What you want to know

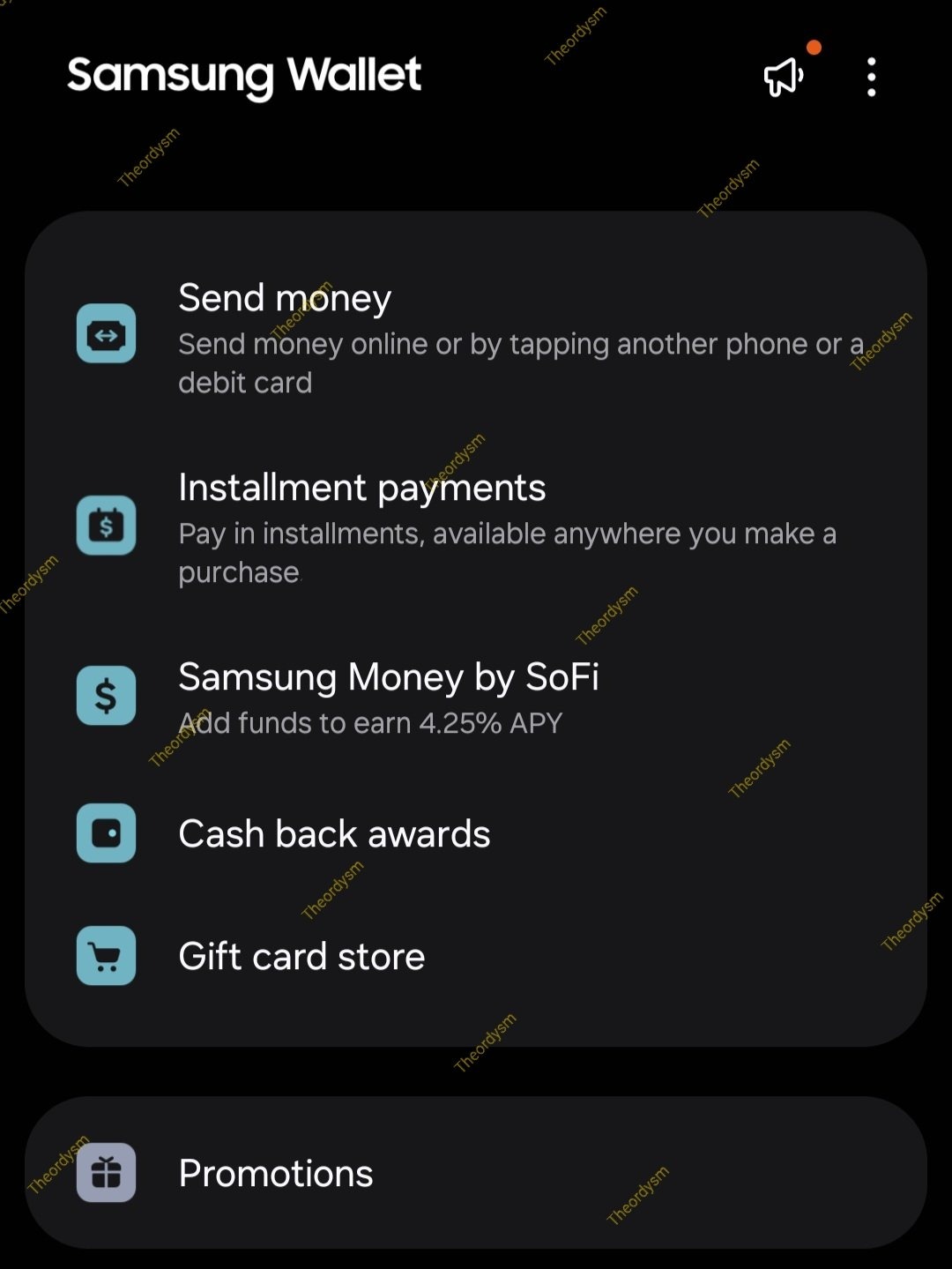

- Samsung Pockets is testing out two thrilling options: ‘Purchase Now, Pay Later’ and ‘Faucet to Switch,’ with a possible U.S. launch on the horizon.

