A rollover for enterprise startups, or a ROBS for brief, is a method for a enterprise proprietor to entry their private retirement funds tax- and penalty-free. Finishing a ROBS generally is a advanced course of because it requires you to navigate a number of areas of tax guidelines and rules. Fortuitously, ROBS suppliers like Guidant Monetary exist not solely to stroll you thru the method but in addition to offer audit protections within the unlikely occasion of a compliance situation.

Key Takeaways

- To be eligible for a ROBS, your online business have to be structured as a C-corp.

- Though you may get tax- and penalty-free entry to your retirement funds, bear in mind that you can lose the funds solely ought to your online business fail.

- A ROBS has ongoing upkeep and compliance necessities that have to be met to keep away from fines or penalties from regulatory companies just like the Inside Income Service (IRS).

What Is a ROBS?

In a simplified kind, a ROBS requires that funds be transferred out of your private retirement accounts into your company’s retirement plan. The company’s retirement plan, performing as a separate entity, then purchases inventory within the firm. This supplies the company with extra funds, which has similarities to how firms have entry to extra funds when people buy inventory in publicly owned companies.

A ROBS shouldn’t be a mortgage, so there aren’t any curiosity fees or funds that have to be repaid. To assist navigate the varied tax guidelines and rules wanted to finish a ROBS, ROBS suppliers typically cost charges starting from $1,000 to $5,000. Relying on the quantity of charges charged, they might additionally require you to have a minimal steadiness to make sure the bills should not extreme in relation to the quantity being rolled over. A minimal steadiness of $50,000 is taken into account commonplace.

Professionals & Cons of a ROBS Rollover

Who a ROBS Is Proper For

A ROBS might be useful for enterprise homeowners due to its accessibility and financing flexibility. For early-stage companies with restricted credit score historical past or entry to capital, a ROBS might help bridge the hole between a wide range of potential enterprise conditions. It might be for you within the following instances:

- You’re an early-stage enterprise: Utilizing private assets can profit your online business in the event you lack different assets to get your online business up and operating. Utilizing a ROBS rather than conventional debt financing lets you fund your online business with restricted restrictions for nevertheless a lot it’s possible you’ll want, relying in your obtainable steadiness.

- You wish to keep away from debt funds: A ROBS shouldn’t be a mortgage, so there isn’t a debt so that you can repay. With out the burden of needing to make debt funds, this may will let you handle your online business with larger ranges of month-to-month money circulation.

- You’re unable to qualify for a enterprise mortgage: A ROBS rollover has fewer qualification necessities in contrast with a standard mortgage. The 2 most troublesome necessities to fulfill embody having a steadiness of $50,000 in retirement funds and beginning a C company (C-corp). Frequent mortgage necessities—akin to credit score rating, time in enterprise, and income—should not thought-about when utilizing a ROBS.

- You don’t wish to damage your credit score: Getting a ROBS is not going to influence your credit score. Most loans, however, can quickly decrease your credit score rating within the quick time period. It is because making use of for credit score can lead to a tough credit score inquiry, which generally lowers your credit score rating by a number of factors. Having a brand new mortgage may negatively influence your credit score rating because it lowers your common age of credit score accounts.

If you end up in certainly one of these classes and wish to focus on your eligibility with a supplier, I like to recommend Guidant Monetary. It permits enterprise homeowners to schedule a free, no-obligation session telephone name to find out whether it is proper for the enterprise.

Prohibited Makes use of of ROBS Funds

Funds supplied by a ROBS have to be used strictly for enterprise bills. Throughout the scope of enterprise functions, nevertheless, there are a number of makes use of of funds that aren’t allowed.

- Paying your self an unreasonable wage: To keep away from penalties or charges, the wage you pay your self have to be thought-about cheap, and also you’ll want to have the ability to assist this if audited by the DOL or IRS. You possibly can take into account common salaries for people performing your job capabilities, in addition to the wage you’re incomes in relation to the income generated by your online business.

