A Dun & Bradstreet credit score report, or D&B credit score report for brief, supplies a snapshot of how a enterprise handles its debt funds. Its major function is to supply potential collectors and enterprise companions perception into how an organization will probably deal with its funds shifting ahead and its general monetary well being.

Info generally included with a Dun & Bradstreet credit score report contains knowledge on previous cost historical past, bankruptcies, lawsuits, liens, and different public filings. This knowledge is then used as the premise for varied credit score scores designed to replicate the corporate’s danger of sure varieties of conduct, equivalent to its probability of going bankrupt or being delinquent on funds in a given timeframe.

How a D&B Credit score Report Works

D&B collects knowledge from totally different private and non-private knowledge sources. This may embrace public data knowledge from varied county and state entities, which regularly reveal issues like contact info and normal enterprise knowledge which will have been required while you filed for mandatory state licenses or permits. Lastly, particular person lenders, collectors, and distributors may report your cost info to credit score bureaus like D&B.

The info compiled is then used to create a wide range of scores and scores on a credit score report back to reveal the monetary well-being of what you are promoting. Your corporation profile is publicly accessible, and your creditworthiness may be evaluated by collectors, companions, or distributors who could also be concerned about working with you. Quite a few report varieties can be found, and the data included will differ relying in your alternative of report.

Sorts & Prices of Reviews

- D&B Credit score Insights Free: $0 for alerts that monitor adjustments in your credit score profile whereas highlighting potential dangers or alternatives. This product contains PAYDEX®, delinquency, and failure Rating. Additionally included is a abstract of primary firm info and authorized occasions.

- D&B Credit score Insights Primary: $49 month-to-month for twenty-four/7 monitoring and entry to PAYDEX®, delinquency rating, failure rating, most credit score suggestion, and D&B ranking. This report contains detailed insights primarily based on the historic traits of what you are promoting’s credit score rating and scores, together with complete authorized occasions particulars, together with lawsuits, liens, judgments, and UCC filings.

- D&B Credit score Insights Plus: $149 monthly for all the options in Primary, plus darkish net monitoring for as much as 5 enterprise e mail addresses and the flexibility to match what you are promoting scores towards as much as 5 different firms and to supply the corporate with varied monetary statements in order that they might be validated and included with what you are promoting credit score report.

- Enterprise Info Report™ Snapshot: $139.99 a yr to view one other US or Canadian firm’s detailed enterprise credit score report, which is obtainable on-line for as much as 12 months. Included is an organization’s PAYDEX® rating together with 5 different D&B scores and scores. You’ll additionally be capable to view firm info and cost historical past.

- Enterprise Info Report™ On Demand: $189.99 yearly for limitless entry to view one other firm’s enterprise credit score file in real-time for as much as 12 months. Included are D&B scores that present perception into potential defaulted funds or the probability of monetary pressure. Alerts for adjustments to the corporate’s credit score file are additionally accessible for as much as 12 months.

- D&B Credit score Evaluator Plus: $61.99 for a single report, though you will get a quantity low cost if you buy 5 or extra on the identical time. This product permits you to view credit score info in your suppliers, distributors, clients, and different enterprise companions so as to decide any potential danger. This will help with selections like figuring out how a lot credit score to increase, what cost phrases needs to be, and whether or not there are any potential authorized dangers as a consequence of pending litigation.

Key Options of D&B Reviews

There are a lot of components to decipher when studying a D&B credit score report. Listed below are some key options to look out for.