- The ‘On the spot Installment’ characteristic permits you to cut up funds for purchases, whereas ‘Faucet to Switch’ works like Apple’s Faucet to Money however with extra flexibility for different digital wallets.

- The BNPL characteristic, powered by Splitit, will allow you to use Visa or Mastercard with out a credit score test, although activation might require approval and will have further charges.

A recent beta construct has given us a sneak peek at Samsung Pockets’s “purchase now, pay later” and tap-to-send choices, and though these aren’t official but, all indicators level to those options rolling out quickly.

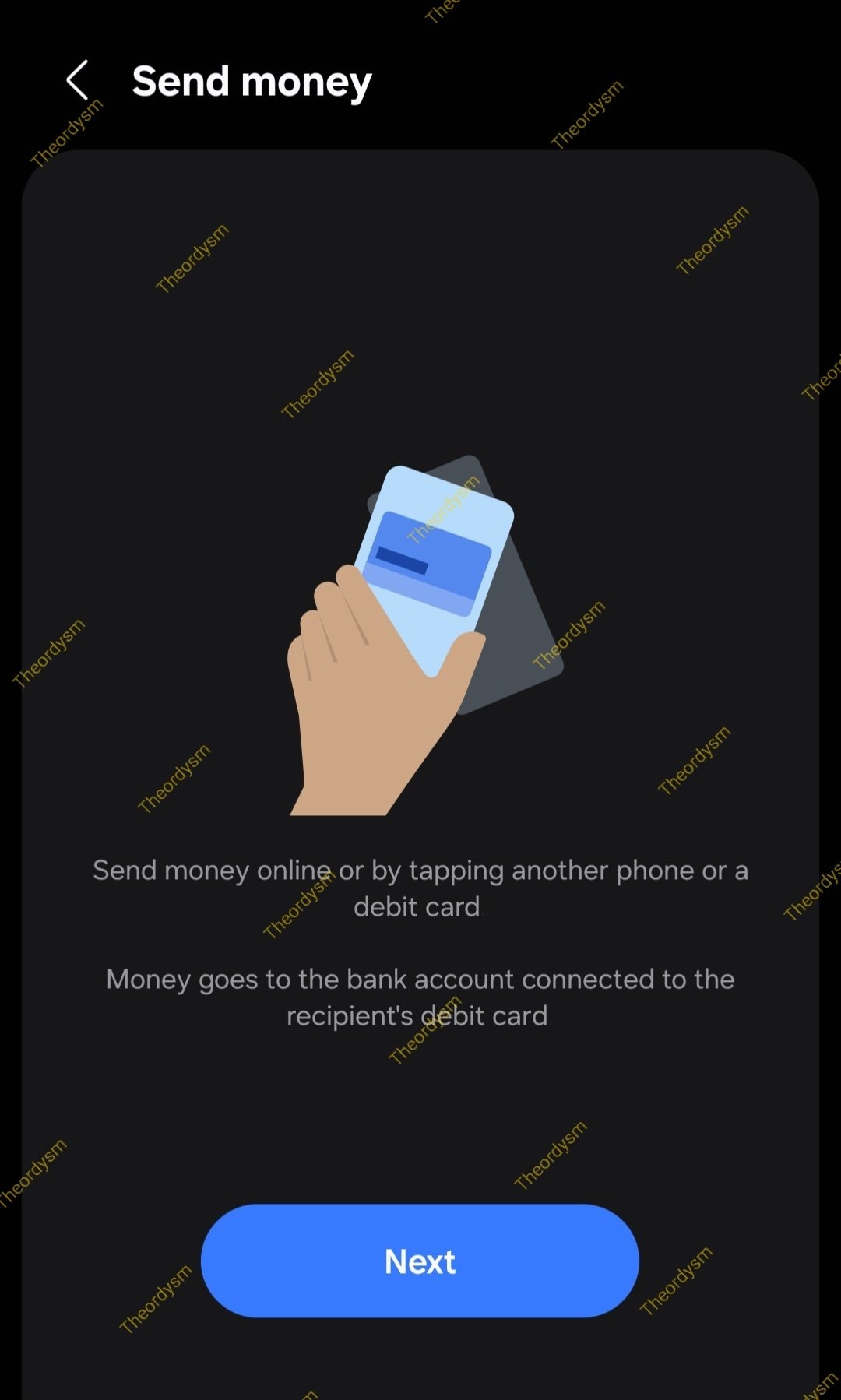

When the Galaxy S25 collection made its debut in January, Samsung additionally snuck in some software program updates that flew below the radar. Two standout options had been “On the spot Installment” for breaking apart funds and a peer-to-peer cash switch possibility that Samsung calls “Faucet to Switch.”