- Funding a enterprise that’s not an energetic working firm: An energetic working firm is one that’s actively engaged in promoting a services or products. You additionally have to play an energetic position in your organization’s day-to-day duties. Some examples can embody managing payroll, assigning worker shifts, and sustaining the cleanliness of the enterprise premises.

- Funding a enterprise engaged in actions that aren’t federally authorized: If your online business offers with services or products that aren’t authorized on the federal stage, you can’t do a ROBS rollover. Hashish, whereas it could be authorized in sure states, shouldn’t be allowed on the federal stage and could be one instance of an trade that might be ineligible for a ROBS.

- Paying sure third-party skilled charges: ROBS enterprise funding can’t be used for sure third-party providers, akin to establishing and sustaining the ROBS program. Reasonably, these providers have to be paid for utilizing a separate supply of funds.

- Utilizing enterprise property for private use: Utilizing ROBS funds for something apart from enterprise functions is prohibited by the IRS. Doing so can lead to fines and penalties.

ROBS Necessities

The necessities essential to qualify for a mortgage are typically not relevant to getting a ROBS, making a ROBS simpler to get. That being mentioned, there are ongoing compliance necessities that have to be met to keep away from charges or penalties from the IRS. Listed here are among the necessities you have to be conscious of:

Though most private retirement accounts are eligible, some can’t be utilized in a ROBS program. Beneath is an inventory of eligible retirement accounts:

- 401(ok)

- 403(b)

- Thrift financial savings plan (TSP)

- Conventional IRA

- Keogh

- Simplified employer pension (SEP)

A minimal steadiness of $50,000 in an eligible retirement account is often required to do a ROBS rollover. Nonetheless, this may occasionally differ relying on the supplier. As a common rule of thumb, if a supplier’s charges are extreme in relation to the quantity you need to roll over, it’s possible you’ll not be capable to do a ROBS.

If you happen to do have a enough quantity in your retirement accounts, make sure you roll over sufficient to fulfill your online business funding wants. Though extra rollovers might be completed, they typically include extra charges.

To do a ROBS, your online business have to be structured as a C-corp. No different enterprise constructions are eligible. For steerage, see our article on methods to begin a C-corp.

One requirement of the ROBS program is that you should draw an affordable wage, which is one thing that could be reviewed if audited by the DOL or IRS. An inexpensive wage could also be decided by components such because the wages paid in relation to your organization’s revenue, the typical wage in your trade for somebody performing your job duties, the extent of your data and expertise, and extra.

To satisfy the definition of an energetic worker, you have to be actively engaged in your online business. Some examples can embody processing payroll, assigning worker shifts, and performing as a flooring supervisor.

To stay compliant with IRS rules, you should enable staff to contribute to your organization’s retirement plan. Some flexibility might be granted, akin to requiring new staff to achieve a minimal variety of days of employment earlier than being eligible to take part.

ROBS Prices

- One-time charges: These can vary from $1,000 to $5,000. It will rely on the ROBS supplier you select. In lots of instances, you get what you pay for. ROBS suppliers that cost larger upfront charges have a tendency to supply extra authorized assist, audit safety, and different providers. These gadgets can prevent money and time if audited by both the DOL or IRS.

- Recurring charges: Month-to-month recurring charges sometimes run from $100 to $200. These sometimes cowl the price of sustaining your C-corp’s retirement plan. It additionally covers providers supplied to you for issues like ongoing administrative and steerage for paperwork submitting necessities.