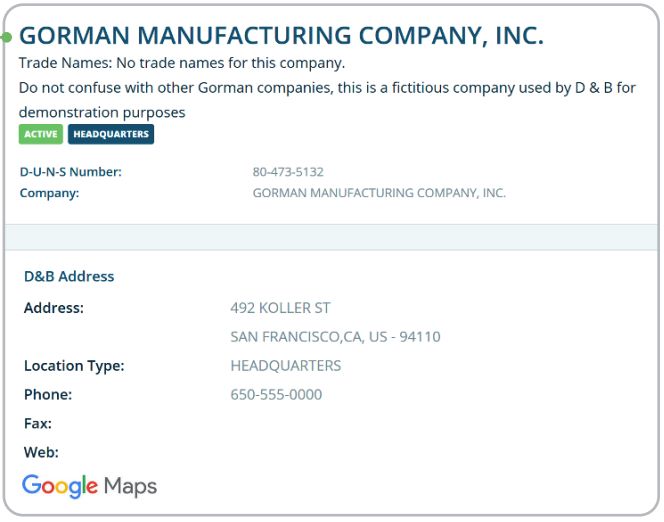

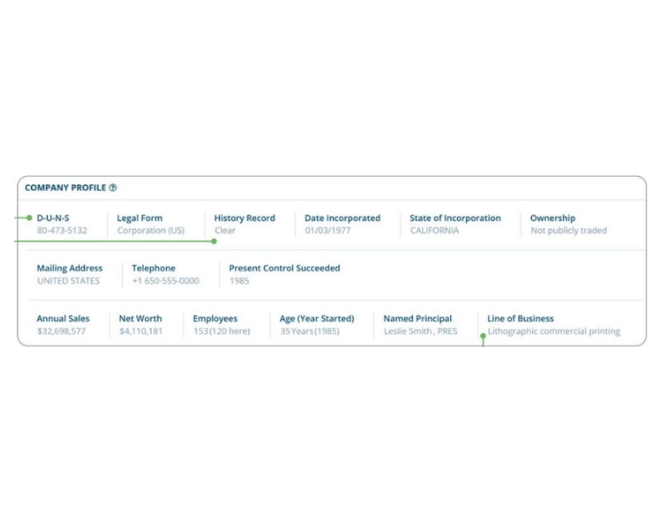

Firm Profile

The corporate profile part summarizes key firm particulars equivalent to your DUNS Quantity, contact info, business classification, and enterprise construction. It may be utilized to confirm and assess what you are promoting by lenders, companions, or distributors.

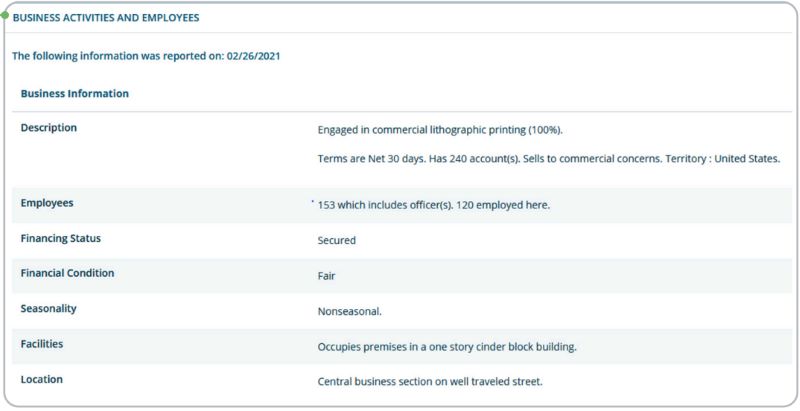

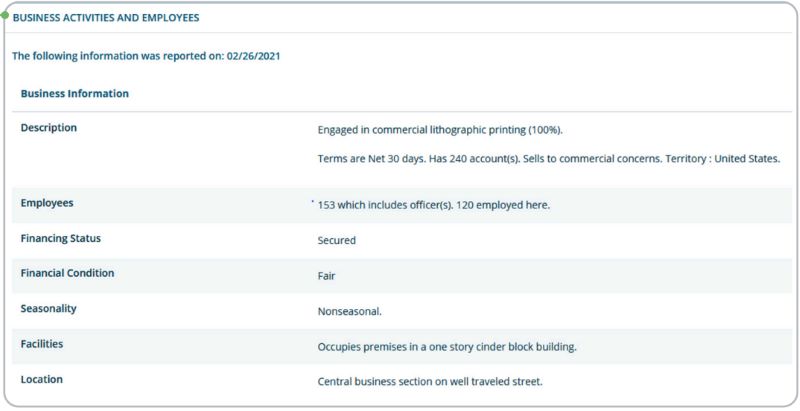

Enterprise Actions

This part is connected to the corporate profile and contains info concerning what you are promoting description, variety of staff, monetary standing and situation, cost phrases, seasonality, and site and services.