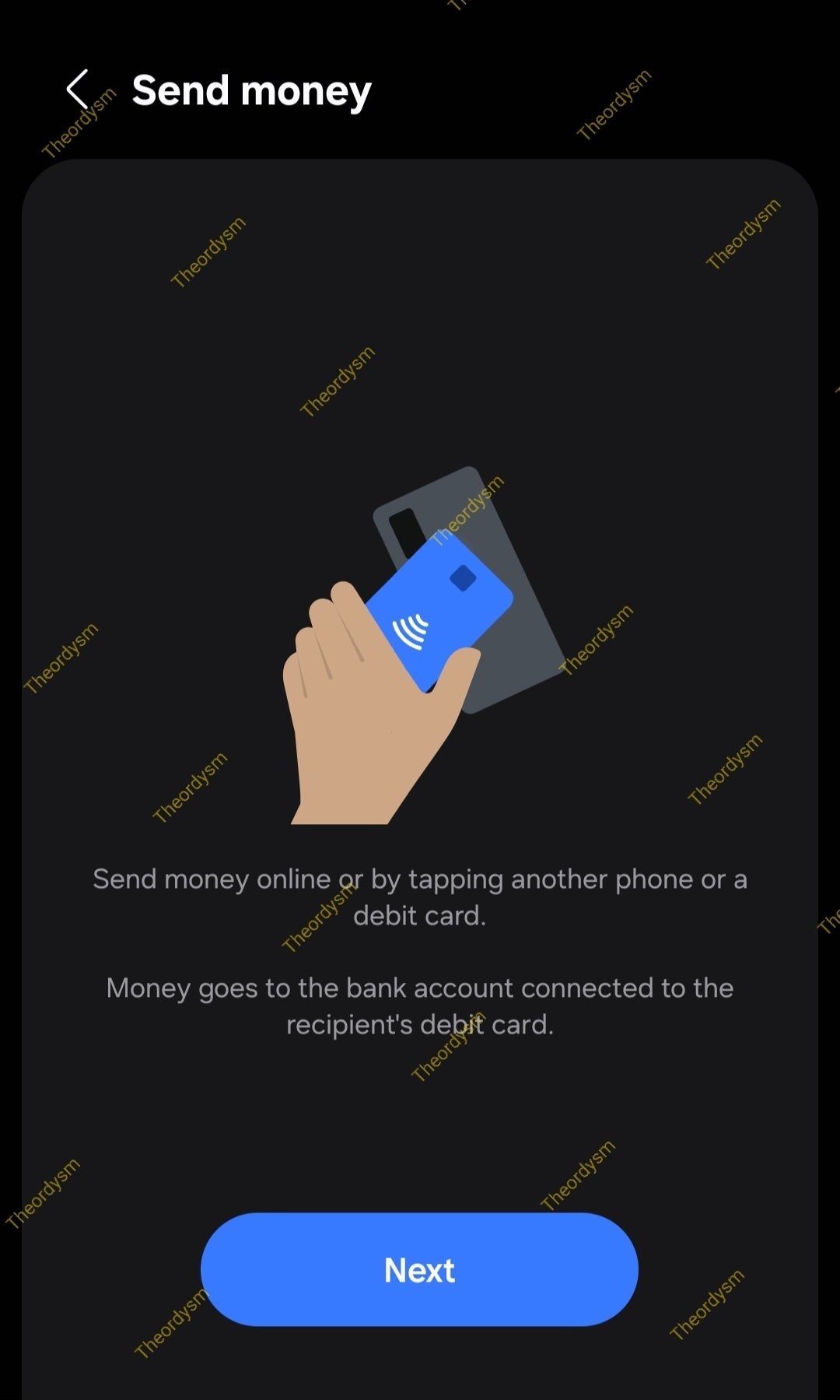

Samsung’s Faucet to Switch works so much like Apple’s Faucet to Money—simply bump telephones to ship cash. Nonetheless, whereas Apple retains issues locked in its ecosystem, Samsung is presumably taking part in good with different digital wallets. Which means you won’t want a Galaxy cellphone to obtain money, giving it a flexibility Apple doesn’t provide.

