The federal funds charge is the speed that’s charged when a financial institution lends funds to a different financial institution. This could happen if a financial institution wants cash to fulfill reserve necessities

The necessities be sure that the financial institution can meet its liabilities if it receives numerous withdrawal requests.

set by federal laws. Whereas the federal funds charge describes the speed banks cost each other, it performs a big function in US financial coverage and has vital implications for customers and small enterprise homeowners. It might affect inventory market efficiency and the charges you see on loans and depository accounts, like checking and financial savings accounts.

How the Federal Funds Curiosity Fee Is Decided

The federal funds rate of interest is decided by the Federal Open Market Committee (FOMC), which usually meets at the very least eight occasions per yr. One objective of those conferences is to determine what modifications in financial coverage to make to assist the US economic system develop—corresponding to whether or not to boost the federal funds charge, decrease it, or depart it unchanged.

All kinds of financial and monetary circumstances is reviewed earlier than a call is made; however typically, modifications to the federal funds charge are usually executed with the next objectives:

For Reducing the Federal Funds Fee

That is usually executed to stimulate financial progress and/or struggle rising unemployment. Reducing the federal funds charge creates a cycle that makes it extra reasonably priced to borrow cash, which finally encourages customers to spend extra. Further spending by customers may help corporations acknowledge extra income, giving them an excellent higher means to rent extra staff and put money into extra progress.

For some banks and lenders, providing decrease rates of interest because of a discount within the federal funds charge can even result in changes in eligibility standards making it simpler for customers to get permitted for loans. When you’re in search of a small enterprise mortgage, chances are you’ll discover it simpler to get credit score coverage exceptions on frequent mortgage necessities.

For Elevating the Federal Funds Fee

A rise within the federal funds charge is usually executed to decelerate an economic system that’s rising too quickly, particularly if it’s deemed to be at an unsustainable charge. It will also be executed to struggle inflation, a possible consequence of a earlier lower of the federal funds charge. Growing the federal funds charge makes it costlier to borrow cash, which discourages spending by each customers and enterprise homeowners, as an alternative encouraging them to avoid wasting extra.

For Leaving the Federal Funds Fee Unchanged

If the FOMC determines that the US economic system is secure, it might determine to go away the federal funds charge unchanged till the subsequent often scheduled assembly.

How the Federal Funds Impacts Banks

Federal laws dictate the quantity of reserves a financial institution will need to have as a way to enhance the probability that it might meet a surge in withdrawal requests. Usually, the quantity of reserves required could be based mostly on the quantity of deposits it has or a ratio of sure internet transactions. For instance, if a financial institution has $500 million in deposits from its prospects with a ten% reserve requirement, it might lend $450 million so long as it retains at the very least $50 million to cowl the chance that prospects might wish to withdraw these funds.

If a financial institution doesn’t have ample funds to satisfy reserve necessities, it might search out funding from one other financial institution that has extra reserves. Banks with extra funding can lend it to different banks in a single day, charging solely the federal funds charge.

How the Federal Funds Fee Impacts the Market

As a client and small enterprise proprietor, modifications to the federal funds charge can have an effect on inventory market efficiency and the charges you get on loans and depository accounts. Under is a desk summarizing the standard affect you’ll see in every of those areas.

Inventory Market

When the Fed lowers the federal funds charge, it makes borrowing cash less expensive to companies. With extra reasonably priced entry to capital, buyers can see this as an opportunity for added progress, one thing that may yield a extra optimistic outlook for the corporate, and thus, the next share worth for publicly traded corporations.

Loans

The rate of interest on loans usually corresponds to how a lot it prices for banks to borrow cash. Because the Fed raises charges, that added price is handed on to debtors. Equally, as charges lower, debtors will see decrease rates of interest on a variety of loans.

Depository Accounts

Checking, financial savings, and Certificates of Deposit (CDs) are frequent kinds of depository accounts that see a rise in charges when the federal funds charge goes up. Since a financial institution’s means to concern loans is usually at the very least partially depending on the quantity of deposits it has, it often gives the next rate of interest to draw extra prospects if the federal funds charge has additionally elevated. By encouraging prospects to deposit extra funds, banks can have a higher means to concern loans, one thing that may be much more worthwhile because of the increased rates of interest it might subsequently cost.