Enterprise Actions part of a D&B profile. (Supply: Dun & Bradstreet)

Danger Evaluation

Scores supplied by D&B are evaluated by a number of components used to find out the potential danger and creditworthiness of a enterprise. In measuring general enterprise danger, there are 5 scores, starting from low to excessive, together with perception supplied by D&B as to the current and future monetary energy of what you are promoting.

Danger evaluation part of D&B profile. (Supply: Dun & Bradstreet)

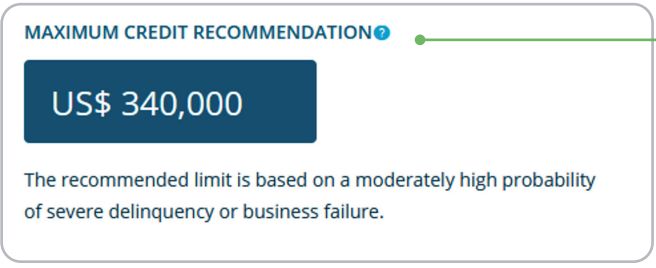

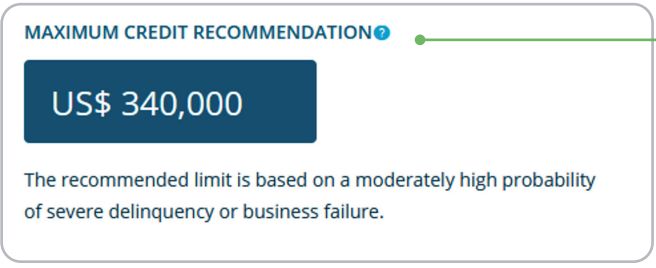

Additionally included is D&B’s Most Credit score Suggestion, which is the instructed most quantity of credit score to be prolonged to what you are promoting.

Most credit score suggestion of a D&B profile. (Supply: Dun & Bradstreet)

Report Scores

There are 5 methods through which D&B measures your rating:

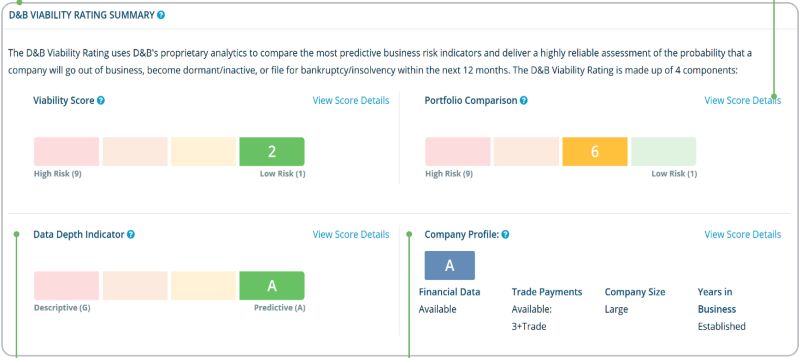

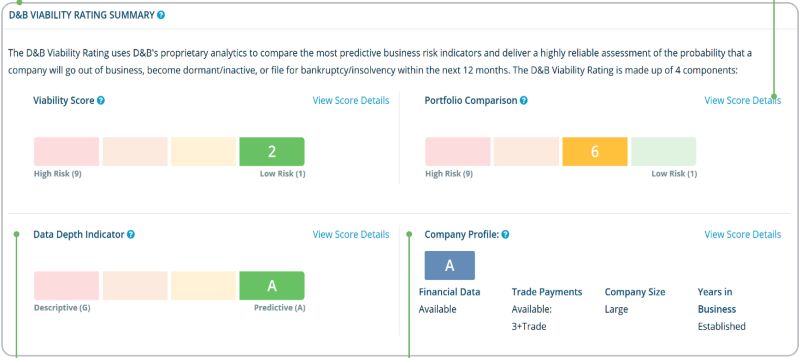

A viability ranking relies on the chance that an organization will now not be in enterprise, file for chapter, or grow to be inactive inside a 12-month interval. The ranking is made up of 4 parts—together with viability rating (scores starting from 1 to 9; 1 being the bottom danger), portfolio comparability (scores additionally starting from 1 to 9; 1 being one of the best as compared), knowledge depth indicator (scores starting from A to M), and firm profile (scores starting from A to Z).