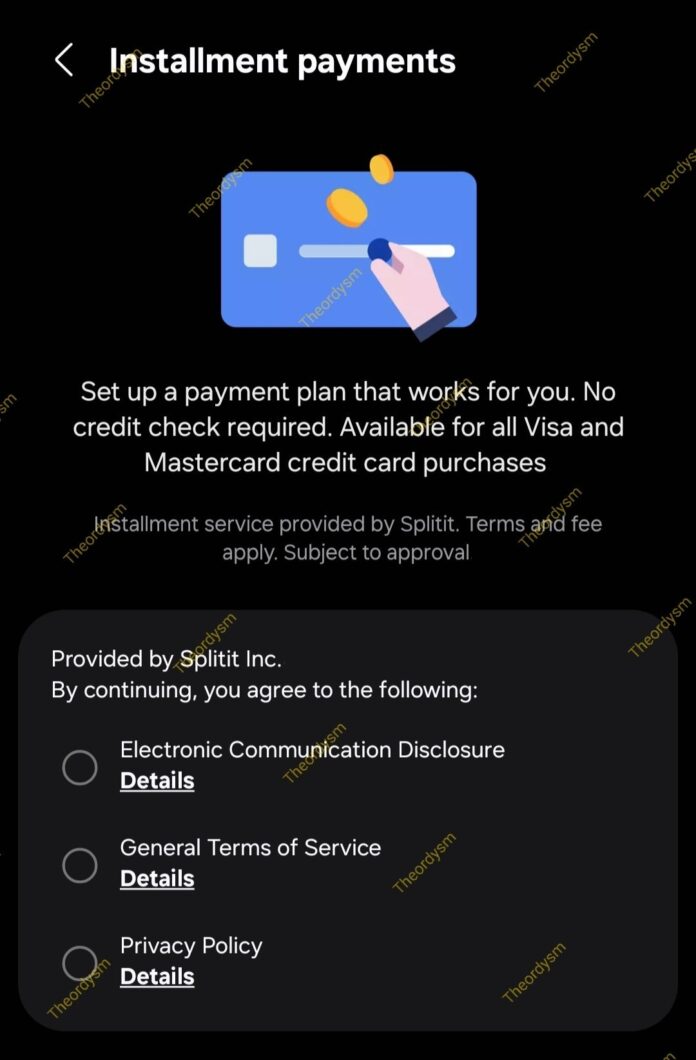

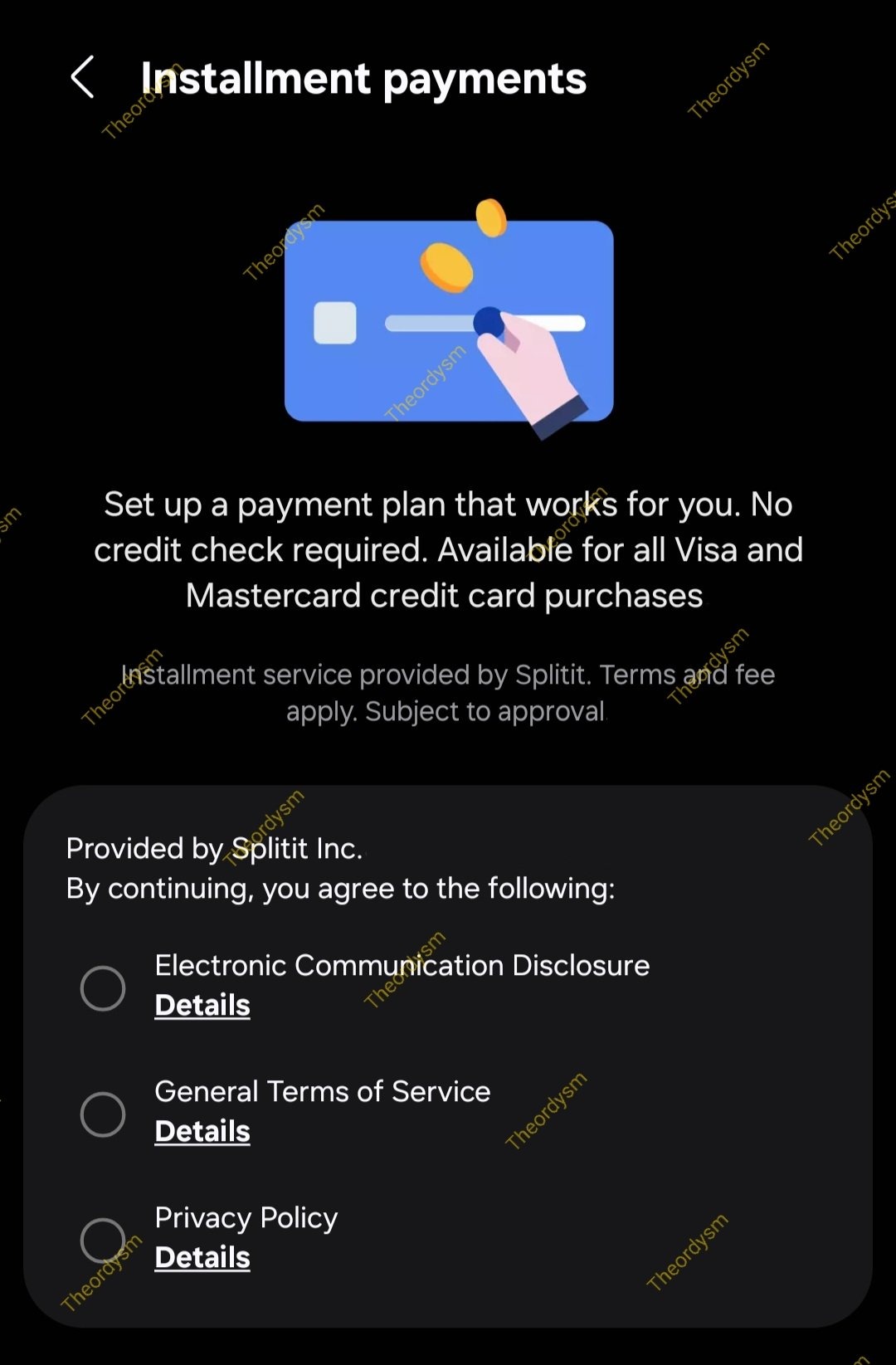

Purchase now, stress later

Now, leaked screenshots of Samsung Pockets, shared by @theordysm on X, present a “Purchase Now, Pay Later” characteristic within the works, powered by Splitit (by way of 9to5Google). It seems to be prefer it’ll work with Visa and Mastercard, with no credit score test wanted. That stated, activation nonetheless wants approval, and there could be some further charges within the combine.

Each options are nonetheless within the testing part, going by way of inner checks and restricted beta runs. Phrase on the road is Samsung would possibly launch them first within the U.S. as soon as they’re prepared for primetime.

From the screenshots, it seems to be just like the Installment Funds characteristic will let customers cut up their purchases into weekly funds. This selection needs to be obtainable for just about any transaction made by way of Samsung Pockets.

Slice your payments

Samsung’s installment funds aren’t about providing credit score or loans. Consider it as turning your common purchases right into a pay-over-time plan, whether or not you’re trying out on-line or in a bodily retailer.

The funds switch characteristic lets customers ship cash both by way of a digital community or by tapping an NFC-compatible gadget or cost card. The recipient’s checking account, linked to their debit card, will get the funds right away.

Whereas we don’t know precisely how briskly the transfers might be, the power to ship cash simply by tapping a debit card is certainly a sport changer.