Historic Adjustments to the Federal Funds Fee

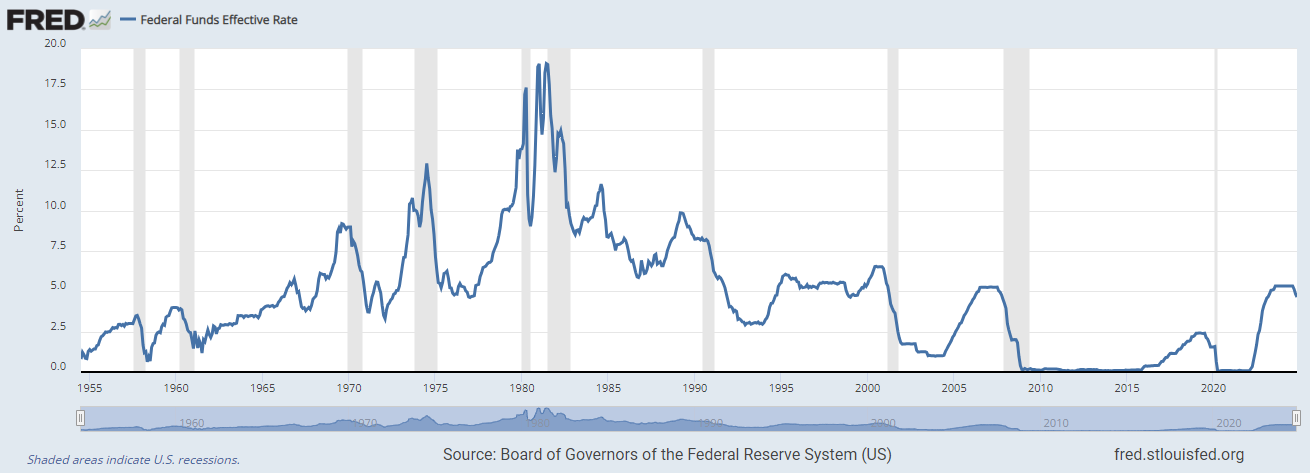

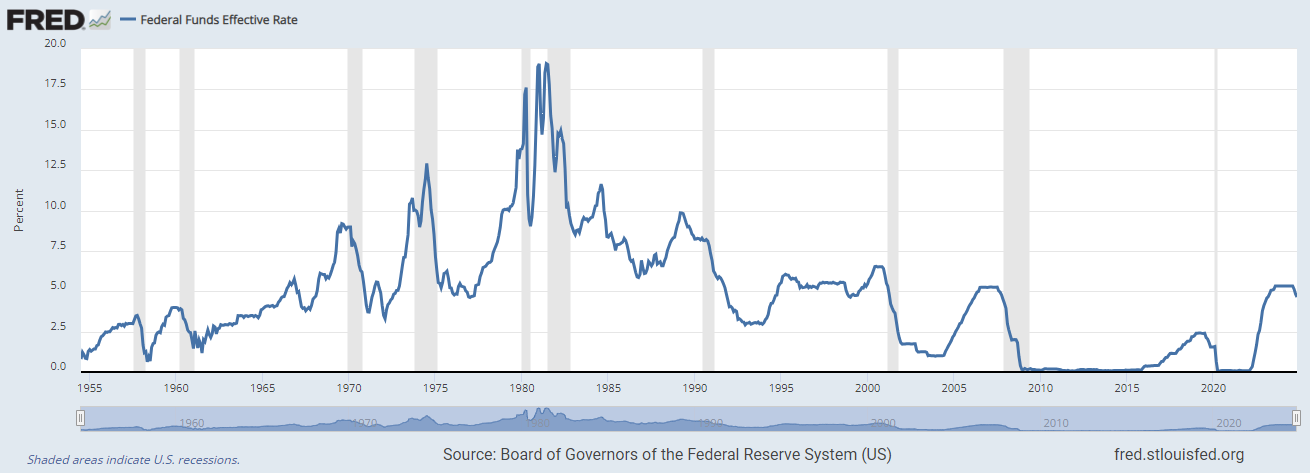

The federal funds charge has fluctuated over time in response to modifications within the US economic system. It reached a excessive of almost 20% within the Nineteen Eighties, to a low of successfully 0% round 2008. Under is a chart taken from the Federal Reserve Financial institution of St. Louis exhibiting these historic modifications.

Adjustments within the federal funds charge going again to the Nineteen Fifties. (Supply: Federal Reserve Financial institution of St. Louis)

Ceaselessly Requested Questions (FAQs)

Sure. The federal funds charge is what banks cost one another to borrow cash. Rates of interest usually consult with the charges customers and small companies obtain after they apply for loans.

Usually, it might change eight or extra occasions per yr. The FOMC has eight often scheduled conferences per yr the place it evaluates any mandatory modifications to help the continued progress of the US economic system.

The federal funds charge is usually modified to help the long-term sustainable progress of the US economic system. Decreases within the charge encourage client spending and make it less expensive to borrow cash, whereas will increase within the charge encourage customers to avoid wasting.

Backside Line

When banks have to borrow cash from one another, the speed that’s charged is the federal funds charge. Nevertheless, the federal funds charge additionally impacts customers and small enterprise homeowners. This charge can change as a lot as eight or extra occasions per yr relying on what the Fed determines to be the most effective plan of action to help sustainable progress of the US economic system. When you’re contemplating getting a small enterprise mortgage and suspect the federal funds charge might change, you’ll be able to regulate your timeline to doubtlessly get a extra aggressive rate of interest.