Viability ranking scoring mannequin. (Supply: Dun & Bradstreet)

The D&B Delinquency rating ranges from 1 to 100 and represents the chance that an organization will probably be delinquent in making funds, typically 90 days or later.

D&B Delinquency Rating mannequin. (Supply: Dun & Bradstreet)

The D&B failure rating ranges from 1 to 100 (1 being the best danger) and determines the probability that collectors received’t obtain cost if an organization fails, together with submitting for chapter or going out of enterprise.

D&B Failure rating mannequin. (Supply: Dun & Bradstreet)

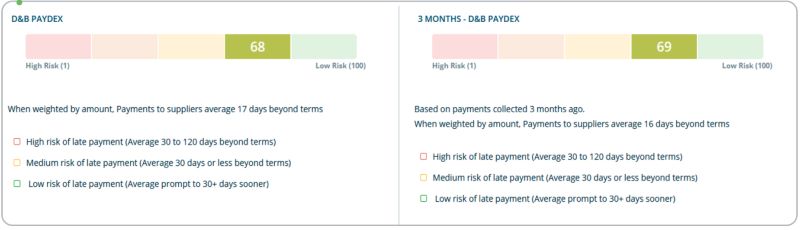

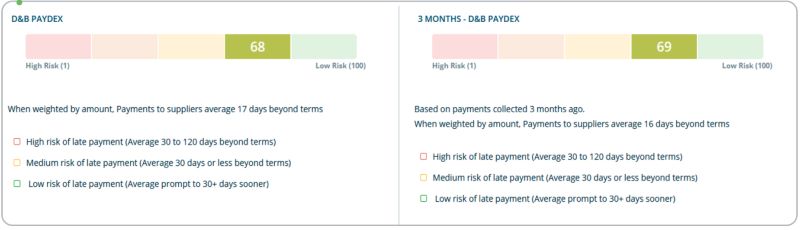

A PAYDEX® rating is calculated by the efficiency of a enterprise’s cost historical past over the previous two years. The rating ranges from 1 to 100 (1 being the worst, and 100 being one of the best) and is usually utilized by collectors to evaluate creditworthiness.

PAYDEX® rating mannequin. (Supply: Dun & Bradstreet)

