeaway is that the quantity of taxes and penalties can shortly decrease the quantity of the ultimate test you obtain.

Professionals & Cons

Who Ought to Take into account a 401(ok) Withdrawal

A 401(ok) withdrawal ought to be thought-about as a final resort except you’ve reached retirement age and may escape the heavy quantity of taxes and penalties concerned with cashing out the account early. With that being mentioned, it could be a great possibility if any of the next apply to you:

- You’ve got an pressing want for funds and can’t get financing elsewhere: If you happen to want funds shortly to cowl an emergency however can’t get accepted for a mortgage, a 401(ok) withdrawal will be an possibility because it doesn’t have any credit score or earnings necessities.

- You’ve got reached retirement age: If you happen to’ve already reached the age of retirement, you possibly can keep away from the penalties related to an early withdrawal. Nonetheless, bear in mind that the funds you get should still be taxed as peculiar earnings.

- You qualify for an exception to be exempt from penalties: The IRS has a listing of exceptions to the ten% further tax that may exempt you from paying an early withdrawal penalty. Nonetheless, no exemptions are listed for using funds for beginning up a enterprise, overlaying common enterprise bills, or buying one other firm.

Abstract of Typical Charges, Phrases & {Qualifications}

Learn how to Full a 401(ok) Withdrawal

Relying in your employer and/or the retirement plan’s administrator, the steps concerned with a 401(ok) withdrawal might differ. Nonetheless, typically, the method is as follows:

- Step 1: Contact your employer or the plan’s administrator together with your request.

- Step 2: Overview any disclosures you’re offered and full your plan’s paperwork for a withdrawal request.

- Step 3: Confirm receipt of funds.

Dangers to Take into account with 401(ok) Enterprise Funding

Utilizing a 401(ok) to finance your online business comes with a couple of dangers for you to remember earlier than you pursue this selection. These embody:

- Shedding your retirement financial savings: If you happen to mismanage your online business funds, you might probably lose your retirement financial savings within the occasion you possibly can’t recoup your monetary losses. This can be a huge threat from a private finance perspective, as you might impression your future monetary stability by investing your retirement funds into your online business.

- Penalties and costs: Relying on the financing kind and administrator, there could also be hefty penalties or charges related to financing your online business with a 401(ok). Make sure to learn the nice print earlier than getting into into any agreements.

- Compliance with IRS laws: There are specific guidelines and laws to be aware of to make sure you’re in compliance with the IRS. It’s price consulting knowledgeable who could possibly assist you to navigate by the financing course of.

Alternate options to 401(ok) Enterprise Funding

Whether or not you might be ineligible or funds from a 401(ok) don’t meet your online business wants, there are alternate options you could contemplate to safe different types of financing. If you happen to determine to pursue a standard enterprise mortgage, we suggest studying our information on methods to get a small enterprise mortgage, because it accommodates tips about bettering your approval odds and getting funded extra shortly.

Listed below are another choices to contemplate:

- Private mortgage: In some circumstances, you possibly can rise up to $100,000 or extra in funding on a private mortgage. Qualification necessities usually focus extra in your private credit score and funds quite than these of your online business. Take a look at our picks of the greatest private loans for enterprise funding.

- House fairness mortgage (HELOAN) or house fairness line of credit score (HELOC): These are good choices if in case you have good private credit score, funds, and adequate fairness in your house. Funds can be utilized for practically any enterprise function, and you may take a look at our separate guides on getting a HELOAN to finance your online business and utilizing a HELOC to fund your online business to study extra about methods to get one of these financing.

- Family and friends: A giant advantage of asking family and friends for funding is you could bypass most of the typical necessities related to getting a mortgage from a financial institution. With that being mentioned, there are nonetheless tax laws to observe, and it will possibly run the danger of straining relationships if the enterprise enterprise doesn’t succeed. To study extra, learn our information on elevating cash from family and friends to fund your online business.

- Angel buyers: Angel buyers are appropriate for early-stage companies in search of capital with out taking over debt. These buyers supply seed cash in change for fairness in your organization, which might make it a fantastic possibility for companies with restricted credit score historical past and monetary assets. To study extra, learn our information on methods to increase angel funding for your online business.

Often Requested Questions (FAQs)

Usually, you possibly can select from one in all three predominant choices. In case you have at the very least $50,000 in your retirement accounts, you are able to do a rollover for enterprise startups (ROBS). Your second possibility is to borrow funds and get a 401(ok) mortgage. Lastly, you possibly can select to money out the steadiness of your 401(ok), though that is an possibility that always carries hefty penalties and tax implications.

IRS laws typically can help you rise up to 50% of your vested steadiness or $50,000, whichever is much less. If you happen to want extra funding than that, you’ll have to money out your 401(ok) or contemplate different strategies of financing.

Through the use of your 401k to purchase a enterprise, there will be vital penalties and costs concerned. Along with having to pay earnings tax, people who haven’t but reached retirement age could also be topic to a further 10% early withdrawal penalty.

Backside Line

If you happen to’re trying to make the most of a 401(ok) to start out or purchase a enterprise, it’s necessary to grasp your choices and their related dangers. You’ll want to contemplate if it’s price risking your retirement financial savings steadiness and examine your financing choices accordingly.

If you happen to’re contemplating 401(ok) enterprise financing, we suggest talking with an organization like Guidant Monetary. It’s a specialist in 401(ok) enterprise financing and affords various kinds of funding choices equivalent to SBA loans, franchise financing, unsecured loans, and tools leasing. You’ll be able to arrange a free session session to debate your wants and see if it will possibly supply an acceptable type of funding for you.