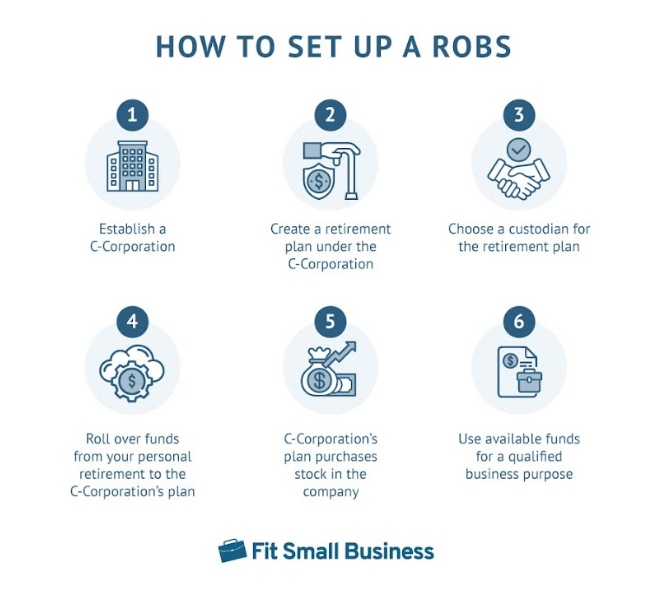

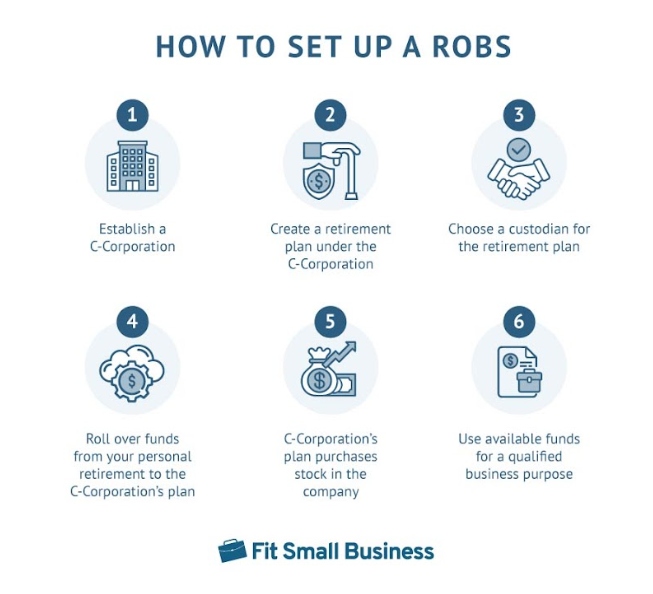

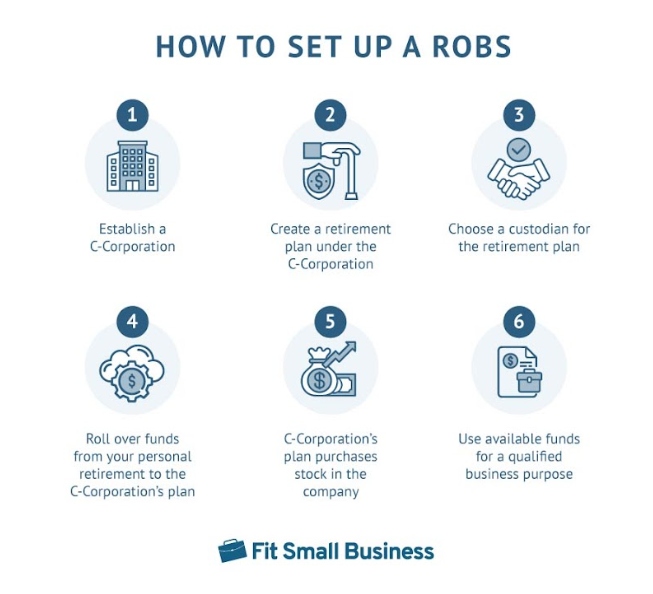

The best way to Get a ROBS

Getting a ROBS includes a number of steps. If you happen to resolve to work with a ROBS supplier, it is going to information you thru every stage of the method to make sure compliance with tax guidelines and rules.

The method of establishing a ROBS

To be eligible to do a ROBS, your online business have to be structured as a C-corp. That is largely as a result of this enterprise construction is the one one that may situation the kind of inventory that may will let you get entry to your private retirement funds. S companies, partnerships, and sole proprietorships could be unable to pursue a ROBS for enterprise funding.

If you’re already structured as a C-corp or have created a brand new C-corp, the subsequent step will likely be to create a retirement plan beneath this enterprise construction. Some retirement plan choices embody a 401(ok), an outlined profit plan, and an outlined contribution plan.