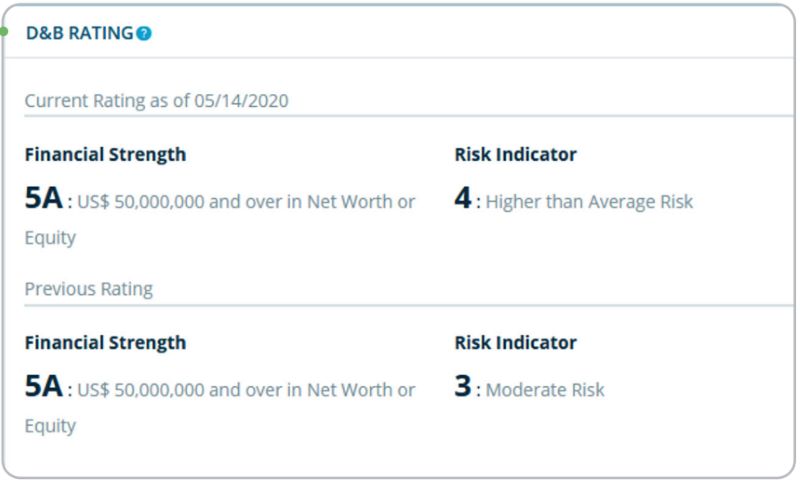

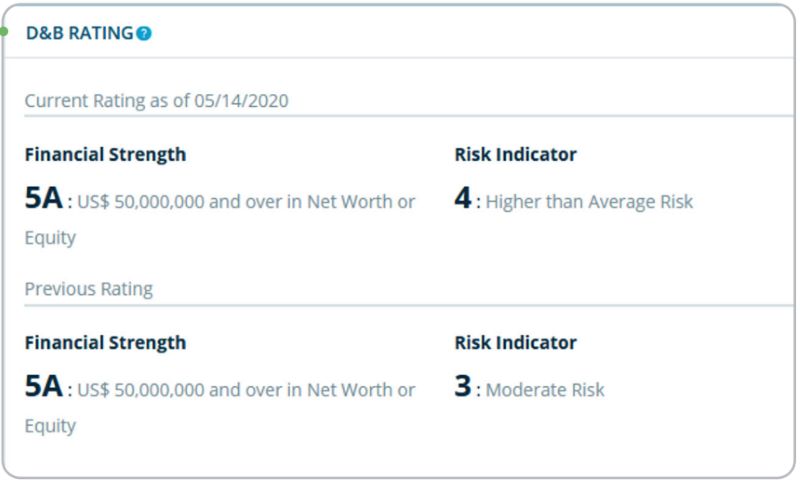

A D&B ranking is a median of an organization’s historic monetary efficiency inclusive of cost historical past, enterprise age and measurement, and different monetary info. The ranking is proven as an alphanumeric determine, consultant of monetary energy and a danger indicator.

D&B ranking mannequin. (Supply: Dun & Bradstreet)

Commerce Funds

The commerce funds part summarizes cost historical past to different companions. It signifies proof of cost conduct equivalent to past-due quantities and whole days of past-due funds. Additionally famous are the varieties of commerce accounts and the whole worth of every tradeline.

Commerce Funds part of a D&B profile. (Supply: Dun & Bradstreet)

Possession

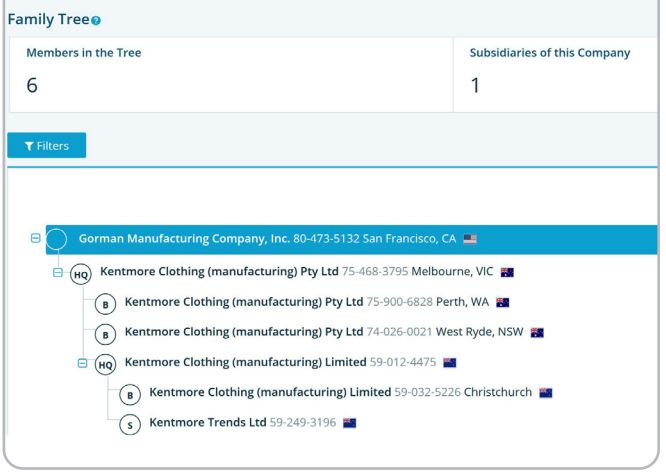

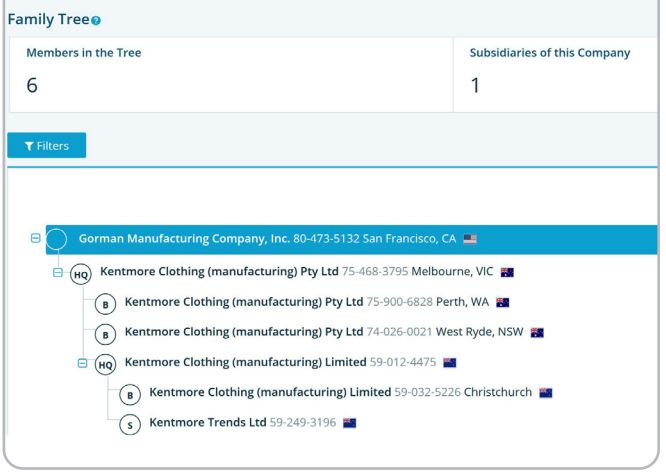

This part supplies an summary of the possession chart, which shows relationships between totally different firms within the D&B database.

This may be utilized to evaluate potential danger throughout a household tree alongside offering a worldwide overview of the majority-owned subsidiaries and their relationships.

