AI is remodeling wealth administration from intuition-based advising to algorithm-driven precision. In 2025, AI-powered options are delivering hyper-personalized portfolios, 24/7 insights, and emotion-free decision-making. With the worldwide WealthTech market projected to hit $137 billion by 2028 (Fortune Enterprise Insights), ignoring this shift is like utilizing paper maps in a GPS world.

What Is Wealthtech, and Why 2025 Is a Turning Level

Consider conventional investing like navigating with a compass. Now, think about switching to an autonomous car that anticipates roadblocks, learns your vacation spot preferences, and recalibrates in actual time. That’s AI in WealthTech.

In 2025, the rise of AI-powered advisors is reshaping how folks make investments, shifting from guide portfolio rebalancing and gut-driven selections to real-time, data-backed steering tailor-made to each investor’s targets and danger urge for food. These advisors don’t sleep, don’t second-guess, and don’t get swayed by headlines.

Take into account this: AI-enabled portfolio administration is anticipated to develop at a 25.7% CAGR from 2021 to 2028, and platforms like Betterment and Wealthfront already handle over $40 billion in mixed property (Statista, Deloitte). This isn’t simply tech adoption, it’s a revolution in monetary habits.

So what does this imply for traders, wealth managers, and monetary establishments clinging to outdated fashions? It’s time to rethink the position of belief, transparency, and expertise in wealth administration, or danger being left behind.

The Rise of AI-Powered Monetary Advisors

What as soon as appeared like science fiction, an AI managing your investments is now a day by day actuality. In 2025, AI-powered advisors are now not restricted to backend evaluation. They’re serving to traders make smarter selections, quicker.

These digital advisors don’t sleep, don’t get emotional, and don’t overlook compliance guidelines. They analyze hundreds of thousands of information factors in actual time to supply personalised funding methods, rebalance portfolios on the fly, and adapt to market shifts immediately. Platforms like Wealthfront, Betterment, and SigFig are main this AI-first shift, managing billions in property with no single human whispering “purchase low, promote excessive.”

And the attraction isn’t only for tech-savvy Gen Z traders. Even high-net-worth people and huge establishments are turning to AI for its pace, accuracy, and skill to detect dangers earlier than human advisors even discover them.

The outcome? An enormous redefinition of what it means to “belief your advisor”, as a result of more and more, that advisor isn’t an individual.

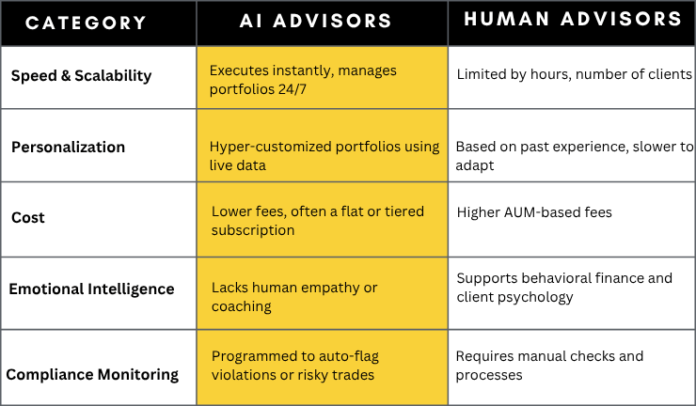

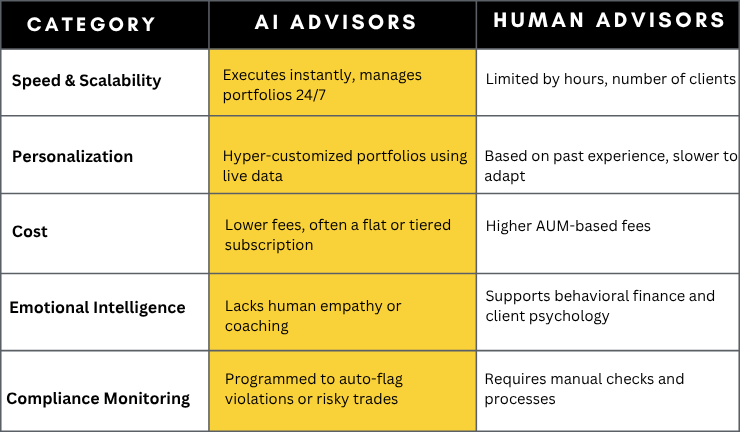

AI vs Conventional Monetary Advisors: Who Wins The place in 2025?

Human advisors carry instinct, empathy, and relationship-building. AI brings real-time knowledge, logic, and scale. So, who wins? In 2025, the reply isn’t both/or, it’s about figuring out the place every excels.

Advantages of AI in Wealth Administration

A. Actual-Time Portfolio Rebalancing

Gone are the times of quarterly check-ins. AI platforms monitor market shifts, investor habits, and macroeconomic traits in actual time, adjusting allocations immediately to remain aligned with danger profiles.