To supervise and handle the retirement plan, you’ll want to decide on a custodian. The custodian can present a platform for plan contributors to handle their accounts and is chargeable for the administration and administration of paperwork and logistics for all plan contributors, akin to issuing year-end tax kinds, month-to-month statements, buying and selling, and extra.

As soon as the C-corp retirement plan is about up, now you can switch funds out of your private retirement accounts to it. Most ROBS suppliers require a minimal of $50,000 in funds to be transferred throughout this step.

As soon as your C-corp’s retirement plan is funded, it is going to buy shares of inventory within the firm. In different phrases, the retirement plan offers funds to the company in trade for shares of inventory. This makes funding obtainable to the company, which may then be used for business-related bills.

So long as you utilize ROBS funds for a business-related function, you shouldn’t run into any points if audited by the IRS or DOL. Enterprise makes use of can embody issues like payroll, tools, equipment, autos, furnishings, and operational bills.

Extra ROBS Rollovers

There’s no restrict to what number of ROBS transactions you are able to do. If you happen to resolve that you simply want extra enterprise funding, you are able to do extra ROBS rollovers. Nonetheless, relying in your ROBS supplier, you can be charged extra charges for every particular person transaction.

Extra ROBS rollovers might also carry extra necessities. For instance, it’s common to have to indicate a optimistic enterprise valuation, one thing that may be completed by having a enterprise appraisal accomplished.

ROBS Rollover Compliance Necessities

There are numerous compliance necessities to remember when getting a ROBS. You’ll have to conduct annual opinions to make sure ongoing compliance necessities are being met and to keep away from any fines or penalties.

The listing of things that have to be reviewed might be prolonged. I like to recommend working along with your accountant and a ROBS supplier to maintain observe of those necessities. You possibly can take into account a supplier like Guidant Monetary, as its group of specialists can guarantee your plan stays compliant. The corporate additionally affords a sturdy audit safety and satisfaction assure to its clients, which guarantees to cowl all authorized prices related to representing your agency do you have to be chosen for an audit.

- File enterprise tax returns: You have to file your C-corp’s tax returns promptly every year to stay compliant. Tax return extensions are additionally permissible so long as they’re filed on time. ROBS suppliers won’t be able to deal with this step for you, however they will hold you knowledgeable of the submitting deadline.

- File Type 5500 in your retirement plan: Type 5500 have to be filed with the IRS every year, which stories the worth, operations, and administration of your company’s retirement plan. Be taught extra about what that is and methods to fill out the shape in our information to IRS Type 5500.

- Keep an ERISA constancy bond: This affords insurance coverage safety to plan contributors in opposition to loss or theft of funds as the results of criminality. You have to preserve satisfactory protection, which is at the moment the lesser of $500,000 or 10% of the plan’s worth.

- Assessment state-specific necessities: Extra submitting necessities could apply relying on the state you might be situated in. Your ROBS supplier might be able to present steerage for this step.

- Preserve your C-corp in good standing: C-corps have ongoing necessities that have to be met if you’d like the enterprise to remain in good standing with the IRS, the Secretary of State, and different state and federal rules. A few of these necessities can embody correctly recording assembly minutes, holding a enough variety of shareholder conferences, submitting annual stories, and sustaining correct monetary data.

- Keep standing as an energetic working firm: To be thought-about an energetic working firm, you have to be primarily engaged within the enterprise of promoting a services or products.

Unwinding a ROBS

Unwinding a ROBS requires sure steps to be taken to keep away from charges and penalties. Unwinding, or terminating a ROBS, can happen if the enterprise fails, you wish to promote or shut the enterprise, otherwise you in any other case wish to discontinue the C-corp.

Figuring out what your organization is value might be achieved by performing an appraisal of the enterprise belongings and present inventory value. Bancrupt companies should be capable to present monetary paperwork that assist a inventory valuation of $0.

A part of terminating the retirement plan requires correct discover to be given to all plan contributors. Extra paperwork might also have to be filed relying on the place you might be situated and the particular particulars of your online business. You possibly can study extra in our information on methods to terminate a ROBS 401(ok) plan.