Possession part of a D&B profile. (Supply: Dun & Bradstreet)

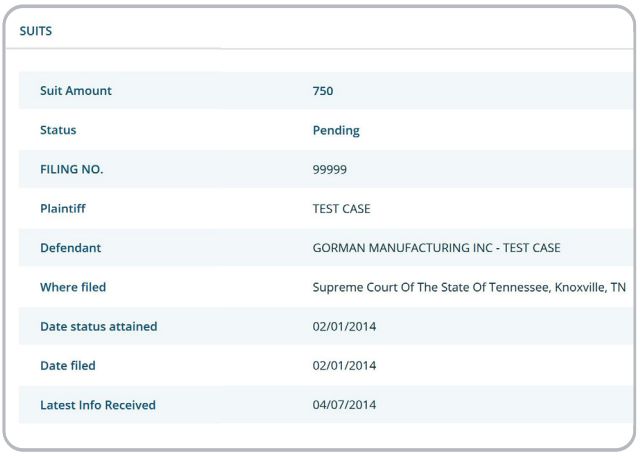

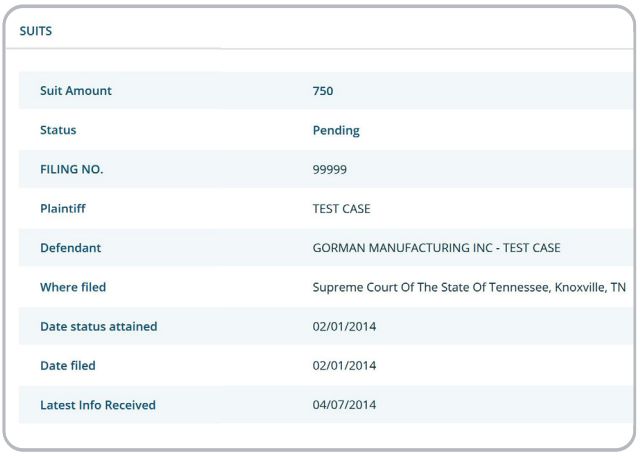

Authorized Occasions

The authorized occasions part stories any authorized exercise that might affect the monetary stability of what you are promoting, equivalent to chapter filings, judgments, liens, lawsuits, and UCC filings.

Authorized Occasions part of a D&B profile. (Supply: Dun & Bradstreet)

Particulars concerning any authorized occasions are summarized as demonstrated within the instance beneath:

Instance of authorized occasions abstract. (Supply: Dun & Bradstreet)

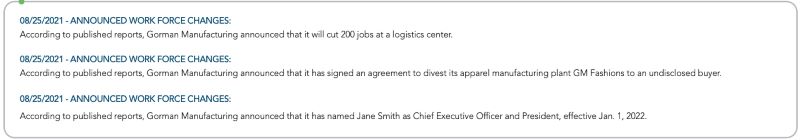

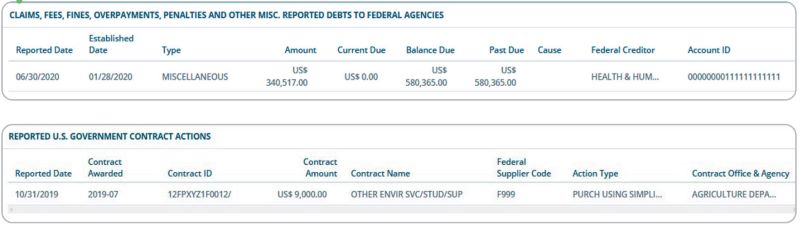

Particular Occasions

The Particular Occasions part presents the newest developments of a enterprise, equivalent to adjustments in possession, operations, and earnings bulletins, if relevant.

Particular Occasions part of a D&B profile. (Supply: Dun & Bradstreet)

Financials

Relying on the corporate, documentation—equivalent to steadiness sheets, money stream data, and revenue and loss statements amongst different monetary stories—may be accessed by way of a D&B credit score report.

Monetary part of a D&B profile. (Supply: Dun & Bradstreet)

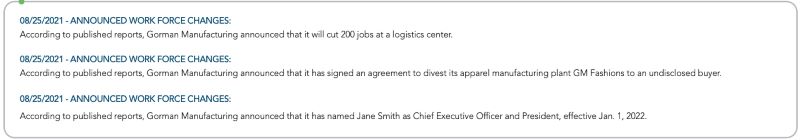

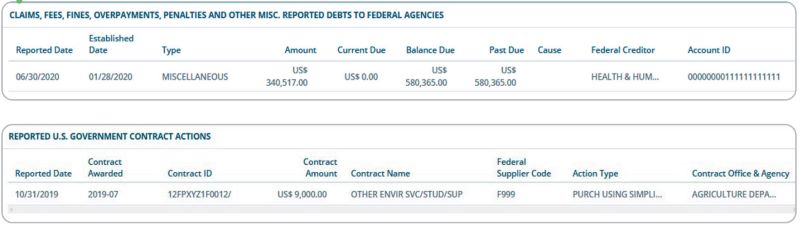

Federal Info

This part provides info concerning dealings with the US Authorities (together with exclusions) and highlights any exercise equivalent to contracts, money owed, or help.