This implies portfolios keep optimized even throughout risky market circumstances, lowering response time and maximizing efficiency.

B. Personalised Funding Methods

Utilizing behavioral knowledge, transaction historical past, and even sentiment evaluation, AI builds methods as distinctive because the investor. This hyper-personalization is almost not possible to realize manually at scale.

AI can tailor portfolios not simply to targets and danger urge for food, however to altering life phases, spending habits, and evolving market dynamics.

C. Enhanced Danger Administration

AI can simulate 1000’s of situations to anticipate and mitigate draw back danger, earlier than it turns into a headline. It flags patterns human eyes may miss, from liquidity crunches to sector volatility.

By constantly studying from market knowledge, AI helps advisors and traders proactively regulate methods as an alternative of reacting to losses.

D. 24/7 Availability and Decrease Prices

AI advisors don’t sleep. Traders can get portfolio insights, make trades, or replace preferences anytime, with out ready for an advisor’s availability. Bonus: fewer overheads imply decrease charges.

This democratizes entry to stylish monetary recommendation, making high quality funding instruments out there even to retail traders with modest portfolios.

E. Bias-Free Determination Making

AI isn’t swayed by panic, market noise, or affirmation bias. It makes chilly, calculated strikes primarily based on logic and knowledge, one thing even seasoned advisors wrestle with in high-stress environments. This eliminates emotional decision-making and ensures long-term self-discipline, particularly throughout turbulent financial cycles.

Prime 5 AI-Powered WealthTech Instruments Main the Cost in 2025

AI is now not an rising function in wealth administration, it’s the engine powering most of the most trusted platforms within the business. These 5 instruments are redefining how traders make selections, handle danger, and develop wealth.

1. Wealthfront

Wealthfront provides totally automated investing with AI-driven monetary planning, rebalancing, and tax optimization. It adapts to consumer targets in actual time, making it very best for hands-off traders looking for sensible, long-term progress.

2. Betterment

Betterment blends AI with entry to human advisors, providing a personalised but scalable expertise. Its algorithms deal with portfolio administration, whereas instruments like SmartDeposit and goal-based planning make it user-friendly and efficient.

3. SigFig

SigFig offers data-driven funding suggestions and portfolio administration for each particular person traders and huge establishments. Its AI platform additionally helps white-label options for monetary companies, serving to them modernize their shopper expertise.

4. Zeni

Zeni acts as an AI-powered finance staff for startups and small companies. It automates bookkeeping, forecasting, and reporting, giving founders real-time insights while not having a full finance division.

5. Magnifi

Magnifi features like a monetary search engine powered by conversational AI. Traders can ask pure language questions and obtain real-time funding suggestions primarily based on their preferences and danger urge for food.

Challenges Forward and Why Hybrid WealthTech Fashions Are the Future

Whereas AI-powered advisors provide pace, scale, and personalization, additionally they include critical challenges that the business can’t afford to disregard. Belief stays a significant hurdle, many traders are nonetheless hesitant to let a machine make selections about their cash. The dearth of transparency in AI decision-making, potential biases in coaching knowledge, and growing issues round knowledge privateness have made regulators, and customers extra cautious.

There’s additionally the query of empathy and context. AI can course of knowledge, however it could’t but totally perceive emotional nuance, life complexities, or behavioral triggers that have an effect on investor selections. That’s the place human advisors nonetheless maintain the sting.

The answer isn’t to decide on between people and machines. It’s to mix them.

Hybrid advisory fashions are rising as the best manner ahead. On this setup, AI handles the heavy lifting, analyzing knowledge, managing portfolios, and delivering real-time alerts, whereas human advisors present strategic steering, emotional reassurance, and context-driven recommendation. Collectively, they create an expertise that’s each clever and reliable.

However constructing a hybrid wealthtech resolution that works seamlessly takes greater than plugging in an algorithm.

The place ISHIR Matches In: Turning Intelligence Into Benefit

ISHIR’s Knowledge & Analytics providers are designed to assist fintech and wealth administration companies unlock the complete potential of AI, ethically, securely, and strategically. Whether or not you’re constructing a robo-advisor, enhancing an current funding platform, or designing a data-driven personalization engine, we carry the engineering energy and area experience to make it actual.

From trendy knowledge structure and ML mannequin improvement to real-time analytics dashboards and predictive insights, we provide help to flip uncooked monetary knowledge into actionable intelligence. And we do it with transparency, compliance, and scale in thoughts, so your platform grows, earns belief, and delivers constant worth.

The way forward for wealth administration isn’t human or AI. It’s each. And with ISHIR, you don’t simply catch the wave, you engineer it.

Struggling to show advanced monetary knowledge into sensible funding selections?

ISHIR’s Knowledge & Analytics providers provide help to construct AI-powered wealthtech options which can be quick, safe, and future-ready.

The submit Wealthtech in 2025: How AI-Powered Advisors Are Altering the Funding Recreation appeared first on ISHIR | Software program Growth India.