IRS Type 5500 have to be filed because it formally notifies the IRS that your company’s retirement plan has been terminated. Skipping this step can lead to the IRS assessing fines and penalties.

The best way to Select a ROBS Supplier

Selecting the best ROBS supplier is a vital step. Not solely can it influence your total expertise, however it will probably additionally have an effect on your organization’s funds and the size of time wanted to get funding. Totally different suppliers additionally provide varied options and value-added perks, so it’s best to take into account that are greatest suited in your wants.

To save lots of you time, our group has evaluated totally different firms and created an inventory of the greatest ROBS suppliers. I additionally suggest contemplating the next traits earlier than deciding on anybody firm:

- Charges: Along with upfront prices related to getting the ROBS, additionally take into consideration any ongoing recurring bills that could be charged for sustaining your organization’s plan. For instance, some firms could cost for getting ready tax kinds that have to be filed yearly with the IRS.

- Audit safety: Due to the complexity of a ROBS, it’s essential to consider carefully about how audits will likely be carried out in the event you’re chosen by the IRS for a assessment. If you happen to’re uncomfortable dealing with this by yourself, it’s possible you’ll wish to choose an organization that not solely supplies providers to help with an audit but in addition one which covers all the related bills.

- Cash-back assure: Some firms provide this to provide you an added layer of confidence that you simply’ll obtain a excessive stage of service.

- Authorized assist & different assets: Since a ROBS offers with tax rules, it’s frequent for firms to offer authorized assist for steerage. Some firms, like Guidant Monetary, might also pay so that you can get unbiased steerage from outdoors counsel at no extra price.

- Ongoing assist: A ROBS has ongoing compliance necessities, so it’s best to take into account whether or not you’ll obtain help for sustaining your 401k plan and whether or not you’ll have steerage in assembly recurring compliance gadgets.

Frequent Errors to Keep away from With a ROBS

A ROBS shouldn’t be a standard type of funding, so it may be straightforward to make errors in the case of finishing a rollover. Beneath are some oversights I’ve seen different enterprise homeowners make in the case of getting funds through a ROBS transaction:

- Feeling uncertainty in regards to the return on funding (ROI): Finishing a ROBS and not using a good diploma of confidence within the anticipated ROI is a dangerous transfer. Ought to your online business fail, you’ll lose the steadiness of the retirement accounts used within the rollover.

- Rolling over the fallacious quantity of funds: Rolling over too little cash can imply you gained’t have a enough quantity to take a position or fund your organization’s objectives. Equally, rolling over an excessive amount of may trigger you to lose greater than is required in your private retirement accounts ought to your online business fail.

- Overlooking compliance necessities: Even after you’ve arrange your ROBS, you’ll nonetheless have to remain on high of recurring compliance paperwork and different necessities. Failing to file paperwork or lacking deadlines can lead to hefty fines and penalties from the IRS. This contains submitting Type 5500, documenting and conducting nondiscrimination assessments in your retirement plan, and making certain minimal contributions had been made.

- Overlooking related prices: If you happen to undergo with a ROBS, you’ll want to keep up your organization’s new retirement plan. Most ROBS suppliers can do that for you in trade for a month-to-month price of $100 to $150. Nonetheless, additionally take into account prices related to record-keeping, compliance, and any potential bills that may be incurred do you have to be chosen for an audit.

Dangers Related With a ROBS

As a ROBS is a part of your private retirement account, your private funds could possibly be in danger if your online business had been to fail. For example the chance of one thing like this taking place, the IRS carried out a ROBS compliance mission research on it in 2009.

It discovered that the majority companies that used a ROBS for funding finally failed or had been on the point of chapter. Different findings confirmed that it was not unusual for companies to miss ongoing compliance necessities, one thing that may result in fines and penalties.

Alternate options to a ROBS

Utilizing a ROBS might be a good way to fund your online business with out taking over debt. Nonetheless, it’s not the one possibility you’ve. When you have a 401(ok), for example, you may also money it out or get a mortgage, one thing we speak about in higher element in our information on methods to use a 401(ok) to fund a enterprise.