Federal Info part of a D&B profile. (Supply: Dun & Bradstreet)

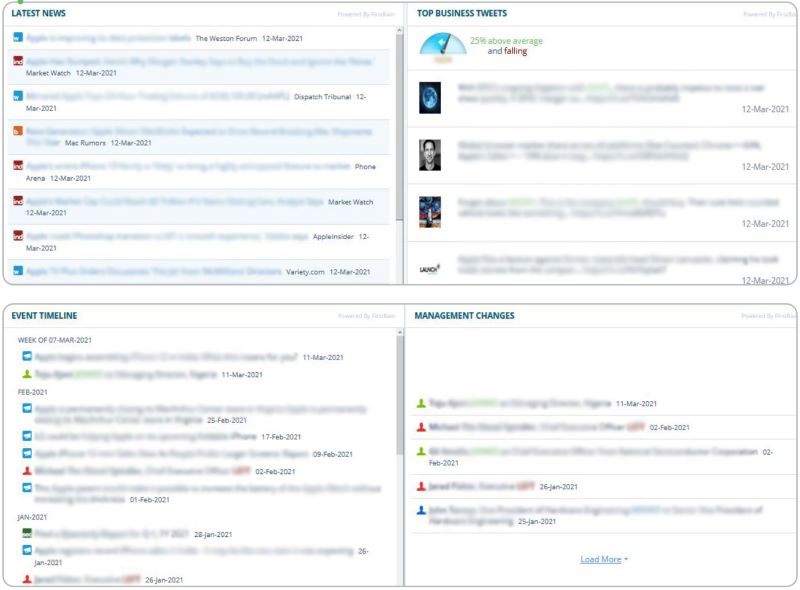

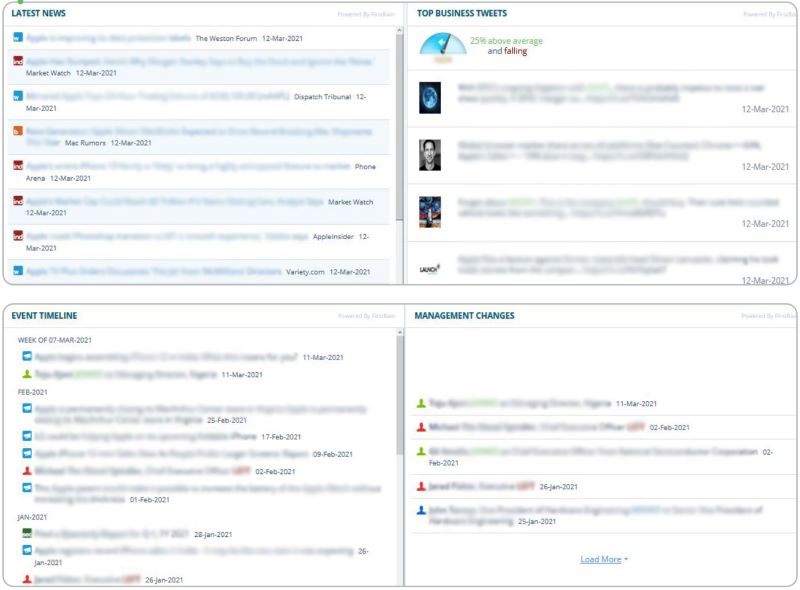

Net & Social

The Net & Social part typically stories on the newest information and any publications which will reference what you are promoting. That is helpful in portray an image to anybody researching your organization or aiding within the rationalization of potential dangers.

Net & Social part of a D&B profile. (Supply: Dun & Bradstreet)

Information reporting rumored occasions don’t have any affect on a D&B credit score rating.