That mentioned, a ROBS will not be for everybody. If you happen to don’t suppose you qualify or don’t wish to danger dropping your retirement funds, listed below are some extra options you’ll be able to take into account that could be simpler to acquire:

- Small Enterprise Administration (SBA) loans: SBA loans are government-backed financing choices that may provide low charges and favorable phrases for companies which have sturdy credit score and funds. View our suggestions for the greatest SBA lenders.

- Startup enterprise mortgage: Some lenders concentrate on lending to startup firms. Funding choices can embody several types of loans, akin to microloans, tools financing, private loans, and extra. Head over to our information on startup enterprise loans to study extra about every possibility.

- Loans from family and friends: Borrowing cash from family and friends can present funding for your online business, often with decrease rates of interest and extra versatile reimbursement phrases than conventional financing. To see if this may be best for you, you’ll be able to take a look at our article on elevating cash from family and friends to fund your online business.

- Enterprise capital: In trade for fairness stakes in your online business, enterprise capitalists can spend money on your online business and supply funding with out debt obligations. There aren’t any month-to-month funds required, though you’ll have to surrender a portion of possession. Be taught extra about whether or not this may be best for you in our article on what enterprise capital is.

- Angel buyers: Angel buyers can provide you funding in trade for fairness, or part-ownership, in your organization. That is just like enterprise capital however is a much less formal course of. To study extra, learn our guides on the execs and cons of angel buyers funding your online business and methods to elevate angel funding.

If you happen to resolve that pursuing a enterprise mortgage could also be a greater possibility in your financing wants, you’ll be able to learn our information on methods to get a small enterprise mortgage to study extra in regards to the course of, how to decide on a lender, and methods to qualify.

Incessantly Requested Questions (FAQs)

A ROBS is a fancy transaction with many guidelines and rules. To save lots of you time and offer you a quick overview of what a ROBS consists of, listed below are some frequent questions concerning the ROBS program.

Establishing a ROBS rollover is a fancy course of, however it may be summarized in three main steps. First, you’ll have to have a retirement plan arrange beneath a C-corp. You possibly can then roll over your private retirement funds to that of the C-corp. These funds are then used to purchase inventory within the firm, at which level you’ll have the funds obtainable to be used.

Funds obtained by a ROBS program have to be used for enterprise functions. Examples embody buying enterprise tools, overlaying operational bills, and funding payroll wants. Funds can be utilized for an current enterprise, buying a brand new enterprise, or investing in a franchise.

To do a ROBS rollover, most suppliers require that you’ve a steadiness of $50,000 in an eligible retirement account. Your enterprise should even be structured as a C-corp. Not like loans, a ROBS has no necessities for credit score rating, time in enterprise, or income.

You might be assessed charges and penalties in the event you full a ROBS rollover however don’t use it for certified enterprise bills. If you happen to’re occupied with beginning a enterprise or buying one other firm, this can be a danger that ought to be considered in the event you’re not sure in the event you’ll see it by to completion.

If your online business fails, you can lose all the private retirement funds that had been used within the ROBS rollover. Companies that fail should additionally file extra paperwork to correctly terminate and unwind the ROBS program.

Sure, you’ll be able to unwind a ROBS if you wish to shut your online business because of a enterprise failure or sale of the corporate. Nonetheless, you’ll want to recollect to file the suitable paperwork to keep away from charges or different penalties.

Backside Line

Utilizing a ROBS can will let you fund your online business with out taking out a mortgage and is an effective possibility in the event you’re on the lookout for financing alternatives with out reimbursement obligations. Understand that it doesn’t come with out danger; within the occasion that your online business fails, your private retirement account could possibly be at a loss.

You’ll additionally want to contemplate the varied compliance and documentation necessities needed and decide in the event you meet the required {qualifications}. Earlier than choosing a ROBS rollover as a funding supply, it’s best to consider all of your choices to find out if it’s the most suitable choice for you and your online business wants.