Professionals & Cons of the Dun & Bradstreet Credit score Report

Who Is a D&B Credit score Report Proper For?

Not solely is a enterprise credit score report accessible to lenders or companions, however it additionally permits you to reveal your creditworthiness and later use it to your benefit. This contains leveraging your profile for higher lending phrases, cost schedules, and so forth.

It could be for you if you’re a enterprise:

- Trying to construct its credit score profile: Your organization can set up enterprise credit score with a D&B credit score profile, even should you presently have little to none.

- Looking for financing alternatives: Lenders usually make the most of a D&B credit score report to find out the creditworthiness of a enterprise. Your demonstrated monetary historical past generally is a nice benefactor towards approval and is usually a part of small enterprise mortgage necessities.

- Working with distributors usually: Distributors or different companions can reference your established cost historical past, which supplies you with leverage to barter higher phrases.

Easy methods to Get a D&B Report

D&B credit score stories are accessible to all companies and may be obtained from the D&B web site.

- Step 1: Get a DUNS quantity. This may then be used to use for or entry a report. You should use D&B’s DUNS Quantity Lookup software to verify if you have already got a DUNS quantity or apply for one if wanted. You’ll want this quantity to look for an organization, whether or not or not it’s your individual or the corporate whose report you’re trying to entry.

- Step 2: Choose your report kind. In case you’re trying to acquire a free report, you will get began with D&B’s Credit score Insights report, which has choices to improve your report at varied value factors. Descriptions of every report together with their price are listed beneath every product kind.

- Step 3: Select your required product, and add it to the cart. You’ll then proceed to the checkout the place you’ll be able to choose your cost choices and full the acquisition. As soon as the transaction is full, your D&B credit score report will probably be accessible to view on-line.

Options to a D&B Report

Whereas the Dun & Bradstreet credit score report is without doubt one of the most trusted monetary assets, there are different choices accessible that may give you related metrics and insights.

- Equifax stories have scores of 224 to 580, which embrace enterprise credit score danger rating, enterprise cost index rating, and enterprise failure rating. Just like D&B, Equifax collects knowledge on monetary info, cost historical past, and public data.

- Experian is the biggest credit score bureau, and its credit score stories embrace a rating of 0 to 100, measured by its Intelliscore Plus mannequin. This components in assortment and cost historical past, filings for chapter, and monetary info. No self-reported knowledge is allowed in distinction to D&B credit score stories.

- Transunion is one other main credit score bureau, providing varied options to assist enterprise house owners measure and establish danger. Danger classes lined embrace credit score, insurance coverage, employment, and tenant danger for rental vacancies. The corporate additionally has extra danger merchandise to assist handle your credit score portfolio, purchase clients, forestall fraud, and far more.

- FICO® SBSS℠ rating is measured by knowledge from all three credit score bureaus (i.e., D&B, Equifax, Experian) and has a rating vary of 0 to 300. It may make the most of each private and enterprise credit score knowledge, partly with different monetary info. To qualify, most SBA lenders require a minimal rating of 160 to 165.

Ceaselessly Requested Questions (FAQs)

A D&B PAYDEX® rating is without doubt one of the extra widespread varieties of credit score scores reviewed by lenders, and a rating of 80 or above is usually thought of favorable. Scores vary from a low of 0 to a excessive of 100 however remember that the credit score rating is usually simply one in all a number of components that may decide whether or not you get accredited or denied for a mortgage.

Sure. D&B Credit score Insights supplies a free credit score report which you can make the most of to verify your scores and monitor any adjustments.

In case you imagine there could also be an error in your report, use the D-U-N-S Supervisor type or contact Dun & Bradstreet instantly. Since potential collectors and distributors might consider your D&B report in setting phrases and situations, it’s vital that you simply right any errors as rapidly as attainable to keep away from any adversarial motion.

Backside Line

A Dun & Bradstreet Credit score Report makes use of knowledge collected from what you are promoting historical past to supply scores that decide what you are promoting’s creditworthiness. The report is utilized by collectors and companions to find out the historical past and reliability of what you are promoting. It’s a great tool for getting a small enterprise mortgage, monitoring your credit score, or leveraging your credibility for higher phrases.